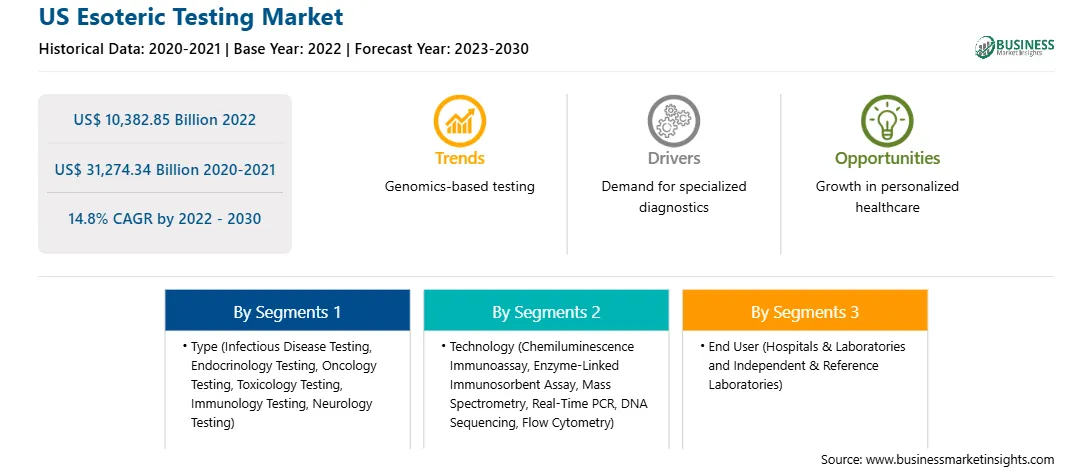

The US Esoteric Testing market is expected to grow from US$ 10,382.85 billion in 2022 to US$ 31,274.34 billion by 2030; it is estimated to grow at a CAGR of 14.8% from 2022 to 2030.

The report highlights trends prevailing in the market and factors driving the market growth. The market growth is attributed to the rising prevalence of chronic diseases and growing awareness of early detection of medical conditions, which are driving the US's esoteric testing market size and growth. Additionally, advancements in genetic testing and rare disease-related initiatives by regulatory authorities are likely to emerge as a significant trend in the market during the forecast period. However, the lack of skilled personnel and the high cost of procedure hinder market growth during the forecast period 2022-2030.

Growing Awareness of Early Detection of Medical Conditions drives the market in the forecast period.

The early diagnosis of diseases helps medical professionals and patients to make various important medical decisions in terms of care, support needs, and financial and legal matters. Obtaining accurate and early diagnosis after noticing cognitive symptoms related to a specific medical condition results in the reversal of symptoms before they are aggravated, followed by an effective and early treatment of patients. It also provides healthcare professionals sufficient time for better decision-making. Laboratory examination procedures are widely performed for the diagnosis of diseases associated with medical specialties, such as neurological disorders, genetic diseases, cancer, and endocrinological disorders. Esoteric testing and genetic testing are performed for the diagnosis of diabetes, cardiovascular disease, lipid disorders, cancer, and genetic diseases.

Various government regulatory bodies are also taking initiatives and conducting campaigns to promote early diagnosis practices. The National Organization for Rare Disorders aims to identify, diagnose, and treat rare disorders through numerous supportive programs, including education, research, advocacy, and patient services. The New York State Rare Disease Workgroup, created in response to legislation passed in New York State (Article 27-L of the Public Health Law), aims to identify best practices that could enhance the awareness of rare diseases. Through such initiatives, people potentially having rare diseases can be referred to specialists, and barriers to their treatments, including financial challenges, can be addressed. Such initiatives to build knowledge regarding available diagnosis options for complex genetic and non-genetic rare disorders favor the growth of the US esoteric testing market.

Report Segmentation and Scope -

The "US Esoteric Testing market" is segmented on the basis of type, technology, and end user. Based on type, the market is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. In terms of technology, the US esoteric testing market is divided into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. In terms of end users, the market is categorized into hospitals and laboratories and independent and reference laboratories.

The US esoteric testing market, by type, is segmented into infectious disease testing, endocrinology testing, oncology testing, toxicology testing, immunology testing, neurology testing, and others. The oncology testing segment held the largest market share in 2022. The infectious disease testing segment is anticipated to register the highest CAGR from 2022 to 2030.

Based on technology, the US esoteric testing market is segmented into chemiluminescence immunoassay, enzyme-linked immunosorbent assay, mass spectrometry, real-time PCR, DNA sequencing, flow cytometry, and others. The chemiluminescence immunoassay segment held the largest market share in 2022. The enzyme-linked immunosorbent assay segment is anticipated to register the highest CAGR of 18.7% during 2022-2030.

