Growing Preference for Healthy Snacking Among Millennials Drives South America Nutritional Bars Market

The millennial generation values health and focuses on managing their body weight to live a healthy lifestyle. They believe in eating right, exercising, and taking a proper diet. Additionally, social media intensifies their desire to appear healthy and vibrant. The growing number of fitness centers, health clubs, and gymnasiums is triggering the demand for healthy snacking products among millennials. Healthy snacking helps fulfill the body's need for proper nutrition. Nutritional bars are considered a suitable healthy snacking option as they contain proteins, omega-3 fatty acids, and fibers in high quantities. They are considered a healthier alternative to other bars due to their low sugar and additive content. These properties of nutritional bars assist in muscle repair by improving protein levels in the body, enhancing overall body performance, boosting metabolism, and lowering glucose and saturated fat levels before and after a workout. These products come in convenient packaging. In addition to proteins, these bars include daily essentials such as vitamins and immunity boosters that help fulfill the body's nutrient requirement, and aid muscle development and recovery. Nutritional bars support an active lifestyle and aid the diet regime. Millennials are generally aware of the nutrition need of their bodies, and nutritional bars provide a healthy option to fulfill those needs in their busy schedules. With hectic work schedules and changing lifestyles, the dependence of millennials on healthy snacking has increased.

South America Nutritional Bars Market Overview

The South America nutritional bars market is segmented into Brazil, Argentina, and the Rest of South America. The rising population and continuous improvement have positively affected the growth of the economy of Brazil and Argentina. The shift in consumer lifestyle and dietary patterns is a major factor boosting the growth of the South America nutritional bars market in the region, especially in Brazil. A large consumer base in Brazil consumes healthy snacks that are low-calorie, sugar-free, and gluten-free. Furthermore, the consumption of nutritional bars, such as energy bars, protein bars, and carbohydrate bars, is increasing across the region. Also, consumer preference for snacking and on-the-go convenient food consumption contribute to the South America nutritional bars market. In addition, the growing preference for a healthy lifestyle is a major factor fueling the South America nutritional bars market growth. The rise in fitness enthusiasts and growing consumer inclination toward a healthy lifestyle are the prime drivers of the South America nutritional bars market growth. The growing participation of people in sports at the national and international levels is likely to increase the number of athletes, which will boost the demand for protein bars and energy bars. Hence, the South America nutritional bars market is expected to grow during the forecast period.

South America Nutritional Bars Market Segmentation

South America Nutritional Bars Market Segmentation

The South America nutritional bars market is segmented into type, category, distribution channel, and country.

Based on type, the South America nutritional bars market is segmented into protein bars, high-fiber bars, and others. In 2022, the protein bars segment registered a largest share in the South America nutritional bars market.

Based on category, the South America nutritional bars market is bifurcated into conventional and gluten-free. In 2022, the conventional segment registered a larger share in the South America nutritional bars market.

Based on distribution channel, the South America nutritional bars market is segmented into supermarkets & hypermarkets, convenience stores, online retail, and others. In 2022, the supermarkets & hypermarkets segment registered a largest share in the South America nutritional bars market.

Based on country, the South America nutritional bars market is segmented into Brazil, Argentina, and the Rest of South America. In 2022, the Rest of South America segment registered a largest share in the South America nutritional bars market.

Clif Bar & Co; General Mills Inc; Mars Inc; The Kellogg Co; The Quaker Oats Co; and The Simply Good Foods Co are the leading companies operating in the South America nutritional bars market.

| Report Attribute | Details |

|---|---|

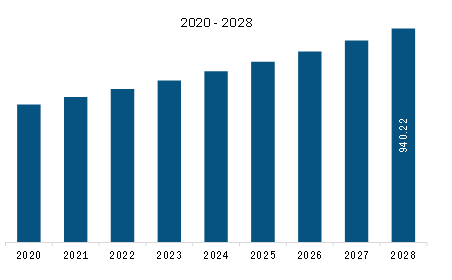

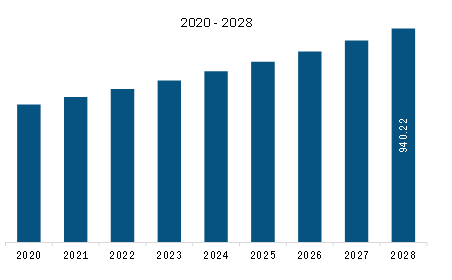

| Market size in 2022 | US$ 674.55 Million |

| Market Size by 2028 | US$ 940.22 Million |

| CAGR (2022 - 2028) | 5.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South America Nutritional Bars Market is valued at US$ 674.55 Million in 2022, it is projected to reach US$ 940.22 Million by 2028.

As per our report South America Nutritional Bars Market, the market size is valued at US$ 674.55 Million in 2022, projecting it to reach US$ 940.22 Million by 2028. This translates to a CAGR of approximately 5.7% during the forecast period.

The South America Nutritional Bars Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Nutritional Bars Market report:

The South America Nutritional Bars Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Nutritional Bars Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Nutritional Bars Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)