South and Central America Monoclonal Antibodies Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Source (Human, Humanized, Chimeric, and Murine), Production Method (In-Vitro, and In-Vivo), Indication (Cancer, Autoimmune Diseases, Infectious Diseases, Inflammatory Diseases, Microbial Diseases, and Others), Application (Therapeutic Applications, Diagnostic Applications, and Research Applications), End-User (Hospitals, Research Institutes, and Others)

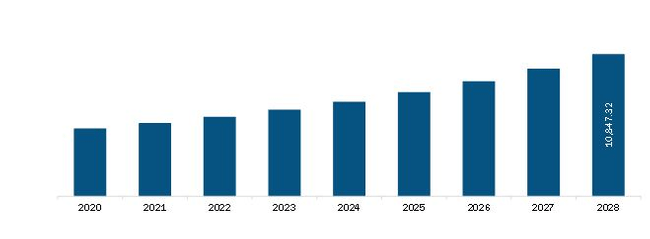

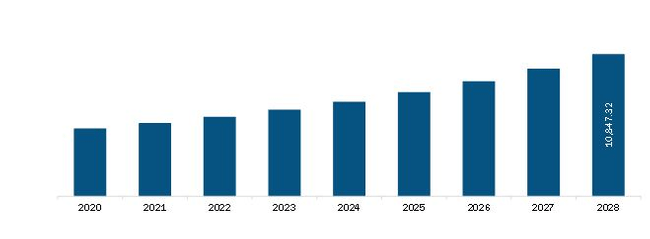

The South & Central America monoclonal antibodies market is expected to reach US$ 10,847.3 million by 2028 from US$ 5,584.2 million in 2021. The market is estimated to grow at a CAGR of 9.9% from 2021–2028.

According to the International AIDS Vaccine Initiative (IAVI) report, the development of mABs is one of the fastest-growing segments of biomedical research. For records, more than 50 mABs were licensed in the last six years, and in 2019, seven of the ten best-selling novel drugs for cancer and autoimmune diseases were mABs. Further, with the growing number of non-communicable and infectious diseases, for which mABs are or might prove effective treatment, there is certainly an accelerating demand for such products. For example, mABs sales are predominant in South & Central America. As the percentage of mABs in the development pipeline increases, more and more mABs will enter the market, and the disparity in access between high-income countries and the rest of the world will worsen. Furthermore, a few combinations of mABs are also being developed to address many diseases, including chronic infections and cancer. On the other hand, several counties are taking strong initiatives to shorten the regulatory process for mABs effective for treating chronic diseases. For records, in early 2019, the CFDA approved three mABs from domestic developers and ten mABs from multinational pharmaceutical companies. Such factors are stimulating the uptake of mABs, aiding the market significantly.According to the NCBI report, monoclonal antibodies (mABs) have been considered as an innovative technology for the treatment of some types of cancer, as they possess the capability of targeting and selectively killing tumor cells. For example, there was a retrospective analysis conducted based on consultation of the Brazilian Health Regulatory Agency (Anvisa) where these mABs were characterized according to the target antigen, type of antibody, year of registration, therapeutic indications, and applicant. For records, in August 2021, Anvisa announced granting of emergency use authorization (EUA) for Celltrion’s “Regdanvimab (CT-P59)” for treating adults with mild-to-moderate COVID-19 and who do not require supplemental oxygen and are at higher risk of progression to severe COVID. As Brazil had the highest number of confirmed cases from COVID-19 in South and Central America with an average 35,000 cases per day and since the beginning of pandemic, at least 1 in 10 residents have been infected a total of 20,249,176 reported severe cases. Therefore, Celltrion’s monoclonal antibody-based product significantly reduces the risk of COVID-19 related hospitalization and deaths by 72% for patients at higher risk of progression to severe COVID-19 and 70% of all patients. Therefore, amid COVID-19 pandemic, monoclonal antibodies witnessed highest ever adoption in South and Central America regional market.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the monoclonal antibodies market. The South & Central America monoclonal antibodies market is expected to grow at a good CAGR during the forecast period.

