Ramping Demand for Detergents in Household Application

Due to the rise in the prevalence of infectious diseases, especially COVID-19, people are becoming more aware of cleanliness and hygiene. The significance of hand sanitization, hygiene, and cleanliness has grown because of the rapidly emerging infectious diseases such as norovirus and influenza. Due to the increased usage of laundry detergents and household cleaning goods, the need for detergents in household applications is growing. Detergents are frequently used for cleaning because they connect water and oil, making them effective against oily stains and grease. Companies are expanding their product lines and focusing on creating eco-friendly surfactants for use in detergents for household cleaning solutions. For instance, BASF SE launched a new product, ""Lamesoft Balance,"" for cleaning purposes. Healthcare professionals are running hygiene awareness campaigns in several developing nations to draw customers' attention and raise awareness. As a result, there is an increasing demand for personal care and household cleaning goods from customers across the region. Additionally, market participants are developing eco-friendly household cleaning solutions and personal care items to ensure that the products are effective in cleaning and are eco-friendly.

Market Overview

South & Central America natural surfactant market is segmented based on country into Brazil, Argentina, and the Rest of South & Central America. In South & Central America, the growing environmental concerns among customers are driving demand in natural, renewable based products. Customers are increasingly sourcing for sustainable ingredients for their production. Synthetic surfactants are usually non-biodegradable and are toxic to the environment. However, natural surfactants are biodegradable and have a low toxicity. This is putting more emphasis on green surfactants utilization. Due to various advantages of natural surfactants, their use in different application segments such as detergents, personal care and cosmetics is growing. In Brazil, the demand for natural cosmetic products continues to increase, driving the natural surfactant market growth.

South & Central America Natural surfactants market Segmentation

South & Central America Natural surfactants market Segmentation

The South & Central America natural surfactants market is segmented into type, application, and country.

Based on type, the market is segmented into anionic, cationic, non-ionic, and amphoteric. The anionic segment registered the largest market share in 2022. Based on application, the market is categorized into detergents, personal care, industrial and institutional cleaning, oilfield chemicals, agriculture chemicals, and others. The detergents segment held the largest market share in 2022. Based on country, the market is segmented into Brazil, Argentina, and Rest of SAM. Brazil dominated the market share in 2022. BASF SE; Clariant AG; Croda International plc; Dow Inc.; KAO Corporation; Solvay S.A.; Arkema; Stepan Company; and Evonik Industries AG are the leading companies operating in the natural surfactants market in the region.

| Report Attribute | Details |

|---|---|

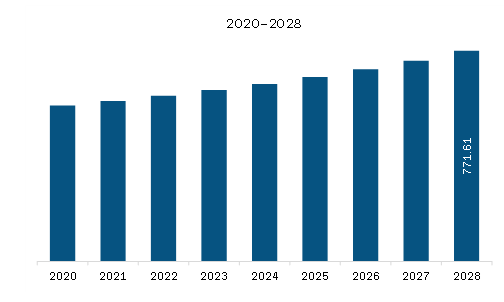

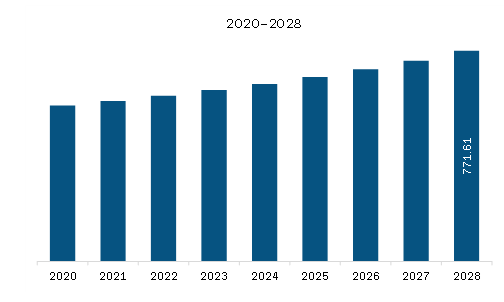

| Market size in 2022 | US$ 606.85 Million |

| Market Size by 2028 | US$ 771.61 Million |

| CAGR (2022 - 2028) | 4.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Natural Surfactants Market is valued at US$ 606.85 Million in 2022, it is projected to reach US$ 771.61 Million by 2028.

As per our report South & Central America Natural Surfactants Market, the market size is valued at US$ 606.85 Million in 2022, projecting it to reach US$ 771.61 Million by 2028. This translates to a CAGR of approximately 4.1% during the forecast period.

The South & Central America Natural Surfactants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Natural Surfactants Market report:

The South & Central America Natural Surfactants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Natural Surfactants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Natural Surfactants Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)