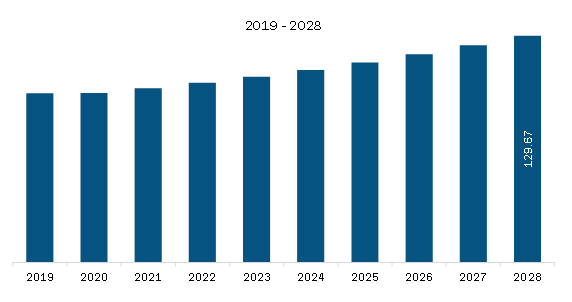

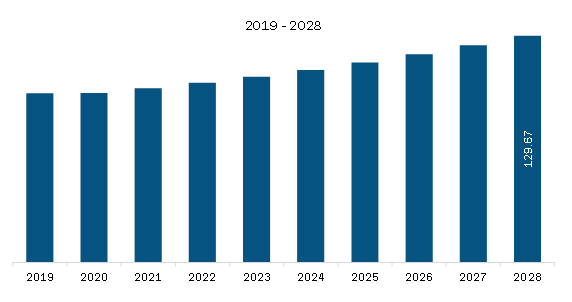

The South & Central America heat shrink tubing market is expected to grow from US$ 102.78 million in 2022 to US$ 129.67 million by 2028. It is estimated to grow at a CAGR of 3.9% from 2022 to 2028.

Increasing Demand from Automotive Industry Drive South & Central America Heat Shrink Tubing Market

The automotive industry plays a crucial role in a country's economy and helps build macroeconomic growth and stability in both developed and developing countries. Heat shrink tube is widely used in automobiles for insulating engine components. The harsh operating environment in an automobile engine chamber has made it necessary to use an electrical shrink tube for an electrical circuit inside it. In automobiles, heat shrink tube has numerous applications, such as fuel line protection, anti-lock braking systems (ABS) tubing, water drain tubing, power steering return hoses, air conditioning aluminum tubing, automatic transmission fluid (ATF) tubing formulated for automotive engines, water-cooling system tubing, fuel system tubing, and air conditioning hoses. Further, the demand for electric vehicles has been growing faster from 2021 owing to increasing investment in manufacturing plants, rising demand for low-emission vehicles, and growing supportive regulations for zero-emission vehicles through subsidies and tax rebates. With the growing trend of electric vehicles, the increasing need for wired appliances is boosting the South & Central America heat shrink tubing market. Heat shrink tube in an electric vehicle is used in many applications for wire shielding from charging socket to electrical components throughout the vehicle dashboard, windscreen wiper system, lighting system, central locking system, acoustic system, air condition system, and so on. Thus, numerous applications of heat shrink tubing in automobiles are propelling the demand from the automotive industry and driving the market growth.

South & Central America Heat Shrink Tubing Market Overview

Economies in South & Central America lag in terms of technological advancements due to lack of skilled labor, decreasing productivity when compared to other countries such as US, China and others. However, factors such as supportive government policies and increasing efforts to meet the growing power demand using clean energy sources are expected to drive the market growth over the projected period. South & Central America is experiencing rapid renewable energy growth. According to the International Renewable Energy Agency (IRENA), the region generates ~25% of energy from renewables, largely hydropower and biofuels. Solar and wind resources accounted for 16% of the total renewable generation in 2020. Further, the Chilean government is looking at creating a regulatory framework to enable the installation of power storage on a large scale, allowing the energy sector to be fully decarbonized. Such factors are anticipated to boost the South & Central America heat shrink tubing market growth.

South & Central America Heat Shrink Tubing Market Revenue and Forecast to 2028 (US$ Million)

South & Central America Heat Shrink Tubing Market Segmentation

The South & Central America heat shrink tubing market is segmented into voltage, material, end user, and country.

Based on voltage, the South & Central America heat shrink tubing market is segmented into low voltage (less than 5kV), medium voltage (5-35 kV), and high voltage (above 35kV). In 2022, the low voltage (less than 5kV) segment registered the largest share in the South & Central America heat shrink tubing market.

Based on material, the South & Central America heat shrink tubing market is segmented into polyolefin, polytetrafluoroethylene, fluorinated ethylene propylene, perfluoro alkoxy alkane, polyvinylidene fluoride, and others. In 2022, the polyolefin segment registered the largest share in the South & Central America heat shrink tubing market.

Based on end user, the South & Central America heat shrink tubing market is segmented into energy, utilities, electrical power, infrastructure/building construction, industrial, telecommunication, automotive, aerospace, defense, mass transit and mobility, medical, petrochemical, and mining. In 2022, the utilities segment registered the largest share in the South & Central America heat shrink tubing market.

The energy segment is further segmented into renewable and non-renewable. The utilities segment is further segmented into electricity, natural gas, steam supply, water supply, and sewage removal. The electrical power segment is further segmented into power generation, power transmission, and power distribution. The infrastructure/building construction segment is further segmented into residential & commercial, data centers, distribution, HVAC, and infrastructure. The industrial segment is further segmented into residential & commercial, data centers, distribution, HVAC, and infrastructure. The industrial segment is further segmented into industrial equipment and industrial electrical. The telecommunication segment is further segmented into wireless, broadband, CATV, and others. The automotive segment is further segmented into heavy duty machinery and agriculture, EV vehicles, hybrid vehicles, diesel vehicles, gasoline vehicles, and autonomous vehicles. The aerospace segment is further segmented into commercial aircraft, space exploration, and others. The defense segment is further segmented into military aircraft, military equipment & machinery, and others. The mass transit and mobility segment is further segmented into mass transit and mobility. The medical segment is further segmented into high temperature (150 C>) and low temperature (<150 C).

Based on country, the South & Central America heat shrink tubing market is segmented into Brazil, Argentina, and the Rest of South & Central America. In 2022, Brazil registered the largest share in the South & Central America heat shrink tubing market.

3M Co, HellermannTyton Ltd, Molex LLC, Sumitomo Electric Industries Ltd, and TE Connectivity Ltd are some of the leading companies operating in the South & Central America heat shrink tubing market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 102.78 Million |

| Market Size by 2028 | US$ 129.67 Million |

| CAGR (2022 - 2028) | 3.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Voltage

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Heat Shrink Tubing Market is valued at US$ 102.78 Million in 2022, it is projected to reach US$ 129.67 Million by 2028.

As per our report South & Central America Heat Shrink Tubing Market, the market size is valued at US$ 102.78 Million in 2022, projecting it to reach US$ 129.67 Million by 2028. This translates to a CAGR of approximately 3.9% during the forecast period.

The South & Central America Heat Shrink Tubing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Heat Shrink Tubing Market report:

The South & Central America Heat Shrink Tubing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Heat Shrink Tubing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Heat Shrink Tubing Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)