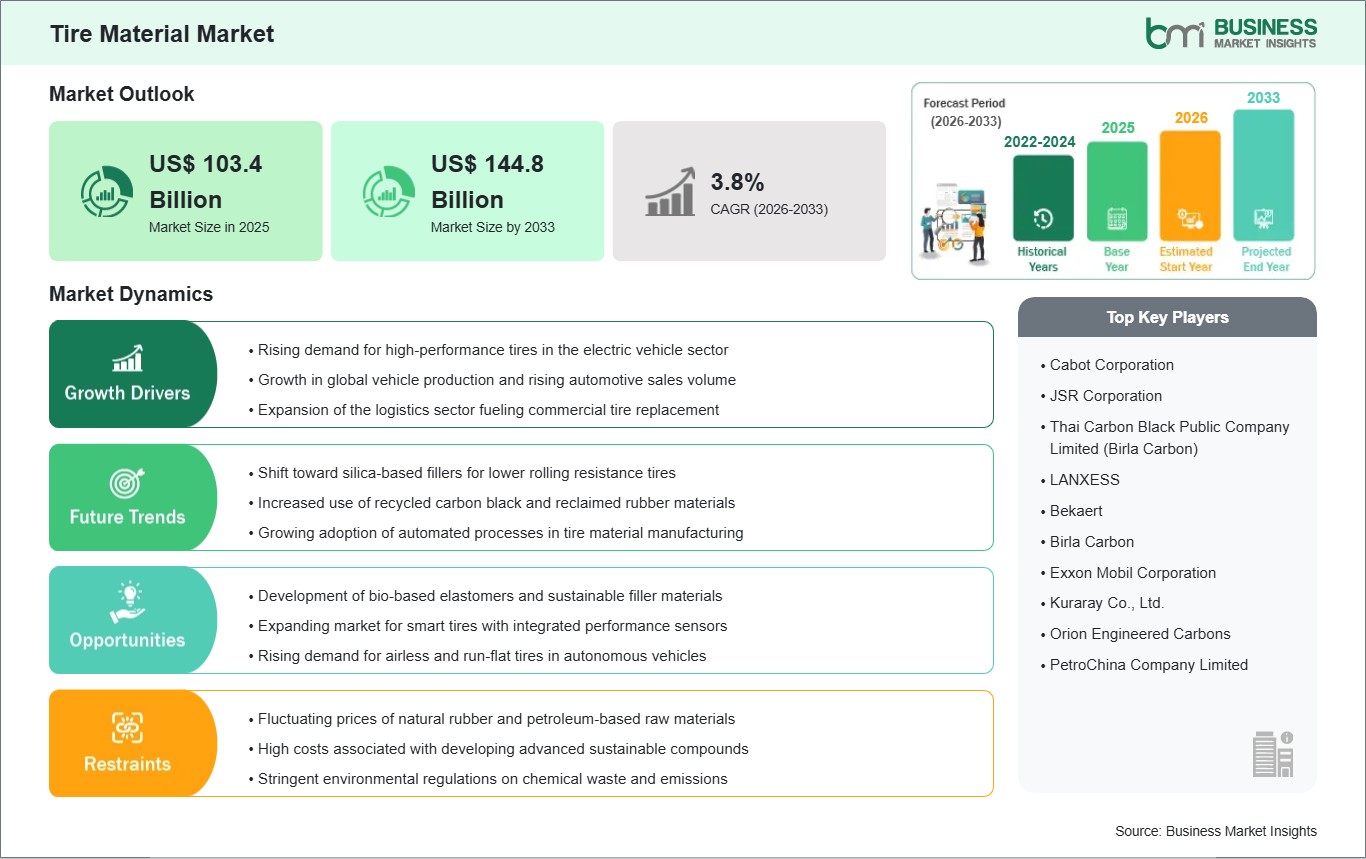

The Tire Material market size is expected to reach US$ 144.8 billion by 2033 from US$ 103.4 billion in 2025. The market is estimated to record a CAGR of 3.75% from 2026 to 2033.

Tire material represents a sophisticated cross-section of the chemical and polymer industries, dedicated to the production of high-performance components such as elastomers, reinforcing fillers, plasticizers, and textile reinforcements. These materials are engineered to meet the grueling demands of modern mobility, providing the essential balance of traction, structural integrity, and thermal stability required for vehicle safety. At its core, the market is shifting from a commodity-driven sector to one defined by advanced materials science, as manufacturers strive to optimize "the magic triangle"—the trade-off between rolling resistance, wet grip, and wear resistance.

