South & Central America Extended Detection and Response Market

No. of Pages: 150 | Report Code: BMIRE00031551 | Category: Technology, Media and Telecommunications

No. of Pages: 150 | Report Code: BMIRE00031551 | Category: Technology, Media and Telecommunications

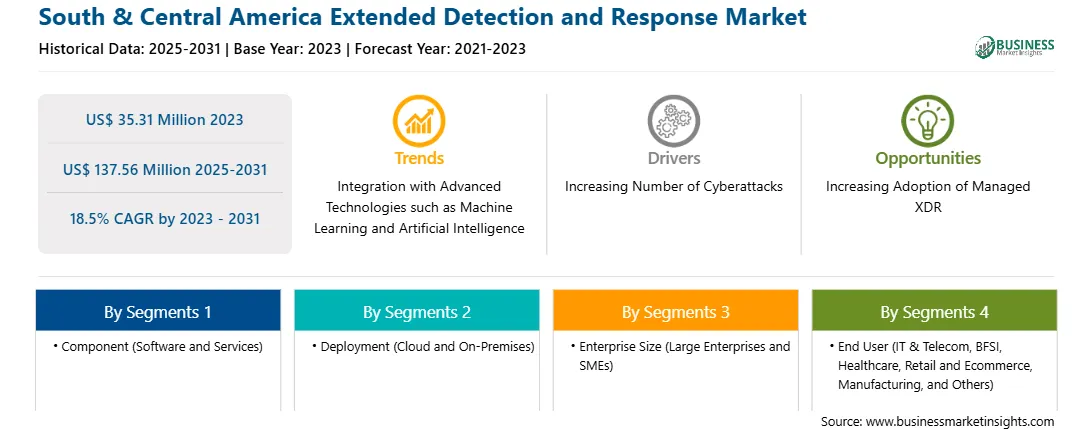

The South & Central America extended detection and response market was valued at US$ 35.31 million in 2023 and is expected to reach US$ 137.56 million by 2031; it is estimated to record a CAGR of 18.5% from 2023 to 2031.

Managed XDR refers to a service model that provides a subscription-based XDR capability delivered by a third-party provider. Organizations looking to add XDR value to their current security teams and solutions will find managed XDR solutions appealing. Organizations using Managed XDR (MXDR) solutions can benefit from lower complexity, cost, and risk associated with outsourcing in addition to the advantages of XDR, such as enhanced visibility, detection, and reaction. In order to improve security results, managed XDR solutions will also give users access to professional advice, best practices, and threat intelligence. In addition, key companies in the market are increasingly engaging themselves in various strategic decisions such as product launches and partnerships. For instance, in May 2024, Sekuro launched a managed extended detection and response (XDR) platform, offering sovereign architecture and adaptive intelligence. In May 2024, Noventiq achieved Microsoft-verified MXDR solution status. By achieving this status, Noventiq has proven its robust MXDR services, including a security operations center (SOC) with 24/7/365 proactive hunting, monitoring, and response capabilities, all built on tight integrations with the Microsoft Security platform. Similarly, in June 2023, Critical Start announced the launch of its new managed XDR offering, which unifies Critical Start's award-winning MDR service with a cloud-delivered collection, storage, and search platform for security-relevant log sources. In December 2023, BlackBerry Limited announced an update to its BlackBerry Guard MDR service to deliver MXDR service. Thus, the increasing adoption of MXDR is expected to provide lucrative opportunities for the players operating in the extended detection and response market growth in the coming years.

The South & Central America extended detection and response market consists of Brazil, Argentina, and the Rest of South & Central America. The region is widely adopting digital revolutions in various sectors such as BFSI, automotive, IT & telecom, and manufacturing. The region is inclined toward the adoption of solutions that reduce operational costs, minimize downtime, and enhance overall productivity and IT security. The growing digitalization is driving the extended detection and response market in SAM. In addition, the growing concern over cyberattacks drives the adoption of extended detection and response solutions by SMEs and large enterprises across wide industries.

Strategic insights for the South & Central America Extended Detection and Response provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Extended Detection and Response refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Extended Detection and Response Strategic Insights

South & Central America Extended Detection and Response Report Scope

Report Attribute

Details

Market size in 2023

US$ 35.31 Million

Market Size by 2031

US$ 137.56 Million

CAGR (2023 - 2031) 18.5%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Component

By Deployment

By Enterprise Size

By End User

Regions and Countries Covered

South & Central America

Market leaders and key company profiles

South & Central America Extended Detection and Response Regional Insights

The South & Central America extended detection and response market is segmented based on component, deployment, enterprise size, end user, and country. Based on component, the South & Central America extended detection and response market is bifurcated into software and services. The software segment held a larger market share in 2023.

In terms of deployment, the South & Central America extended detection and response market is bifurcated into cloud and on-premises. The cloud segment held a larger market share in 2023.

Based on enterprise size, the South & Central America extended detection and response market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

By end user, the South & Central America extended detection and response market is categorized into IT & Telecom, BFSI, healthcare, retail and Ecommerce, manufacturing, and others. The IT & Telecom segment held the largest market share in 2023.

Based on country, the South & Central America extended detection and response market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America extended detection and response market share in 2023.

Broadcom Inc, Palo Alto Networks Inc, Microsoft Corp, Sophos Ltd, Cisco Systems Inc, International Business Machines Corp, Check Point Software Technologies Ltd, Fortinet Inc, and Cybereason Inc are some of the leading players operating in the South & Central America extended detection and response market.

The South & Central America Extended Detection and Response Market is valued at US$ 35.31 Million in 2023, it is projected to reach US$ 137.56 Million by 2031.

As per our report South & Central America Extended Detection and Response Market, the market size is valued at US$ 35.31 Million in 2023, projecting it to reach US$ 137.56 Million by 2031. This translates to a CAGR of approximately 18.5% during the forecast period.

The South & Central America Extended Detection and Response Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Extended Detection and Response Market report:

The South & Central America Extended Detection and Response Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Extended Detection and Response Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Extended Detection and Response Market value chain can benefit from the information contained in a comprehensive market report.