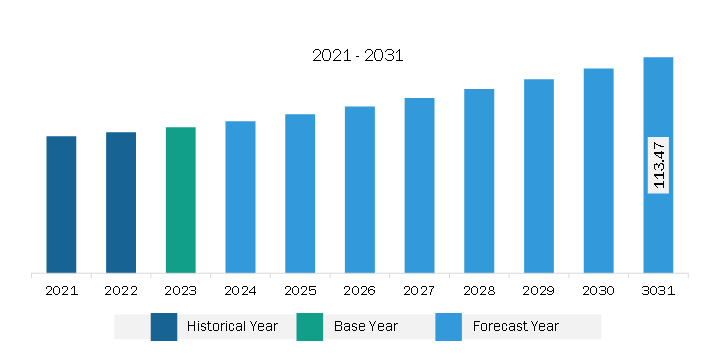

The South & Central America gas chromatography (GC) market was valued at US$ 76.49 million in 2023 and is expected to reach US$ 113.47 million by 2031; it is estimated to register a CAGR of 5.1% from 2023 to 2031.

The development of intelligent, connected features to enhance and simplify user experience is a major trend in the gas chromatography market. Features, including automatic leak detections and troubleshooting diagnostics, enable operators to work more quickly and accurately while producing superior results. Furthermore, proactively assisting users with preventive maintenance procedures lowers unscheduled downtime and sample reruns, which significantly boosts productivity.

Moreover, cross-training operators are in high demand, and even when they are not physically present in a laboratory, they must be informed about what is going on in other ones at the same time. As "Industry 4.0" digital transformation drives resource deployment optimization throughout analytical laboratory organizations globally, remote connectivity is a trend of the future.

Another key trend is the use of less power, water, helium, and other natural resources in the development of many modern instruments. Other trends include green chemistry and sustainable operations. Recently developed, inexpensive, oil-free GC-MS pumps—which operate far more quietly and cleanly and prevent oil spills—are being used more frequently. Another emerging trend is the migration of applications to quicker, greener, and smaller GC systems using effective direct heating technology.

The growth of the energy & power industry in SAM is driving the gas chromatography market in the region. The SAM gas chromatography market is segmented into Brazil, Argentina, and the Rest of SAM. Per the World Population Review, the population of South America was 439.71 million in 2023. Brazil is the fifth most populous country in the world with a population of 210 million, which is expected to reach 218 million by 2060. The increasing population across the region can boost the demand for energy, pushing the development and expansion of power generation sources across SAM in the future and generating the need for gas chromatography technology. The growth of the pharmaceutical industry plays an important role in the region’s economy. Brazil is now leading the way in improving pharmaceutical research and production and reducing the region’s dependence on foreign medical imports from the US, China, and Russia. This factor fosters the adoption of gas analysis technologies, further fueling the gas chromatography market growth. In May 2023, Brazilian President Lula da Silva took steps to revive the Union of South American Nations, or UNASUR, in an attempt to boost pharmaceutical trade and raise disease response standards across the region. The South America summit aimed at increasing investment and market access and eliminating unilateral trade measures where medical imports and exports will be a vital component.

In September 2021, the Pan American Health Organization (PAHO) announced the selection of two centers in Argentina and Brazil as regional hubs for developing and producing mRNA-based vaccines in Latin America to tackle COVID-19 and future infectious disease challenges. The development of vaccines generates the need for the accurate determination of various ingredients in vaccines, driving the demand for gas chromatography technology.

The South & Central America gas chromatography (GC) market is categorized into sample introduction technique, injection type, detector type, end user, and country.

Based on sample introduction technique, the South & Central America gas chromatography (GC) market is segmented into liquid injection, static headspace, dynamic headspace, thermal desorption, pyrolysis, and others. The liquid injection segment held the largest share of South & Central America gas chromatography (GC) market share in 2023.

In terms of injection type, the South & Central America gas chromatography (GC) market is segmented into split injection, splitless injection, and others. The split injection segment held the largest share of South & Central America gas chromatography (GC) market in 2023.

By detector type, the South & Central America gas chromatography (GC) market is divided into flame ionization detector, thermal conductivity detector, electron capture detector, thermionic specific detector, flame photometric detector, photo ionization detector, mass spectrometers, and others. The others segment held the largest share of South & Central America gas chromatography (GC) market in 2023.

Based on end user, the South & Central America gas chromatography (GC) market is categorized into oil and gas, chemical and energy, consumer products (polymer plastic), pharmaceutical, and others. The oil and gas chemical and energy segment held the largest share of South & Central America gas chromatography (GC) market in 2023.

By country, the South & Central America gas chromatography (GC) market is segmented into Brazil, Argentina, Venezuela, Caribbean Islands, and the Rest of South & Central America. Brazil dominated the South & Central America gas chromatography (GC) market share in 2023.

Thermo Fisher Scientific Inc; Shimadzu Corp; Merck KGaA; PerkinElmer, Inc. (Revvity Inc); VUV Analytics; and Wasson-ECE Instrumentation are some of the leading companies operating in the South & Central America gas chromatography (GC) market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 76.49 Million |

| Market Size by 2031 | US$ 113.47 Million |

| CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Sample Introduction Technique

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Gas Chromatography (GC) Market is valued at US$ 76.49 Million in 2023, it is projected to reach US$ 113.47 Million by 2031.

As per our report South & Central America Gas Chromatography (GC) Market, the market size is valued at US$ 76.49 Million in 2023, projecting it to reach US$ 113.47 Million by 2031. This translates to a CAGR of approximately 5.1% during the forecast period.

The South & Central America Gas Chromatography (GC) Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Gas Chromatography (GC) Market report:

The South & Central America Gas Chromatography (GC) Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Gas Chromatography (GC) Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Gas Chromatography (GC) Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)