However, the industry currently navigates a complex landscape of restraints. Volatility in petrochemical feedstocks and natural rubber prices remains a significant hurdle, directly impacting the cost of synthetic rubbers like SBR and BR. Furthermore, stringent environmental mandates, such as the European Union's tire labeling regulations and the EPA's standards for hazardous air pollutants, have increased R&D expenditures. These pressures are compounded by the technical difficulty of maintaining high-speed performance while increasing the percentage of recycled content within the tire's complex chemical matrix.

Despite these deterrents, the market is entering a phase of lucrative expansion. The accelerated adoption of Electric Vehicles (EVs) acts as a primary catalyst, as these vehicles require specialized materials to manage higher torque and increased battery weight. This transition has opened significant avenues for bio-based silica, recovered carbon black, and sustainable oils (such as soybean or orange oil). Innovations in airless tire technology and System-on-Chip (SoC) sensor integration for smart tires also present high-value opportunities, positioning the market to reach a projected valuation as the global fleet transitions toward a carbon-neutral and intelligent future.

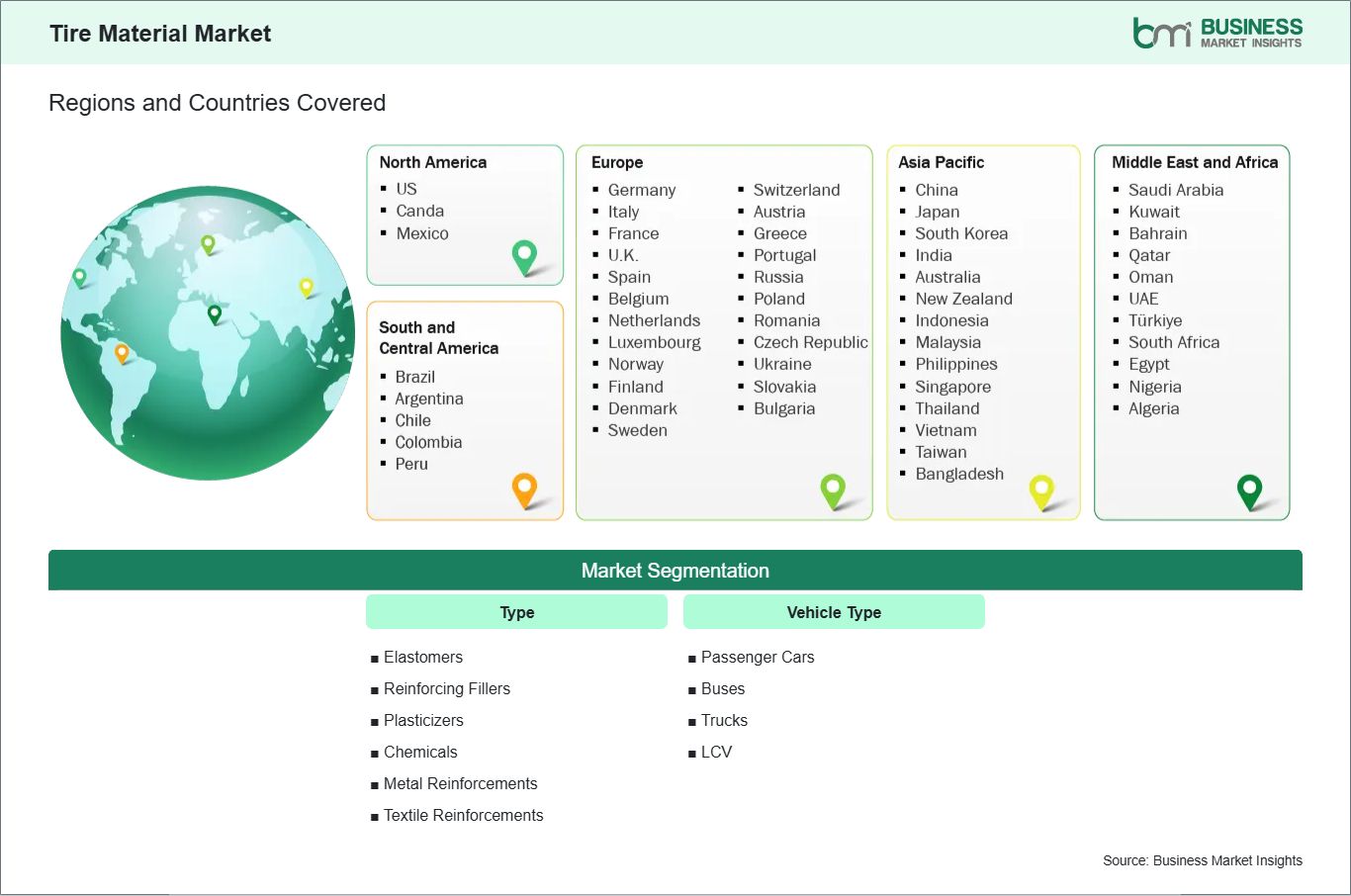

Key segments that contributed to the derivation of the Tire Material market analysis are type and vehicle type.

