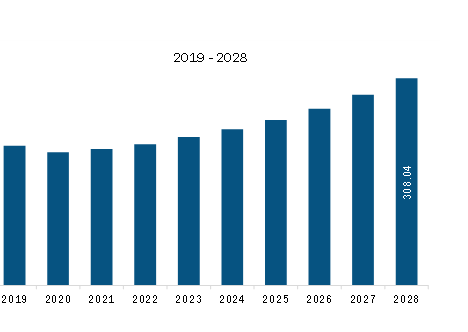

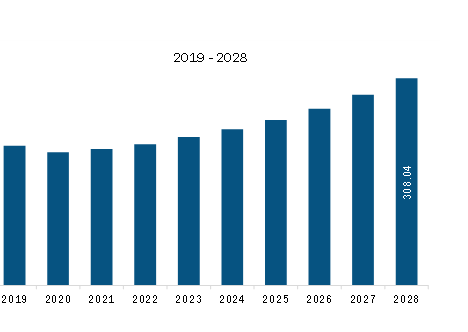

The South America rugged phones market is expected to grow from US$ 220.06 million in 2023 to US$ 308.04 million by 2028. It is estimated to grow at a CAGR of 7.0% from 2023 to 2028.

Increasing Demand of Rugged Phones Across Diverse Industries Drive South America Rugged Phones Market

The consumer electronics industry worldwide is strongly stimulated due to significant adoption of smartphones among various industry verticals, including construction, manufacturing, industrial environments, retail, transportation, and emergency services, among others, for both mission-critical and non-critical communication applications. The demand for smartphones and feature phones is growing at an impressive pace owing to increasing investments in research and development related to display technologies, communication networks, battery, and camera advancements, among several others. Regular upgradations in rugged phones design and integration of new features to match the level of features/applications offered by today’s consumer grade smartphones and feature phones is boosting the demand for these phones, especially in industrial sectors with harsh working environments. The demand for these rugged phones with differentiated features such as IP certification, dustproof, drop-tested, and high battery capacity for industrial task force and public safety workers has been growing at an impressive rate in the past few years in both developed and developing regions. Hence, the rise in the proliferation of smartphones & feature phones with rugged capabilities across industry sectors is anticipated to drive the growth of rugged phones market during the forecast period of 2023 to 2028.

South America Rugged Phones Market Overview

South America includes Brazil, Argentina, and the Rest of South America. Brazil is the most advanced country in South America, and it leverages several technologically advanced solutions to maintain or uplift its global image. The government is also making substantial progress in boosting its oil & gas and chemical & petrochemical industries. Rising adoption of advanced technologies and public and private cooperation has encouraged the retailers in this region to automate the flow of oil, gas, and chemicals, thereby generating huge demand for the installation of rugged phones. Moreover, projects associated with oil & gas are being initiated in the region, which would attract the use of rugged phones. For instance, in June 2019, Total—a Petroleum refining company based in France—and its partner have taken investment decisions for the second phase of the Mero project situated deep offshore, 180 kilometers off the coast of Rio de Janeiro, Brazil. The Mero 2 floating production storage and offloading have a liquid treatment capacity of 180,000 barrels per day. This project is expected to start by 2022. This project is all set to launch a new milestone that would enhance the oil resources of the Mero field in Brazil, expected at 3 to 4 billion barrels. Thus, increase in oil production projects would propel the demand for rugged phones in South America. On the other hand, the region is also witnessing initiatives like contractual alliances in context to supply of rugged phones which would assist in boosting the market growth. For instance, Sonim Technologies signed a partnership agreement with Acuraflow to supply rugged smartphones designed by Sonim Technologies to South America. This partnership would give more ultra-rugged mobility options to field workers in oil & gas, public safety, utilities, manufacturing, mining, and other demanding work environments. Moreover, it would keep them connected in extreme environments. Such partnerships for distribution of rugged smartphones devices are anticipated to increase their demand in the forthcoming period.

South America Rugged Phones Market Revenue and Forecast to 2028 (US$ Million)

South America rugged phones market Segmentation

The South America rugged phones market is segmented into type, screen size, and end-user, and country.

Based on type, the South America rugged phones market is bifurcated into smartphone and featured phones. In 2023, the smartphone segment registered a larger share in the South America rugged phones market.

Based on screen size, the South America rugged phones market is segmented into below 5-inch, 5 inch to 6 inch, and above 6 inch. In 2023, the 5 inch to 6 inch segment registered a largest share in the South America rugged phones market.

Based on end-user, the South America rugged phones market is segmented into industrial, government, commercial, military and defense, and consumer. In 2023, the industrial segment registered a largest share in the South America rugged phones market.

Based on country, the South America rugged phones market is segmented into Brazil, Argentina, and the Rest of South America. In 2023, Brazil segment registered a largest share in the South America rugged phones market.

AGM MOBILE; Blackview; Caterpillar Inc; KYOCERA Portugal; Nokia Corp; OUKITEL; Samsung Electronics Co Ltd; Ulefone Mobile; Unitech Electronics Co., LTD; and Zebra Technologies Corp are the leading companies operating in the South America rugged phones market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 220.06 Million |

| Market Size by 2028 | US$ 308.04 Million |

| CAGR (2023 - 2028) | 7.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South America Rugged Phones Market is valued at US$ 220.06 Million in 2023, it is projected to reach US$ 308.04 Million by 2028.

As per our report South America Rugged Phones Market, the market size is valued at US$ 220.06 Million in 2023, projecting it to reach US$ 308.04 Million by 2028. This translates to a CAGR of approximately 7.0% during the forecast period.

The South America Rugged Phones Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Rugged Phones Market report:

The South America Rugged Phones Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Rugged Phones Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Rugged Phones Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)