Immunoglobulin G (IgG) therapies are highly used to treat primary immune deficiency cause by the genetics. The demand for IgG has been increasing steadily for the last few years due to the increasing awareness of IgG therapy. The growth is also accounted for its new therapy for its newly identified indication. Based on controlled trials done by Network Meta Analysis (NMA), IgG therapy has been approved for the treatment of Guillain-Barré syndrome (GBS), Chronic Inflammatory Demyelinating Polyneuropathy (CIDP), Multifocal Motor Neuropathy (MMN), and dermatomyositis. The Immunoglobulin G (IgG) therapies is also effective for the treatment of myasthenia gravis exacerbations and stiff-person syndrome. In addition, it provides convincing efficacy in autoimmune disorders like epilepsy, neuromyelitis, and autoimmune encephalitis.

A large proportion of IgG is used in specialties outside of immunology, such as oncology, neurology, hematology, and rheumatology. Compared to all, neurology is the fastest-growing specialty in the global market. The growth of the Immunoglobulin G market is attributed due to its approved for on-label use for chronic inflammatory demyelinating polyneuropathy (CIDP) followed by its off-label use in secondary immune deficiencies caused by lymphoma, myeloma, and leukemia and the certain immunosuppressive therapies esp. B-cell targeting therapies. Thus, the wide range of IgG usage in multiple treatments for on-label and off-label prescription will continue to expand and drive IgG demand across the global market in the coming years.

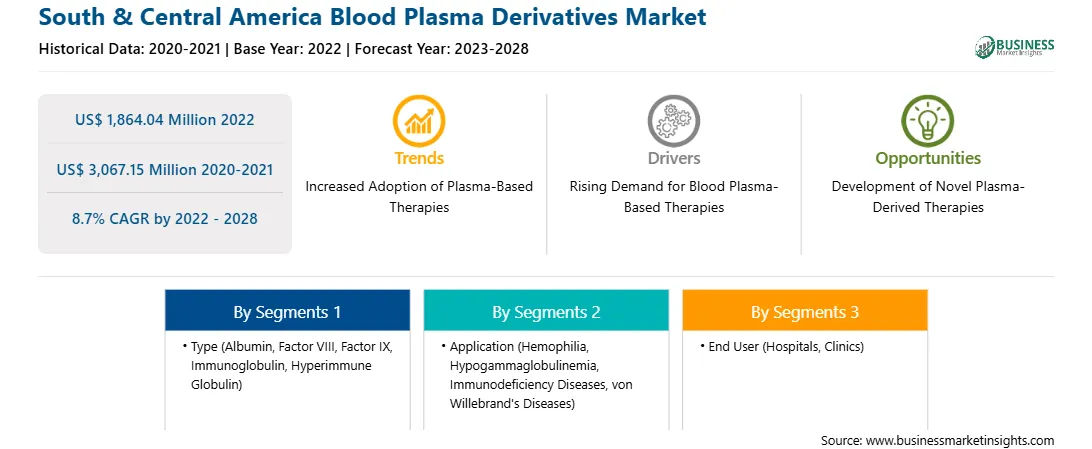

The South & Central America blood plasma derivatives market has been segmented into Brazil, Argentina, and the Rest of South & Central America. The region has a high prevalence of hemophilia, von Willebrand disease, and other bleeding disorders, increasing the adoption of plasma derivatives products for treatment. For instance, according to the World Federation of Hemophilia (WFH) Annual Global Survey 2021, Brazil and Argentina have a significantly high number of active hemophilia, von Willebrand disease, and other bleeding disorders cases. In 2021, Brazil had 13,337 people with Hemophilia, 10,231 with von Willebrand disease, and 3,959 with other bleeding disorders. At the same time, Argentina had 2,843 people with Hemophilia, 399 people with von Willebrand disease, and 11 people with other bleeding disorders.

Furthermore, according to the CDC (U.S. Department of Health & Human Services), countries such as Brazil have a recommendation for travelers who are allergic to a vaccine component or who are younger than six months should receive a single dose of immune globulin, which provides effective protection for up to 2 months depending on the dosage given. Additionally, various global plasma derivative manufacturers are expanding their business into South & Central America, boosting market growth. For instance, in November 2019, Grifols announced the start of production at its new blood-collection systems plant in Campo Largo, Brazil. The production line is fulfilling local customer orders in the region. It has an annual capacity of more than 10 million blood collection bags, and the more than 5,500-square-meter plant is expected to increase output to serve the broader Latin American region gradually.

Strategic insights for the South & Central America Blood Plasma Derivatives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Blood Plasma Derivatives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Blood Plasma Derivatives Strategic Insights

South & Central America Blood Plasma Derivatives Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,864.04 Million

Market Size by 2028

US$ 3,067.15 Million

CAGR (2022 - 2028) 8.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By Application

By End User

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Blood Plasma Derivatives Regional Insights

The South & Central America blood plasma derivatives market is segmented into type, application, end user, and country.

The South & Central America blood plasma derivatives market, by type, is segmented into albumin, factor VIII, factor IX, immunoglobulin, hyperimmune globulin, and others. The immunoglobulins segment held a larger market share in 2022.

Based on application, the South & Central America blood plasma derivatives market is divided into hemophilia, hypogammaglobulinemia, immunodeficiency diseases, von Willebrand disease, and other applications. The immunodeficiency diseases applications segment held the largest share of the market in 2022.

The blood plasma derivatives market, by end user, is segmented into hospitals, diagnostic laboratories, clinics, and other end users. The hospitals segment held the largest share of the market in 2022.

Based on country, the South & Central America blood plasma derivatives market is segmented into Brazil, Argentina, and the Rest of South & Central America. Saudi Arabia dominated the market in 2022.

Grifols SA; Octapharma AG; Monobind Inc.; CSL Behring LLC; LFB SA; Kedrion SpA; and Takeda Pharmaceutical Co Ltd are the leading companies operating in the South & Central America blood plasma derivatives market.

The South & Central America Blood Plasma Derivatives Market is valued at US$ 1,864.04 Million in 2022, it is projected to reach US$ 3,067.15 Million by 2028.

As per our report South & Central America Blood Plasma Derivatives Market, the market size is valued at US$ 1,864.04 Million in 2022, projecting it to reach US$ 3,067.15 Million by 2028. This translates to a CAGR of approximately 8.7% during the forecast period.

The South & Central America Blood Plasma Derivatives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Blood Plasma Derivatives Market report:

The South & Central America Blood Plasma Derivatives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Blood Plasma Derivatives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Blood Plasma Derivatives Market value chain can benefit from the information contained in a comprehensive market report.