The global transition toward vehicle electrification serves as a primary driver for the tire material market. Electric vehicles present unique mechanical challenges that traditional internal combustion engine tires are not fully equipped to handle. Primarily, the substantial weight of battery packs necessitates tires with significantly higher load-bearing capacities and reinforced sidewalls. Furthermore, the instantaneous torque delivered by electric motors subjects the tread to extreme frictional forces during acceleration, which typically results in much faster rubber degradation. This shift is compelling tire manufacturers to move away from standard rubber blends toward high-performance, functionalized elastomers that offer superior abrasion resistance. These advanced materials are essential for ensuring that tire longevity remains comparable to traditional vehicles despite the harsher operating conditions.

Additionally, because tire-road friction is a major contributor to energy loss, there is an intensified focus on reducing rolling resistance to maximize battery range. Consequently, the market is seeing a surge in demand for specialized reinforcing fillers and silane coupling agents that can minimize energy dissipation within the rubber matrix. This evolution in vehicle architecture is effectively transforming tires from simple rubber components into high-tech, material-intensive systems, creating a robust growth trajectory for suppliers of premium synthetic rubbers and specialized chemical additives.

A significant opportunity within the market lies in the industrial-scale adoption of sustainable and circular material alternatives. As leading global manufacturers commit to ambitious goals of using only sustainable materials in their products by mid-century, the demand for bio-circular inputs is reaching a critical inflection point. This includes the replacement of traditional, sand-mined silica with highly dispersible silica derived from rice husk ash—a byproduct of agricultural processing that offers a much lower carbon footprint while maintaining high performance. Similarly, the emergence of recovered carbon black, produced through the pyrolysis of end-of-life tires, presents a lucrative opportunity to close the production loop and reduce reliance on fossil-fuel-based furnace blacks. Beyond fillers, there is a growing market for bio-based resins and oils—such as those derived from soybean, sunflower, or orange peels—to replace petroleum-based plasticizers.

These "green" materials not only help companies comply with increasingly strict environmental, social, and governance (ESG) reporting standards but also cater to a growing segment of environmentally conscious consumers and fleet operators. By developing a supply chain rooted in renewable feedstocks and recycled content, material providers can differentiate their offerings in a competitive market, secure long-term partnerships with major automotive brands, and insulate themselves from the price volatility and regulatory risks associated with traditional petrochemical-based manufacturing.

The Tire Material market demonstrates steady growth, with size and share analysis revealing evolving trends and competitive positioning among key players. The report further examines subsegments categorized within type and vehicle type, offering insights into their contribution to overall market performance.

Within the type segment, elastomers continue to represent the largest portion of material volume due to their fundamental role in providing elasticity and grip.

On the other hand, under the vehicle type category, the passenger cars sub-segment accounts for the highest share of consumption as a result of the sheer volume of global annual vehicle production and the shorter replacement cycles associated with private commuting.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 103.4 Billion |

| Market Size by 2033 | US$ 144.8 Billion |

| Global CAGR (2026 - 2033) | 3.8% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "Tire Material Market Size and Forecast (2022 - 2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Tire Material market report is divided into five regions: North America, Asia Pacific, Europe, the Middle East &Africa, and South &Central America.

In North America, the market is characterized by a sophisticated focus on high-durability compounds and advanced reinforcements to support an extensive roadway network and a robust long-haul logistics sector. Europe maintains a leading position in the adoption of sustainable chemistries, where stringent environmental directives drive the integration of bio-based elastomers and circular raw materials within premium automotive supply chains. The Asia-Pacific region functions as the primary global hub for both production and consumption, sustained by a massive manufacturing ecosystem and the rapid expansion of domestic vehicle ownership in emerging economies.

In the Middle East &Africa, the market is expanding through the modernization of transportation infrastructure and a growing industrial interest in localized chemical processing facilities to reduce import reliance. Meanwhile, South &Central America are witnessing steady development fueled by the digital and industrial transformation of regional fleets and the increasing demand for specialized tires in the agricultural and mining sectors. Collectively, these regions contribute to a resilient global framework, as local markets align their material requirements with broader international trends toward performance optimization and environmental stewardship.

The Tire Material market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Tire Material market are:

The Tire Material Market is valued at US$ 103.4 Billion in 2025, it is projected to reach US$ 144.8 Billion by 2033.

As per our report Tire Material Market, the market size is valued at US$ 103.4 Billion in 2025, projecting it to reach US$ 144.8 Billion by 2033. This translates to a CAGR of approximately 3.8% during the forecast period.

The Tire Material Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Tire Material Market report:

The Tire Material Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Tire Material Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Tire Material Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)