South & Central America Monoclonal Antibodies Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

South & Central America Monoclonal Antibodies Market Segmentation

By Source

- Human

- Humanized

- Chimeric

- Murine

By Production Method

- In-Vitro

- In-Vivo

By Indication

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Inflammatory Diseases

- Microbial Diseases

- Others

By Application

- Therapeutic Applications

- Diagnostic Applications

- Research Applications

By End-User

- Hospitals

- Research Institutes

- Others

By Country

- South & Central America

- Brazil

- Argentina

- Rest of South & Central America

Companies Mentioned

- Novartis AG

- Pfizer Inc.

- GlaxoSmithKline plc.

- Amgen Inc

- DAIICHI SANKYO COMPANY, LIMITED

- F. Hoffmann-La Roche Ltd.

- AstraZeneca

- Bayer AG

- Bristol-Myers Squibb Company

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 South & Central America Monoclonal Antibodies (mAbs) Market – By Source

1.3.2 South & Central America Monoclonal Antibodies (mAbs) Market – By Production Method

1.3.3 South & Central America Monoclonal Antibodies (mAbs) Market – By Indication

1.3.4 South & Central America Monoclonal Antibodies (mAbs) Market – By Application

1.3.5 South & Central America Monoclonal Antibodies (mAbs) Market – By End-User

1.3.6 South & Central America Monoclonal Antibodies (mAbs) Market – By Geography

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. Monoclonal Antibodies (mAbs) Market – Market Landscape

4.1 Overview

4.2 PEST Analysis

4.2.1 South & Central America PEST Analysis

4.3 Experts Opinion

5. Monoclonal Antibodies (mAbs) Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Rising Prevalence of Cancer and Other Chronic Diseases

