The electric power utility industry widely uses steel poles for power transmission and distribution. Due to greater mechanical strength of steel poles, it is extensively adopted in the utility sector to transmit power to end-use industries such as power, transportation, residential, commercial, and others. Steel poles have a long life and can be extended further by proper maintenance and paints as a coating for prolonging life. The poles can withstand severe climatic conditions and permit longer spans. Steel can be easily shaped, welded, and bolted in different arrays, which makes it a suitable option for the utility industry to install power transmission poles of different heights.

A wood pole has a service life of ∼30 to 40 years, while steel poles exhibit service lives of 50–80 years with proper maintenance. Chemical treatments are required to maintain and protect wood poles and extend their life, whereas steel poles don’t require harsh chemical treatments. The use of steel poles offers important natural advantages, including less greenhouse gas and vaporized releases. Therefore, steel poles are widely preferred over wood poles for power transmission due to their benefits in the US. Growing awareness regarding the environmental benefits of installing steel poles has led to the initiation of several projects for wood-to-steel pole replacement. As the country has millions of wooden poles, the need for their replacement generates the demand for steel poles, which drives the US power transmission steel poles market growth.

Moreover, the growing infrastructure development across the US requires a constant, uninterrupted power supply. Installing steel poles for power transmission to these infrastructures fuels the power transmission steel poles market growth. The rise in the telecommunication industry due to digitalization and the need for high-speed internet generates demand for power transmission steel poles in the newly developed telecom infrastructures. The rising investment by the government to boost their telecommunication sector further propels the US power transmission steel poles market growth.

The US power transmission steel poles market size is segmented on the basis of pole size, application, and geography. Based on application, the US power transmission steel poles market size is segmented into electricity transmission and distribution, telecommunication, street lighting, heavy power lines, sub transmission lines, and others. In 2022, the electricity transmission and distribution segment held the largest US power transmission steel poles market share. Utility companies use two distinct types of power lines—transmission and distribution power lines—to transport electricity from generation sources to consumers. Transmission lines are generally used to carry electricity over long distances, and distribution lines are used for shorter distances. These power lines demand steel poles to transmit electricity due to their longer life span, durability, and reliability. In addition, rising demand for electricity and growing awareness regarding clean electricity generation in the country have contributed to the investments for a net-zero carbon economy. For instance, in August 2022, the board of directors of the Midcontinent Independent System Operator (MISO) approved the US$ 10.3 billion grid expansion to grow grid reliability, lower system costs, and eliminate barriers to renewable energy projects waiting for grid interconnection. These grid interconnection constructions from renewable power stations to consumer generates the demand for steel poles to transmit electricity, further fueling the US power transmission steel poles market growth.

Valmont Industries Inc, Weatherspoon & Williams LLC, Sabre Industries Inc, Browning Enterprise Inc, Nello Corp, SAE Towers Holdings LLC, Metalpol SA de CV, Central Steel Service Inc, Nova Pole International Inc, Nucor Corp, Meyer Utility Structures are some of the key US power transmission steel poles market players. Various other companies are also introducing new technologies and offerings, helping the US power transmission steel poles market players to expand their business in terms of revenue.

