Retrofitting various components, including implementing newer technologies on older aircraft fleets to increase passenger comfort and safety, will fuel the demand for aircraft MRO. Continuous advancements in aircraft technologies further lead to the upgrade of MRO capabilities, because of which MRO service providers are constantly looking for the upgrade and integration of newer technologies. This integration of new technologies is further helping to service and retrofit older aircraft fleets. In addition, the retrofitting trend is soaring among MRO service providers, driving the general aviation aircraft MRO market. A similar trend is also anticipated to continue over the forecast period, which is further raising the demand for the integration of advanced and modern technologies on older aircraft fleets.

The growing adoption of innovative technologies in the general aviation aircraft MRO market is increasing the demand for real-time data analytics. The impact of integrating the new technologies in the aircraft fleet will remain high in the coming years, as projects such as the Federal Aviation Administration's NextGen, a modernization project of the US, are driving the adoption of the new technologies. This NextGen project refers to the air transportation system to make flying safer. Moreover, airline companies are introducing new products to integrate with their aircraft fleet to enhance fuel efficiency and passenger safety. Thus, the amalgamation of advanced technologies on the existing aircraft is expected to offer an opportunity for the general aviation aircraft MRO market growth.

The rise in spending on maintenance and repair activities of various aircraft components will fuel the market growth. MRO service providers continually focus on creating integrated technologies, such as digital MRO technology, which enables service providers to carry out MRO activities more efficiently. Hence, the rising adoption of digital MRO technology is further boosting the general aviation aircraft MRO market forecast. Furthermore, the country has the presence of several international MRO service providers, which are continuously working on expanding their business in the US. For instance, in March 2022, Southwest Airlines and United Airlines announced that they were preparing to open new aircraft hangars for their MRO operations in Houston and Los Angeles, respectively. Also, airlines in the US are engaged in MRO outsourcing activities to cut costs associated with MRO, further fueling the US general aviation aircraft MRO market growth.

The rapid drop in demand for charter flights across the airport was observed after the New York tri-state order to halt travel plans both domestically and internationally for general aviation passengers to combat the spread of SARS-CoV-2 across the country. These factors negatively impacted the general aviation industry across the US. The significant decrease in demand for charter flights and a complete halt on general aviation travel across the country to combat the spread of the virus further significantly impacted the US general aviation aircraft MRO market negatively.

The overall general aviation aircraft MRO market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information on the general aviation aircraft MRO market. The process also serves the purpose of obtaining an overview and forecast of the general aviation aircraft MRO market size with respect to all market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. The participants of this process include VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the general aviation aircraft MRO market.

Strategic insights for the US General Aviation Aircraft MRO provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

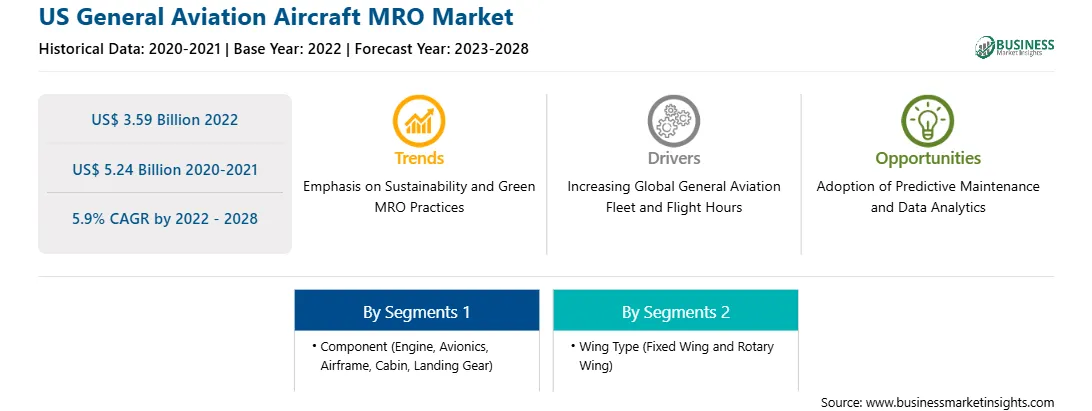

| Market size in 2022 | US$ 3.59 Billion |

| Market Size by 2028 | US$ 5.24 Billion |

| CAGR (2022 - 2028) | 5.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

|

The geographic scope of the US General Aviation Aircraft MRO refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The US General Aviation Aircraft MRO Market is valued at US$ 3.59 Billion in 2022, it is projected to reach US$ 5.24 Billion by 2028.

As per our report US General Aviation Aircraft MRO Market, the market size is valued at US$ 3.59 Billion in 2022, projecting it to reach US$ 5.24 Billion by 2028. This translates to a CAGR of approximately 5.9% during the forecast period.

The US General Aviation Aircraft MRO Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US General Aviation Aircraft MRO Market report:

The US General Aviation Aircraft MRO Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US General Aviation Aircraft MRO Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US General Aviation Aircraft MRO Market value chain can benefit from the information contained in a comprehensive market report.