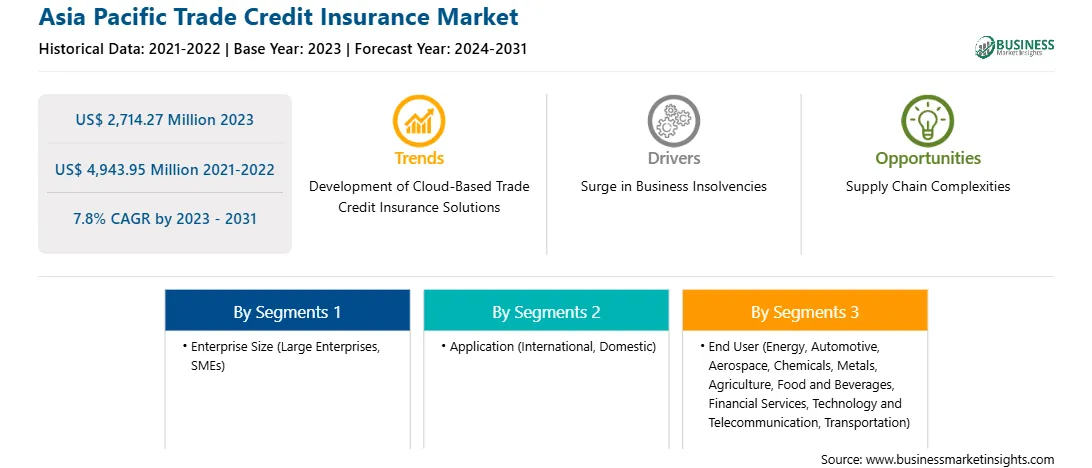

亚太贸易信用保险市场预测至 2031 年 - 区域分析 - 按企业规模(大型企业和中小型企业)、应用(国际和国内)和最终用户(能源、汽车、航空航天、化学品、金属、农业、食品和饮料、金融服务、技术和电信、运输等)

No. of Pages: 102 | Report Code: BMIRE00031129 | Category: Banking, Financial Services, and Insurance

No. of Pages: 102 | Report Code: BMIRE00031129 | Category: Banking, Financial Services, and Insurance

Strategic insights for Asia Pacific Trade Credit Insurance involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2,714.27 Million |

| Market Size by 2031 | US$ 4,943.95 Million |

| Global CAGR (2023 - 2031) | 7.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By 企业规模

|

| Regions and Countries Covered | 亚太地区

|

| Market leaders and key company profiles |

The regional scope of Asia Pacific Trade Credit Insurance refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The Asia Pacific Trade Credit Insurance Market is valued at US$ 2,714.27 Million in 2023, it is projected to reach US$ 4,943.95 Million by 2031.

As per our report Asia Pacific Trade Credit Insurance Market, the market size is valued at US$ 2,714.27 Million in 2023, projecting it to reach US$ 4,943.95 Million by 2031. This translates to a CAGR of approximately 7.8% during the forecast period.

The Asia Pacific Trade Credit Insurance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Trade Credit Insurance Market report:

The Asia Pacific Trade Credit Insurance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Trade Credit Insurance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Trade Credit Insurance Market value chain can benefit from the information contained in a comprehensive market report.