| Report Attribute | Details |

|---|---|

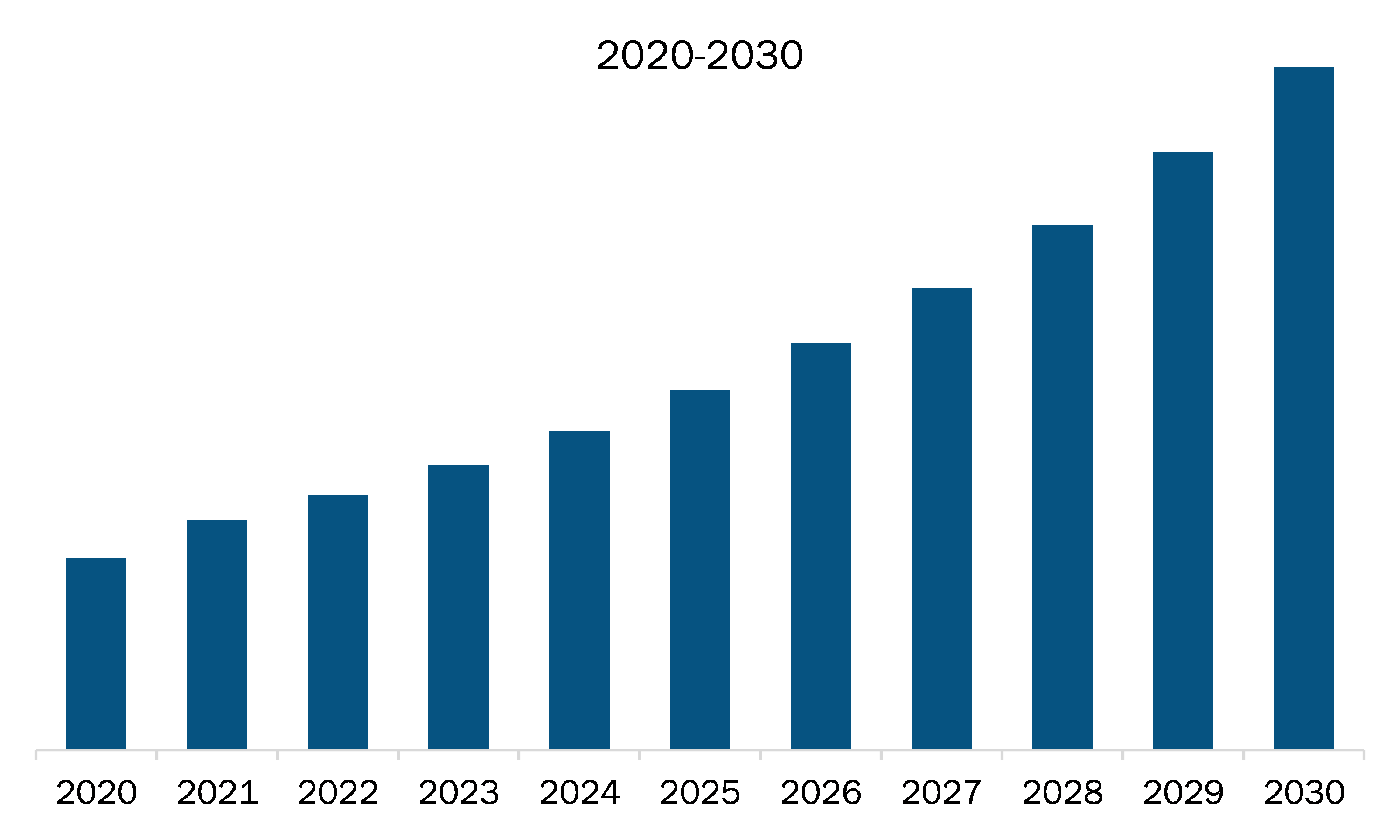

| Market size in 2022 | US$ 422.65 Million |

| Market Size by 2030 | US$ 758.32 Million |

| CAGR (2023 - 2030) | 7.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Pole Size

|

| Regions and Countries Covered |

United States

|

| Market leaders and key company profiles |

|

The US Power Transmission Steel Poles Market is valued at US$ 422.65 Million in 2022, it is projected to reach US$ 758.32 Million by 2030.

As per our report US Power Transmission Steel Poles Market, the market size is valued at US$ 422.65 Million in 2022, projecting it to reach US$ 758.32 Million by 2030. This translates to a CAGR of approximately 7.9% during the forecast period.

The US Power Transmission Steel Poles Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Power Transmission Steel Poles Market report:

The US Power Transmission Steel Poles Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Power Transmission Steel Poles Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Power Transmission Steel Poles Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)