5.1.2 mABs Uptake Proves to be Effective During Pandemic Outbreak

5.2 Market Restraints

5.2.1 Low Awareness, Accessibility, and High Cost

5.3 Market Opportunities

5.3.1 Cost-effective Advanced Technology for Developing mABs Presents Billion-Dollar Opportunity

5.4 Future Trends

5.4.1 Strategic Research Collaborations

5.5 Impact Analysis

6. Monoclonal Antibodies (mAbs) Market– South & Central America Analysis

6.1 South & Central America Monoclonal Antibodies (mAbs) Market, By Geography - Forecast and Analysis

7. South & Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028– by Source

7.1 Overview

7.2 South & Central America Monoclonal Antibodies (mAbs) Market, By Source, 2020 & 2028 (%)

7.3 Murine

7.3.1 Overview

7.3.2 Murine: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

7.4 Chimeric

7.4.1 Overview

7.4.2 Chimeric: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

7.5 Humanized

7.5.1 Overview

7.5.2 Humanized: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

7.6 Human

7.6.1 Overview

7.6.2 Human: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

8. Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 – Production Method

8.1 Overview

8.2 South & Central America Monoclonal Antibodies (mAbs) Market Share by Production Method Segment - 2020 & 2028 (%)

8.3 In-Vivo

8.3.1 Overview

8.3.2 In-Vivo: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

8.4 In-Vitro

8.4.1 Overview

8.4.2 In-Vitro: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

9. Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 – Indication

9.1 Overview

9.2 South & Central America Monoclonal Antibodies (mAbs) Market Share by Indication Segment - 2020 & 2028 (%)

9.3 Cancer

9.3.1 Overview

9.3.2 Cancer: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

9.4 Autoimmune Diseases

9.4.1 Overview

9.4.2 Autoimmune Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

9.5 Inflammatory Diseases

9.5.1 Overview

9.5.2 Inflammatory Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

9.6 Infectious Diseases

9.6.1 Overview

9.6.2 Infectious Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

9.7 Microbial Diseases

9.7.1 Overview

9.7.2 Microbial Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

9.8 Others

9.8.1 Overview

9.8.2 Others: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

10. Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 – Application

10.1 Overview

10.2 South & Central America Monoclonal Antibodies (mAbs) Market Share by Application Segment - 2020 & 2028 (%)

10.3 Diagnostic Applications

10.3.1 Overview

10.3.2 Diagnostic Applications: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

10.4 Therapeutic Applications

10.4.1 Overview

10.4.2 Therapeutic Applications: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

10.5 Research Applications

10.5.1 Overview

10.5.2 Research Applications: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

11. Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 – End-User

11.1 Overview

11.2 South & Central America Monoclonal Antibodies (mAbs) Market Share by End-User Segment - 2020 & 2028 (%)

11.3 Hospitals

11.3.1 Overview

11.3.2 Hospitals: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

11.4 Research Institutes

11.4.1 Overview

11.4.2 Research Institutes: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

11.5 Others

11.5.1 Overview

11.5.2 Others: Monoclonal Antibodies (mAbs) Market Revenue and Forecast to 2028 (US$ Million)

12. Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 – Geographical Analysis

12.1 South And Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028

12.1.1 Overview

12.1.2 South and Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

12.1.3 South and Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

12.1.4 South and Central America: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Production (US$ Million)

12.1.5 South and Central America: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

12.1.6 South and Central America: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

12.1.7 South and Central America: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

12.1.8 South and Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Country (%)

12.1.8.1 Argentina Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

12.1.8.1.1 Overview

12.1.8.1.2 Argentina Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

12.1.8.1.3 Argentina: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

12.1.8.1.4 Argentina: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028, By Production (US$ Million)

12.1.8.1.5 Argentina: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

12.1.8.1.6 Argentina: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

12.1.8.1.7 Argentina: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

12.1.8.2 Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

12.1.8.2.1 Overview

12.1.8.2.2 Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

12.1.8.2.3 Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

12.1.8.2.4 Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028, By Production (US$ Million)

12.1.8.2.5 Brazil: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

12.1.8.2.6 Brazil: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

12.1.8.2.7 Brazil: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

12.1.8.3 Rest of South and Central America: Monoclonal Antibodies (mAbs) Market– Revenue and Forecast to 2028 (USD Mn)

12.1.8.3.1 Overview

12.1.8.3.2 Rest of South and Central America: Monoclonal Antibodies (mAbs) Market– Revenue and Forecast to 2028 (USD Mn)

12.1.8.3.3 Rest of South & Central America: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

12.1.8.3.4 Rest of South & Central America: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028, By Production (US$ Million)

12.1.8.3.5 Rest of South and Central America: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

12.1.8.3.6 Rest of South and Central America: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

12.1.8.3.7 Rest of South and Central America: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

13. Impact Of COVID-19 Pandemic on Monoclonal Antibodies (mAbs) Market

13.1 South & Central America: Impact Assessment of COVID-19 Pandemic

14. Monoclonal Antibodies (mAbs) Market–Industry Landscape

14.1 Overview

14.2 Growth Strategies Done by the Companies in the Market, (%)

14.3 Organic Developments

14.3.1 Overview

14.4 Inorganic Developments

14.4.1 Overview

15. Company Profiles

15.1 Novartis AG

15.1.1 Key Facts

15.1.2 Business Description

15.1.3 Products and Services

15.1.4 Financial Overview

15.1.5 SWOT Analysis

15.1.6 Key Developments

15.2 Pfizer Inc.

15.2.1 Key Facts

15.2.2 Business Description

15.2.3 Products and Services

15.2.4 Financial Overview

15.2.5 SWOT Analysis

15.2.6 Key Developments

15.3 GlaxoSmithKline plc.

15.3.1 Key Facts

15.3.2 Business Description

15.3.3 Products and Services

15.3.4 Financial Overview

15.3.5 SWOT Analysis

15.3.6 Key Developments

15.4 Amgen Inc.

15.4.1 Key Facts

15.4.2 Business Description

15.4.3 Products and Services

15.4.4 Financial Overview

15.4.5 SWOT Analysis

15.4.6 Key Developments

15.5 DAIICHI SANKYO COMPANY LIMITED

15.5.1 Key Facts

15.5.2 Business Description

15.5.3 Products and Services

15.5.4 Financial Overview

15.5.5 SWOT Analysis

15.5.6 Key Developments

15.6 F. HOFFMANN-LA ROCHE LTD.

15.6.1 Key Facts

15.6.2 Business Description

15.6.3 Products and Services

15.6.4 Financial Overview

15.6.5 SWOT Analysis

15.6.6 Key Developments

15.7 AstraZeneca

15.7.1 Key Facts

15.7.2 Business Description

15.7.3 Products and Services

15.7.4 Financial Overview

15.7.5 SWOT Analysis

15.7.6 Key Developments

15.8 Bayer AG

15.8.1 Key Facts

15.8.2 Business Description

15.8.3 Products and Services

15.8.4 Financial Overview

15.8.5 SWOT Analysis

15.8.6 Key Developments

15.9 Bristol-Myers Squibb Company

15.9.1 Key Facts

15.9.2 Business Description

15.9.3 Products and Services

15.9.4 Financial Overview

15.9.5 SWOT Analysis

15.9.6 Key Developments

16. Appendix

16.1 About The Insight Partners

16.2 Glossary of Terms

LIST OF TABLES

Table 1. South and Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

Table 2. South and Central America: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Production (US$ Million)

