Market Introduction

The defense sector is investing in commercial-off-the-shelf (COTS) products such as wearable computing, Internet of Things (IoT), 3D printing, and mobile solutions to increase the defense capability through cutting-edge technology. Military companies must weigh the benefits and drawbacks of COTS against custom-built hardware and software, as well as the types of COTS solutions that best fulfil their mission requirements, before evaluating or adopting COTS items. Furthermore, military equipment are frequently powered by generators or batteries, and they must be carefully engineered to reduce power consumption, optimize the duration, and limit the frequency of dangerous and expensive fuel-resupply missions.

Rapid technological improvements in the power industry are expected to boost the market growth throughout the forecast period. The advanced military technologies are widely available throughout the world. In addition, as the demand for soundless military drones solutions are increasing the demand for military power solutions is rising. To assure the quality of military power supply, they must fulfil extremely stringent criteria. A shorter design cycle means a product can be deployed in a shorter amount of time, reducing the power loss that occurs when power transistors switch from a conducting to a nonconducting state. Thus, technology innovations can be game-changers for improvements in power devices, enabling higher-power, efficient, and conduction-cooled power supplies.

Strategic insights for the US Next Generation Military Power Supply provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the US Next Generation Military Power Supply refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.US Next Generation Military Power Supply Strategic Insights

US Next Generation Military Power Supply Report Scope

Report Attribute

Details

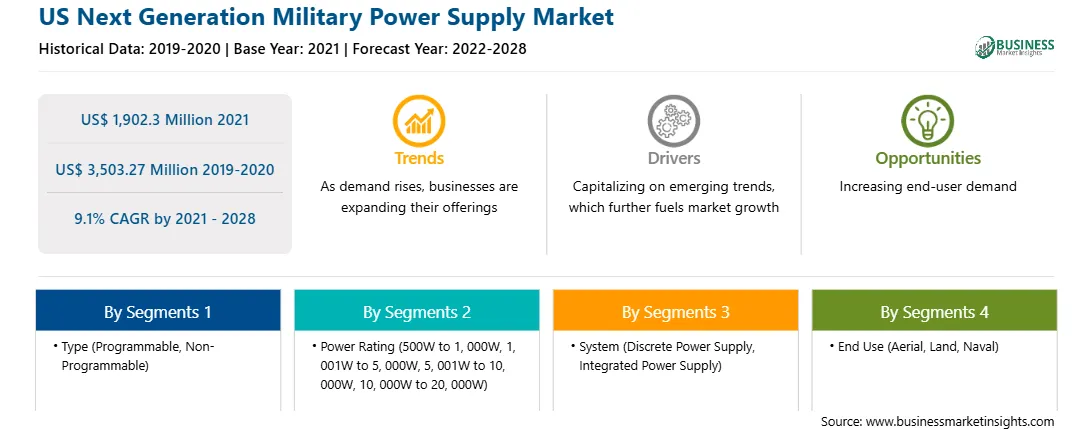

Market size in 2021

US$ 1,902.3 Million

Market Size by 2028

US$ 3,503.27 Million

CAGR (2021 - 2028) 9.1%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Type

By Power Rating

By System

By End Use

Regions and Countries Covered

United States

Market leaders and key company profiles

US Next Generation Military Power Supply Regional Insights

Market Overview and Dynamics

The US Next Generation Military Power Supply market is expected to grow from US$ 1,902.3 million in 2021 to US$ 3,503.27 million by 2028; it is estimated to grow at a CAGR of 9.1% from 2021 to 2028.

Cutting-edge power supply is, in fact, widely adopted in the military because of its advantages, such as the ability to work consistently in a variety of extreme environments and harsh terrains. It can also function for a longer time with little maintenance. The growing need to protect sensitive information from lattice power unreliability and vacation concerns is driving the market. In recent years, there has been a rise in commercial off-the-shelf (COTS) innovation that has favored the delivery of cutting-edge military force supply.

Several players operating in the US next generation military power supply market are adopting significant strategic initiatives. For instance, in 2021, NOVA ELECTRIC launched a new Lightweight Galaxy-Series Rugged DC UPS System specifically designed for demanding military applications in high shock, vibration, humidity, and EMI environments and meeting all military compliances such as MIL-STD-1399, MIL-S-901, MIL-STD-167, MIL-STD-461, MIL-STD-810, and other demanding MIL-STDs.

Key Market Segments

Based on type, the next generation military power supply is segmented into programmable and non-programmable. The programmable segment is dominating the market as these power supplies can be modified as per requirement and can be used for supporting more than single or dual power outputs. The remotely manageable power supply is another factor supporting the programmable segment growth.

Based on power rating, the next generation military power supply is segmented into 500 W to 1,000 W; 1,001 W to 5,000 W; 5,001 W, to 10,000 W; and 10,000 W to 20,000 W. The 501 W to 1,000 W segment holds the largest market share due to wide adoption in the land segment for military vehicles, bases, and machineries. However, with the increasing demand for high power solutions, the 5,001 W to 10,000 W segment is expected to register highest CAGR.

Based on system, the next generation military power supply is segmented into integrated power supply and discrete power supply. The integrated power supply segment dominated the market in 2020 due to various benefits over discreate power such as high reliability, low cost of ownership, design simplicity, and enhanced performance.

The defense sector is investing in commercial-off-the-shelf (COTS) products such as wearable computing, Internet of Things (IoT), 3D printing, and mobile solutions to increase the defense capability through cutting-edge technology. Military companies must weigh the benefits and drawbacks of COTS vs. custom-built hardware and software, as well as the types of COTS solutions that best fulfil their mission requirements, before evaluating or adopting COTS items. Furthermore, military equipment is frequently powered by generators or batteries, and they must be carefully engineered to reduce power consumption, optimize the duration, and limit the frequency of dangerous and expensive fuel-resupply missions.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the next generation military power supply market in the US are company websites, annual reports, financial reports, national government documents, and statistical database. Major companies listed in the US next generation military power supply market report are Abbott Technologies; AJ’S POWER SOURCE INC.; AstrodyneTDI; Eaton.; AMETEK Intellipower, Inc.; TECHNOLOGY DYNAMICS, INC; Prime Power; SynQor, Inc.; Arnold Magnetic Technologies.; Republic Power Systems; NOVA Power Solutions, Inc.; Milpower Source, Inc.; NOVA ELECTRIC; Acumentrics.; and Clary Corporation.

Reasons to Buy Report

US NEXT GENERATION MILITARY POWER SUPPLYMARKET SEGMENTATION

By Deployment Type

By End User

By Vertical

Company Profiles

The List of Companies - Next Generation Military Power Supply Market

The US Next Generation Military Power Supply Market is valued at US$ 1,902.3 Million in 2021, it is projected to reach US$ 3,503.27 Million by 2028.

As per our report US Next Generation Military Power Supply Market, the market size is valued at US$ 1,902.3 Million in 2021, projecting it to reach US$ 3,503.27 Million by 2028. This translates to a CAGR of approximately 9.1% during the forecast period.

The US Next Generation Military Power Supply Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Next Generation Military Power Supply Market report:

The US Next Generation Military Power Supply Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Next Generation Military Power Supply Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Next Generation Military Power Supply Market value chain can benefit from the information contained in a comprehensive market report.