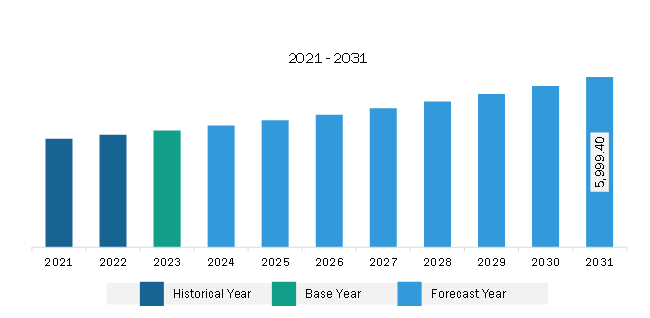

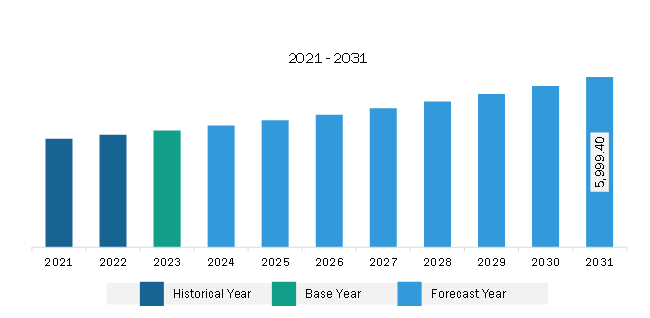

The South & Central America water treatment system market was valued at US$ 4,119.73 million in 2023 and is expected to reach US$ 5,999.40 million by 2031; it is estimated to register a CAGR of 4.8% from 2023 to 2031.

There is a growing demand for purified water in various end-use industries, such as power generation, manufacturing, pharmaceutical, and food & beverages. In these end-use industries, clean and purified water is utilized for various applications, including steam generation, dilution, and manufacturing equipment washing and cooling. This has mounted the requirement for a reliable and consistent water supply in sectors such as agriculture, power generation, manufacturing, and food & beverages. The energy & power sector is one of the major end users of water. Additionally, the food & beverage sector is also contributing to the soaring demand for water treatment systems globally, as clean water is widely used for food production, food item cleaning, food processing, and preservation. Water filtration or treatment systems are also used in the manufacturing sector for removing contaminants, impurities, and other unnecessary substances from water utilized in industrial processes. Water treatment systems are crucial for enhancing product quality, meeting regulatory requirements, and equipment protection, which is anticipated to drive the growth of the water treatment systems market in the coming years. Furthermore, the increasing government focus on implementing sustainable alternatives in the industrial sector is boosting the application of water treatment systems.

The demand for water for industrial applications and power generation is mounting at a rate of ~42% per year from China, India, South Africa, and Brazil. According to data from the Central Pollution Control Board (CPCB) of India, ~500 billion cubic meters of fresh water is utilized in Indian industries annually. The increasing development in the municipal sector is also contributing to the demand for water treatment systems, specifically in economies such as China, India, and Brazil.

Mineral exploration is one of the major application areas of water treatment systems since mineral exploration sites require water purification systems for cleaning equipment and other drilling processes. Nations such as China, Australia, Russia, Brazil, Canada, and the US are widely engaged in mineral exploration activities. These countries are also promoting the discovery of new mineral exploration sites and upgrade and maintenance of existing sites, which is anticipated to propel the application of water treatment systems globally. Thus, the growing demand for purified water in various end-use industries is a major driving factor for the water treatment systems market.

Brazil and Argentina are among the major countries in the water treatment systems market in South America. Rapid industrialization, urbanization, and population growth are anticipated to boost the demand for water treatment facilities, positively influencing the use of water treatment systems in the region. Additionally, the mounting demand for clean water in the food & beverages, manufacturing, and construction industries is also fueling the growth of the water treatment systems market in South America. Rising government initiatives to mitigate environmental pollution and increasing concern for public health issues occurring from waterborne diseases are anticipated to drive the water treatment systems market in South America over the forecast period.

The South & Central America water treatment system market is categorized into filtration process, type, application, end user, and country.

Based on filtration process, the South & Central America water treatment system market is segmented distillation, ultra-violet sterilization, reverse osmosis, filtration, ion-exchange, and others. The reverse osmosis segment held the largest market share in 2023.

In terms of type, the South & Central America water treatment system market is categorized into drinking water treatment system, industrial water treatment systems, wastewater treatment systems, portable water treatment systems, and well water treatment systems. The drinking water treatment system segment held the largest market share in 2023.

By application, the South & Central America water treatment system market is segmented into ground water, brackish and sea water desalination, rainwater harvesting, drinking water, and others. The drinking water segment held the largest market share in 2023.

By end user, the South & Central America water treatment system market is segmented into residential, municipal, agriculture, food and beverage, commercial, mining and metal, oil and gas, pharmaceuticals, and others. The municipal segment held the largest market share in 2023.

By country, the South & Central America water treatment system market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America water treatment system market share in 2023.

Hitachi Zosen Corporation, 3M Co, Culligan International Co, DuPont de Nemours Inc, Filtra-Systems Company LLC, Pall Corp, Pentair Plc, Thermax Limited, Thermo Fisher Scientific Inc, Veolia Environnement SA, and Xylem Inc are some of the leading companies operating in the South & Central America water treatment system market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4,119.73 Million |

| Market Size by 2031 | US$ 5,999.40 Million |

| CAGR (2023 - 2031) | 4.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Filtration Process

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Water Treatment System Market is valued at US$ 4,119.73 Million in 2023, it is projected to reach US$ 5,999.40 Million by 2031.

As per our report South & Central America Water Treatment System Market, the market size is valued at US$ 4,119.73 Million in 2023, projecting it to reach US$ 5,999.40 Million by 2031. This translates to a CAGR of approximately 4.8% during the forecast period.

The South & Central America Water Treatment System Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Water Treatment System Market report:

The South & Central America Water Treatment System Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Water Treatment System Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Water Treatment System Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)