Table 3. South and Central America: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

Table 4. South and Central America: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 5. South and Central America: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 6. Argentina: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

Table 7. Argentina: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Production (US$ Million)

Table 8. Argentina: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

Table 9. Argentina: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 10. Argentina: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 11. Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

Table 12. Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Production (US$ Million)

Table 13. Brazil: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

Table 14. Brazil: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 15. Brazil: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 16. Rest of South & Central America: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Source (US$ Million)

Table 17. Rest of South & Central America: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Production (US$ Million)

Table 18. Rest of South and Central America: Monoclonal Antibodies (mAbs) Market, by Indication – Revenue and Forecast to 2028 (US$ Million)

Table 19. Rest of South and Central America: Monoclonal Antibodies (mAbs) Market, by Application – Revenue and Forecast to 2028 (US$ Million)

Table 20. Rest of South and Central America: Monoclonal Antibodies (mAbs) Market, by End-User – Revenue and Forecast to 2028 (US$ Million)

Table 21. Organic Developments Done by Companies

Table 22. Inorganic Developments Done by Companies

Table 23. Glossary of Terms

LIST OF FIGURES

Figure 1. Monoclonal Antibodies (mAbs) Market Segmentation

Figure 2. South & Central America Monoclonal Antibodies (mAbs) Market Overview

Figure 3. Human Segment Held Largest Share of Source Segment in Monoclonal Antibodies (mAbs) Market

Figure 4. Brazil is Expected to Show Remarkable Growth During the Forecast Period

Figure 5. South & Central America Monoclonal Antibodies (mAbs) Market, Industry Landscape

Figure 6. South & Central America: PEST Analysis

Figure 7. Experts Opinion

Figure 8. Impact Analysis of Drivers and Restraints Pertaining to Monoclonal Antibodies (mAbs) Market

Figure 9. South & Central America Monoclonal Antibodies (mAbs) Market – By Geography Forecast and Analysis – 2021 - 2028

Figure 10. South & Central America Monoclonal Antibodies (mAbs) Market, by Source, 2020 & 2028 (%)

Figure 11. Murine: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 12. Chimeric: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 13. Humanized: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 14. Human: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 15. South & Central America Monoclonal Antibodies (mAbs) Market Share by Production Method Segment - 2020 & 2028 (%)

Figure 16. In-Vivo: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 17. In-Vitro: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 18. South & Central America Monoclonal Antibodies (mAbs) Market Share by Indication Segment - 2020 & 2028 (%)

Figure 19. Cancer: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 20. Autoimmune Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 21. Inflammatory Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 22. Infectious Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 23. Microbial Diseases: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 24. Others: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 25. South & Central America Monoclonal Antibodies (mAbs) Market Share by Application Segment - 2020 & 2028 (%)

Figure 26. Diagnostic Applications: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 27. Therapeutic Applications: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 28. Research Applications: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 29. South & Central America Monoclonal Antibodies (mAbs) Market Share by End-User Segment - 2020 & 2028 (%)

Figure 30. Hospitals: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 31. Research Institutes: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 32. Others: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts To 2028 (US$ Million)

Figure 33. South and Central America Monoclonal Antibodies (mAbs) Market Revenue Overview, by Country, 2021 (US$ Million)

Figure 34. South and Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 35. South and Central America Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028, By Country (%)

Figure 36. Argentina Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 37. Brazil: Monoclonal Antibodies (mAbs) Market Revenue and Forecasts to 2028 (US$ Million)

Figure 38. Rest of South and Central America: Monoclonal Antibodies (mAbs) Market– Revenue and Forecast to 2028 (USD Mn)

Figure 39. Impact of COVID-19 Pandemic in South & Central America Country Markets

Figure 40. Growth Strategies Done by the Companies in the Market, (%)

- Novartis AG

- Pfizer Inc.

- GlaxoSmithKline plc.

- Amgen Inc

- DAIICHI SANKYO COMPANY, LIMITED

- F. Hoffmann-La Roche Ltd.

- AstraZeneca

- Bayer AG

- Bristol-Myers Squibb Company

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South & Central America monoclonal antibodies market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the South & Central America monoclonal antibodies market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.