Heavy construction machinery are highly versatile machines predominantly used in various applications such as highway/road construction, power generation, quarry & excavation, residential and nonresidential buildings construction, special underground engineering projects, material handling, and irrigation. Skidders, excavators, wheel loaders, off-highway trucks, dozers, compactors, forwarders, backhoe loaders, motor graders, and many other machines help in saving time and human efforts while transporting and lifting heavy loads, compacting the road surface, and other functions. Growing infrastructural projects, such as construction of highways and residential buildings, and increasing agricultural and mining activities are driving to the growth of the US heavy construction equipment market. In addition, electric-powered equipment are getting adopted among the end user to ensure zero-emission in the environment to comply with government rules and regulations for reducing carbon emission levels. Moreover, rising scope of developing and using autonomous construction equipment is forecasted to influence the demand for heavy construction equipment in the US during the forecast period.

Strategic insights for the US Heavy Construction Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 38,382.5 Million |

| Market Size by 2027 | US$ 52,477.6 Million |

| Global CAGR (2020 - 2027) | 6.2% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

The geographic scope of the US Heavy Construction Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

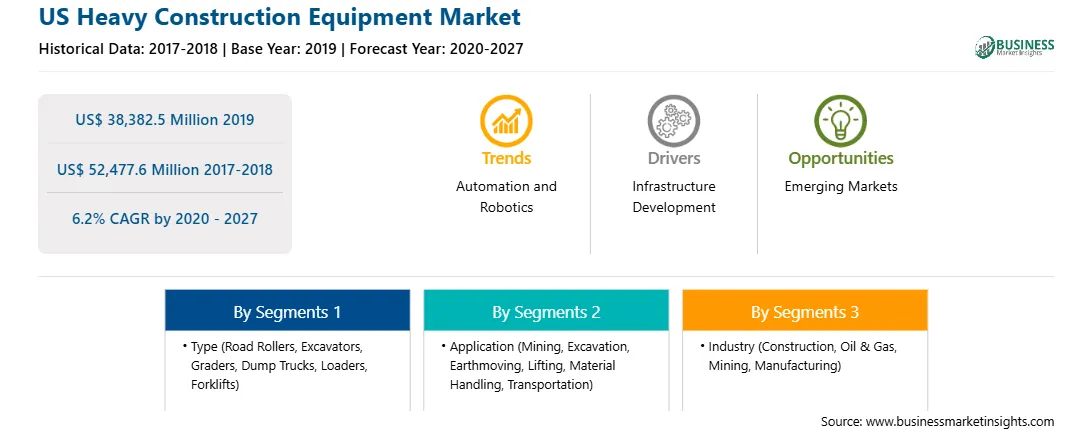

The US heavy construction equipment market was valued at US$ 38,382.5 million in 2019 and is projected to reach US$ 52,477.6 million by 2027; it is expected to grow at a CAGR of 6.2% from 2020 to 2027.

Infrastructure-driven growth in the US has resulted in high economic growth. Also, there is increase in mining activities in the country owing to growing demand for iron ore, coal, manganese, cobalt, copper, and other commodities. The exploration activities for necessary minerals and metals are vital for the overall growth of the mining industry. The US claims to have more than 3,915,000 mines on public land, which are managed by the Bureau of Land Management. In addition, California, Arizona, Utah, Nevada, Colorado, and Montana are a few of the prominent states having large number of total and active mines. With the established business of mining in the US, the rate of extracting ores and minerals from mines is increasing. This, in turn, requires more and advanced heavy construction equipment in the mining business for greater productivity while ensuring low risk of fatalities. Moreover, modern mining workforces are using automation and digitalization in their mining process, which is creating lucrative growth opportunities for the heavy construction equipment market in the US. For instance, JC Bamford Excavators received a contract of worth US $269 million from the US Department of Defense (DoD) to supply upto 400 High Mobility Engineer Excavators (HMEEs) over the next eight years. In 2019, Doosan Corporation opened a new 57,000 sq. ft. distribution center near Seattle, US.

The US heavy construction equipment market is segmented on the basis of type, application, and industry. Based on type, the market is segmented into road rollers, excavators, graders, dump trucks, loaders, and forklifts. The market for dump trucks segment is expected to grow at the highest rate during the forecast period. Based on application, the market is segmented into mining, excavation, earthmoving, lifting, material handling, and transportation. In 2019, mining segment held the largest market share. The market, based on industry, is segmented into construction, oil & gas, mining, manufacturing, and others. The market for construction segment is expected to grow at the highest rate during 2020–2027.

A few major primary and secondary sources referred to while preparing the report on the US heavy construction equipment market are company websites, annual reports, financial reports, national government documents, and statistical database. JC Bamford Excavators Ltd, AB Volvo, Caterpillar, Hitachi Ltd., Hyundai Construction Equipment Co. Ltd, Doosan Corporation, CNH Industrial N.V., Deere & Company, Komatsu Ltd., and Liebherr are among the key players that were profiled during this market study. In addition, several other important market players were studied and analyzed during the course of this market research study to get a holistic view of the US heavy construction equipment market and its ecosystem.

The US Heavy Construction Equipment Market is valued at US$ 38,382.5 Million in 2019, it is projected to reach US$ 52,477.6 Million by 2027.

As per our report US Heavy Construction Equipment Market, the market size is valued at US$ 38,382.5 Million in 2019, projecting it to reach US$ 52,477.6 Million by 2027. This translates to a CAGR of approximately 6.2% during the forecast period.

The US Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Heavy Construction Equipment Market report:

The US Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.