Based on end users, the US esoteric testing market is segmented into hospitals and laboratories, as well as independent and reference laboratories. The hospitals and laboratories segment held a larger share of the market in 2022. It is further expected to register a higher CAGR of 15.2% during 2022-2030.

Esoteric tests are generally performed for the analysis of rare and unique substances that are not concluded in regular tests. To perform these tests, clinical laboratories require expertise in relevant specialties. Therefore, large commercial laboratories outsource these complex tests to reference and esoteric testing laboratories. A few of the labs performing esoteric testing in the US include Quest Diagnostics Incorporated, Mayo Medical Laboratories, ARUP Laboratories, Myriad Genetics, Genomic Health, Foundation Medicine, and Laboratory Corporation of America. The number of laboratories that can perform these specialized tests is increasing in the region.

As per an article by the Endocrine Society, published in January 2022, hypogonadism is a common condition in the male population, with a higher prevalence in older men, obese men, and men with type 2 diabetes. 35% of men older than 45 years of age and 30-50% of men with type 2 diabetes or obesity are estimated to have hypogonadism. Moreover, as per the US Census Bureau's estimation, the incidences of hypogonadism in men aged 65 years and more grew from ~35 million in 2000 to ~55 million by 2020. Further, it is estimated to rise to ~87 million by 2050. The surging prevalence of this condition is due to the rise in the geriatric population in the US.

An upsurge in the demand for esoteric testing is also attributed to the rising cases of hepatic cirrhosis. As per Statista, 51,642 adults in the US died from liver disease in 2020. Chronic liver disease/cirrhosis was the 12th leading cause of mortality in the US in 2020; an increase in the incidences of alcoholic cirrhosis is a major risk factor for this disease.

Furthermore, collaborations and partnerships are also expected to propel the market growth of esoteric testing in the US. For instance, as per The National Institutes of Health (NIH) press release of October 2021, NIH, the US Food and Drug Administration, ten pharmaceutical companies, and five non-profit organizations have joined to fasten the development of gene therapies for the 30 million Americans who suffer from rare diseases. Whereas there are nearly 7,000 rare diseases, currently, only 2 heritable diseases have FDA-approved gene therapies. The recently launched Bespoke Gene Therapy Consortium (BGTC), a section of the NIH Accelerating Medicines Partnership (AMP) program and project-lead by the Foundation of NIH, aims to enhance and streamline the development process of gene therapy to support the unmet medical needs of people with rare diseases.

Thus, the burgeoning cases of hypogonadism, hepatic cirrhosis, and other such disease is driving the growth of the esoteric testing market in the US.

Companies in the US's esoteric testing market adopt various organic and inorganic strategies. The organic strategies mainly include product launches and product approvals. Further, inorganic growth strategies witnessed in the market are acquisitions, collaborations, and partnerships. These growth strategies allow the market players to expand their businesses and enhance their geographic presence, thereby contributing to the overall market growth. Further, acquisition and partnership strategies help the market players strengthen their customer base and expand their product portfolios. A few of the significant developments by key players in the US's esoteric testing market are listed below.

The American Heart Association, The American Thyroid Association, The United States Food and Drug Administration (FDA), MyBioSource.com., The Endocrine Society National Institutes of Health (NIH) are a few of the major primary and secondary sources referred to while preparing the report on the US Esoteric Testing market.

Strategic insights for the US Esoteric Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10,382.85 Billion |

| Market Size by 2030 | US$ 31,274.34 Billion |

| CAGR (2022 - 2030) | 14.8% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | United States

|

| Market leaders and key company profiles |

|

The geographic scope of the US Esoteric Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies - US Esoteric Testing Market

- Georgia Esoteric & Molecular Laboratory LLC

- Laboratory Corp of America Holdings

- Quest Diagnostics Inc

- National Medical Services Inc

- OPKO Health Inc

- ARUP Laboratories Inc

- bioMONTR Labs

- Athena Esoterix LLC

- Stanford Hospital & Clinics

- Foundation Medicine Inc

The US Esoteric Testing Market is valued at US$ 10,382.85 Billion in 2022, it is projected to reach US$ 31,274.34 Billion by 2030.

As per our report US Esoteric Testing Market, the market size is valued at US$ 10,382.85 Billion in 2022, projecting it to reach US$ 31,274.34 Billion by 2030. This translates to a CAGR of approximately 14.8% during the forecast period.

The US Esoteric Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the US Esoteric Testing Market report:

The US Esoteric Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The US Esoteric Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the US Esoteric Testing Market value chain can benefit from the information contained in a comprehensive market report.