South America Vertical Farming Crops Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Crop Type (Tomato, Leafy Greens, Herbs, and Others), End-Use (Food Retail, and Food Service), and Farming Technique (Hydroponics, Aeroponics, and Aquaponics)

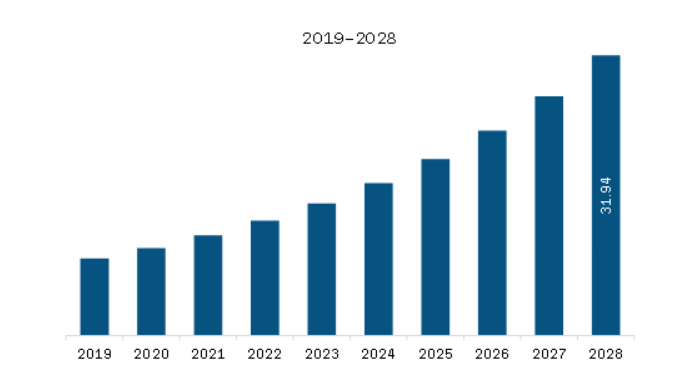

The vertical farming crops market in South America is expected to grow from US$ 31.94 million in 2021 to US$ 11.43 million by 2028; it is estimated to grow at a CAGR of 15.8% from 2021 to 2028.

Vertical farming is a massively promising agricultural technique that aims to produce more food to meet the growing population. Vertical farming includes growing crops in vertical frames or high-rise farms, saving ground space while relocating farms into urban areas, and producing nutritious crops without topsoil. The rising demand for organic food among the population triggers market growth. High usage of synthetic chemical fertilizers and pesticides in food products often leads to several health issues, including cancer, obesity, and other congenital disabilities. These factors are driving the consumers' inclination toward locally grown organic produce. Furthermore, due to the increasing focus on health and nutrition, consumers' demand for pesticide-free food products has grown exponentially. This, in turn, is fueling the demand for vertically farmed crops as they are cultivated with extreme hygiene, free of pesticides, and delivered to the retail stores within hours of harvest. Furthermore, especially in metropolitan areas, consumers are becoming more conscious about the techniques used for growing the crops and prefer food free from chemical pesticides and genetically modified organisms, thereby driving the demand for vertical farming crops across the region. Moreover, the essential nutrients in fruits and vegetables are reduced considerably during import and export. Also, most conventionally grown produce is sprayed with pesticides and fungicides. These factors drive the consumers’ inclination toward locally grown produce free from chemical fertilizers and pesticides. Besides, the food produced in vertical farms is fresh, local, suitable for environmental air quality, and pesticide-free. Therefore, the rise in demand for fresh, pesticide-free, and locally grown produce will provide huge market opportunities over the projected period.

Brazil had the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina. South America's government had taken an array of actions to protect its citizens against the COVID-19 spread. South America faced lower export revenues, both from the drop-in commodity prices and reduction in export volumes, especially to China, Europe, and the U.S, which are important trade partners. In several South American countries, containment measures reduced economic activity in the agriculture sector for at least the next quarter. However, the players in the area come up with opportunities. For instance, to respond to the COVID-19 pandemic, Pink Farms shifted its sales online and developed a new product line, "microgreens," early-harvest leaf vegetables packed with nutrients and flavor. Pink Farms is the first vertical farm in Sao Paulo, Brazil. Such strategies are projected to uplift market growth in the coming years.

Vendors attract new customers and expand their footprints in emerging markets with the new features and technologies, thereby driving the South America vertical farming crops market. The South America vertical farming crops market is expected to grow at a significant CAGR during the forecast period.

South America Vertical Farming Crops Market Revenue and Forecast to 2028 (US$ Million)

South America Vertical Farming Crops Market Segmentation

South America Vertical Farming Crops Market – By Crop Type

- Tomato

- Leafy Greens

- Herbs

- Others

South America Vertical Farming Crops Market – By End-Use

- Food Service

- Food Retail

South America Vertical Farming Crops Market – By Farming Technique

- Hydroponics

- Aeroponics

- Aquaponics

South America Vertical Farming Crops Market – By Country

- Brazil

- Argentina

- Rest of SAM

South America Vertical Farming Crops Market – Companies Mentioned

- AeroFarms

- CropOne

- Plantlab

- Gotham Greens

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis Formulation:

3.2.4 Macro-economic Factor Analysis:

3.2.5 Developing Base Number:

3.2.6 Data Triangulation:

3.2.7 Country Level Data:

3.2.8 Assumptions & Limitations:

4. South America Vertical Farming Crops Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.3 Expert Opinion

5. South America Vertical Farming Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Thriving Demand for Fresh, Pesticide-Free, and Locally Grown Produce

5.1.2 Scarce Availability of Arable Land for Conventional Agriculture

5.2 Market Restraints

5.2.1 Huge Initial Investment

5.3 Market Opportunities

5.3.1 Strengthening Demand for Vertical Farming in Highly Populated Urban countries

5.4 Future Trends

5.4.1 AI-Controlled Vertical Farms

5.5 Impact Analysis of Drivers and Restraints

6. South America Vertical Farming Crops – Market Analysis

6.1 South America Vertical Farming Crops Market Overview

6.2 South America Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

7. South America Vertical Farming Market Analysis – By Crop Type

7.1 Overview

7.2 South America Vertical Farming Market, By Crop Type (2020 and 2028)

7.3 Tomato

7.3.1 Overview

7.3.2 Tomato: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

7.4 Leafy Greens

7.4.1 Overview

7.4.2 Leafy Greens: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

7.5 Herbs

7.5.1 Overview

7.5.2 Herbs: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

8. South America Vertical Farming Market Analysis – By End-Use

8.1 Overview

8.2 South America Vertical Farming Crops Market, By End-Use (2020 and 2028)

8.3 Food Retail

8.3.1 Overview

8.3.2 Food Retail: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

8.4 Food Service

8.4.1 Overview

8.4.2 Food Service: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

9. South America Vertical Farming Market Analysis – By Farming Technique

9.1 Overview

9.2 South America Vertical Farming Crops Market, By Farming Technique (2020 and 2028)

9.3 Hydroponics

9.3.1 Overview

9.3.2 Hydroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

9.4 Aeroponics

9.4.1 Overview

9.4.2 Aeroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

9.5 Aquaponics

9.5.1 Overview

9.5.2 Aquaponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

10. South America Vertical Farming Crops Market – Country Analysis

10.1 Overvie

10.1.1 South America: Vertical Farming Crops Market, by Key Country

10.1.1.1 Brazil: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.1.1 Brazil: Vertical Farming Crops Market, by Crop Type

10.1.1.1.2 Brazil: Vertical Farming Crops Market, by End-Use

10.1.1.1.3 Brazil: Vertical Farming Crops Market, by Farming Technique

10.1.1.2 Argentina: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.2.1 Argentina: Vertical Farming Crops Market, by Crop Type

10.1.1.2.2 Argentina: Vertical Farming Crops Market, by End-Use

10.1.1.2.3 Argentina: Vertical Farming Crops Market, by Farming Technique

10.1.1.3 Rest of SAM: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

10.1.1.3.1 Rest of SAM: Vertical Farming Crops Market, by Crop Type

10.1.1.3.2 Rest of SAM: Vertical Farming Crops Market, by End-Use

10.1.1.3.3 Rest of SAM: Vertical Farming Crops Market, by Farming Technique

11. Impact of COVID-19 Pandemic on South America Vertical Farming Crops Market

11.1 South America: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Overview

12.2 Strategy & Business Planning

12.3 Merger and Acquisition

13. Company Profiles

13.1 AeroFarms

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 CropOne

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Plantlab

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 Gotham Greens

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary of Terms

LIST OF TABLES

Table 1. South America Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. South America Vertical Farming Crops Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. Brazil Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 5. Brazil Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 6. Argentina Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 7. Argentina Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 8. Argentina Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 9. Rest of SAM Vertical Farming Crops Market, by Crop Type – Revenue and Forecast to 2028 (US$ Million)

Table 10. Rest of SAM Vertical Farming Crops Market, by End Use – Revenue and Forecast to 2028 (US$ Million)

Table 11. Rest of SAM Vertical Farming Crops Market, by Farming Technique – Revenue and Forecast to 2028 (US$ Million)

Table 12. Glossary of Terms, South America Vertical Farming Crops Market

LIST OF FIGURES

Figure 1. South America Vertical Farming Crops Market Segmentation

Figure 2. South America Vertical Farming Crops Market Segmentation – By Country

Figure 3. South America Vertical Farming Crops Market Overview

Figure 4. South America Vertical Farming Crops Market, By Crop Type

Figure 5. South America Vertical Farming Crops Market, By Country

Figure 6. South America Vertical Farming Crops Market, Industry Landscape

Figure 7. South America: PEST Analysis

Figure 8. Expert Opinion

Figure 9. South America Vertical Farming Crops Market Impact Analysis of Drivers and Restraints

Figure 10. South America Vertical Farming Crops Market – Revenue and Forecast to 2028 (US$ Million)

Figure 11. South America Vertical Farming Crops Market Revenue Share, by Crop Type (2020 and 2028)

Figure 12. Tomato: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 13. Leafy Greens: Vertical Farming Crops Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. Herbs: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 15. Others: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 16. South America Vertical Farming Crops Market Revenue Share, by End-Use (2020 and 2028)

Figure 17. Food Retail: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 18. Food Service: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 19. South America Vertical Farming Crops Market Revenue Share, by Farming Technique (2020 and 2028)

Figure 20. Hydroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 21. Aeroponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 22. Aquaponics: Vertical Farming Crops Market – Revenue, and Forecast to 2028 (US$ Million)

Figure 23. Geographic Overview of South America Vertical Farming Crops Market

Figure 24. South America: Vertical Farming Crops Market Revenue Share, by Key Country (2020 and 2028)

Figure 25. Brazil: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 26. Argentina: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 27. Rest of SAM: Vertical Farming Crops Market –Revenue and Forecast to 2028 (US$ Million)

Figure 28. Impact of COVID-19 Pandemic in South America Country Markets

- AeroFarms

- CropOne

- Plantlab

- Gotham Greens

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the South America vertical farming crops market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the South America vertical farming crops market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South America market trends and outlook coupled with the factors driving the vertical farming crops market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution