South America Homeland Security Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By End User (Public Security and Private Security) and Security Type (Border Security, Mass Transit Security, Cyber Security, Critical Infrastructure Security, Aviation Security, Maritime Security, and Others)

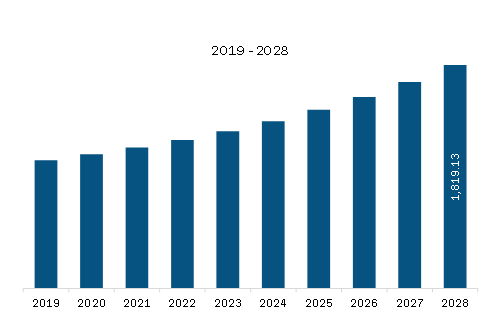

The homeland security market in South America is expected to grow from US$ 3,318.80 million in 2022 to US$ 3,903.23 million by 2028. It is estimated to grow at a CAGR of 2.7% from 2022 to 2028.

Rise in Strategic Initiatives by Market Players

Homeland security plays a crucial role in ensuring the safety of both the private and public sectors of nations. Thus, the rise in spending by state and regional government bodies to procure and indicate security solutions is influencing the SAM homeland security market players to undertake various strategic initiatives such as new product development, strategic partnerships, and mergers & acquisitions. Major players operating in the market include Elbit Systems, General Dynamics, IBM Corp, Lockheed Martin Corporation, Northrop Grumman Corporation, and Thales Group. Some of the strategic initiatives are as follows:

• IBM Corp. has engaged itself in the acquisition of various cyber security and threat detection solution providers to enhance its product portfolio. In November 2021, the company acquired ReaQta to integrate its automated technology for identifying and managing threats. Similarly, in June 2022, the company acquired Randori, which provides attack surface management and offensive cyber security solutions.

•In July 2022, Thales Group acquired ONEWELCOME to enhance its cyber security product portfolio. ONEWELCOME offers one of the prominent customer identity and access management solutions to both public and private players.

Thus, the rise in strategic initiatives taken by market players is enhancing the product portfolio offered. These factors are expected to further augment the growth of the South America homeland security market over the forecast period

Market Overview

Brazil and rest of South America are the key contributors to the homeland security market in the South America. Rise in urbanization and several large-scale government efforts in South American countries are propelling the region's smart security in the South America homeland security market forward. Most South American countries, including Brazil and Argentina, are affected by severe issues such as traffic, contamination, high crime rates, government inefficiencies, and a lack of transparency. All these considerations call for improved and more effective security architecture. Border security measures are critical in South America because most nations are experiencing migration crises, and some are afflicted by illegal crossings and armed conflicts connected to Venezuela's instability. In this region, transnational crime, including drug trafficking and smuggling, is common. Government officials require effective security technologies to speed up identification processes, improve decision-making, and battle hostile people within their borders. Innovative and sustainable border security products have seen rapid growth in recent years, owing to the pandemic and stricter border controls. For instance, in February 2022, Customs and Border Protection (CBP) in the US announced the inauguration of a comprehensive Global Entry agreement with the Government of Brazil. Drug trafficking, human trafficking, cyber-attacks, riot, and the threat of terrorists and other illegal activities have occurred in countries such as Brazil, Venezuela, Chile, Peru, and Argentina in the past couple of years, with local economic crises and political instability in the countries being the primary causes. Homeland security agencies play a significant part in the country to control of such activities because they can be utilized as a less harmful alternative to firearms to lessen the risk of public injury or in instances when some force is required. Such scenarios are propelling the adoption of homeland security across South America by law enforcement agencies, thereby contributing to the growth of the South America homeland security market.

South America Homeland Security Market Revenue and Forecast to 2028 (US$ Million)

The South America homeland security market is segmented into end user, security type, and country.

Based on end user, the market is bifurcated into public security and private security. The public security segment registered the larger market share in 2022.

Based on security type, the market is segmented into border security, mass transit security, cyber security, critical infrastructure security, aviation security, maritime security, and others. The cyber security segment held the largest market share in 2022.

Based on country, the market is segmented into Brazil and rest of South America. Brazil dominated the market share in 2022.

Elbit Systems Ltd; IBM Corporation; Lockheed Martin Corporation; Leidos; Thales Group; Teledyne FLIR LLC; Northrop Grumman Corporation; Raytheon Technologies Corporation; Textron Systems; and General Dynamic Information Technology, Inc. are the leading companies operating in the homeland security market in the region.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Homeland Security Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Buyers

4.2.2 Bargaining Power of Suppliers

4.2.3 Threat to New Entrants

4.2.4 Threat to Substitutes

4.2.5 Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Homeland Security Market - Key Market Dynamics

5.1 Market Drivers

5.1.1 Rise in Severe Cyberattacks

5.1.2 Increase in Number of Airports and Passenger Traffic

5.2 Key Market Restraints

5.2.1 Lack of Central Governing Body for Homeland Security Across Countries

5.3 Key Market Opportunities

5.3.1 Rise in Strategic Initiatives by Market Players

5.4 Future Trends

5.4.1 Rise in Procurement of Various Security Solutions and Services

5.5 Impact Analysis of Drivers and Restraints

6. Homeland Security Market – SAM Market Analysis

6.1 SAM Homeland Security Market Forecast and Analysis

7. SAM Homeland Security Market Analysis – by End User

7.1 Overview

7.2 SAM Homeland Security Market Breakdown, by End User, 2021 and 2028

7.3 Public Sector

7.3.1 Overview

7.3.2 Public Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Private Sector

7.4.1 Overview

7.4.2 Private Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

8. SAM Homeland Security Market Analysis – by Security Type

8.1 Overview

8.2 SAM Homeland Security Market Breakdown, by Security Type, 2021 and 2028

8.3 Border Security

8.3.1 Overview

8.3.2 Border Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.4 Mass Transit Security

8.4.1 Overview

8.4.2 Mass Transit Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.5 Cyber Security

8.5.1 Overview

8.5.2 Cyber Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.6 Critical Infrastructure Security

8.6.1 Overview

8.6.2 Critical Infrastructure Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.7 Aviation Security

8.7.1 Overview

8.7.1.1 Aviation Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.8 Maritime Security

8.8.1 Overview

8.8.2 Maritime Security: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

8.9 Others

8.9.1 Overview

8.9.2 Others: Homeland Security Market– Revenue and Forecast to 2028 (US$ Million)

9. SAM Homeland Security Market – Country Analysis

9.1 Overview

9.1.1 SAM: Homeland Security Market, by Key Country

9.1.1.1 Brazil: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.1.1 Brazil: Homeland Security Market, by End User

9.1.1.1.2 Brazil: Homeland Security Market, by Service Type

9.1.1.2 Rest of SAM: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

9.1.1.2.1 Rest of SAM: Homeland Security Market, by End User

9.1.1.2.2 Rest of SAM: Homeland Security Market, by Service Type

10. Industry Landscape

10.1 Overview

10.2 Market Initiative

10.3 New Product Development

11. Company Profiles

11.1 Elbit Systems Ltd.

11.1.1 Key Facts

11.1.2 Business Description

11.1.3 Products and Services

11.1.4 Financial Overview

11.1.5 SWOT Analysis

11.1.6 Key Developments

11.2 IBM Corporation

11.2.1 Key Facts

11.2.2 Business Description

11.2.3 Products and Services

11.2.4 Financial Overview

11.2.5 SWOT Analysis

11.2.6 Key Developments

11.3 Lockheed Martin Corporation

11.3.1 Key Facts

11.3.2 Business Description

11.3.3 Products and Services

11.3.4 Financial Overview

11.3.5 SWOT Analysis

11.3.6 Key Developments

11.4 Leidos

11.4.1 Key Facts

11.4.2 Business Description

11.4.3 Products and Services

11.4.4 Financial Overview

11.4.5 SWOT Analysis

11.4.6 Key Developments

11.5 Thales Group

11.5.1 Key Facts

11.5.2 Business Description

11.5.3 Products and Services

11.5.4 Financial Overview

11.5.5 SWOT Analysis

11.5.6 Key Developments

11.6 Teledyne FLIR LLC

11.6.1 Key Facts

11.6.2 Business Description

11.6.3 Products and Services

11.6.4 Financial Overview

11.6.5 SWOT Analysis

11.6.6 Key Developments

11.7 Northrop Grumman Corporation

11.7.1 Key Facts

11.7.2 Business Description

11.7.3 Products and Services

11.7.4 Financial Overview

11.7.5 SWOT Analysis

11.7.6 Key Developments

11.8 Raytheon Technologies Corporation

11.8.1 Key Facts

11.8.2 Business Description

11.8.3 Products and Services

11.8.4 Financial Overview

11.8.5 SWOT Analysis

11.8.6 Key Developments

11.9 Textron Systems

11.9.1 Key Facts

11.9.2 Business Description

11.9.3 Products and Services

11.9.4 Financial Overview

11.9.5 SWOT Analysis

11.9.6 Key Developments

11.10 General Dynamics Information Technology, Inc.

11.10.1 Key Facts

11.10.2 Business Description

11.10.3 Products and Services

11.10.4 Financial Overview

11.10.5 SWOT Analysis

11.10.6 Key Developments

12. Appendix

12.1 About The Insight Partners

12.2 Word Index

LIST OF TABLES

Table 1. SAM Homeland Security Market, Revenue and Forecast, 2020–2028 (US$ Million)

Table 2. Brazil: Homeland Security Market, by End User – Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil: Homeland Security Market, by Service Type – Revenue and Forecast to 2028 (US$ Million)

Table 4. Rest of SAM: Homeland Security Market, by End User– Revenue and Forecast to 2028 (US$ Million)

Table 5. Rest of SAM: Homeland Security Market, by Service Type – Revenue and Forecast to 2028 (US$ Million)

Table 6. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Homeland Security Market Segmentation

Figure 2. SAM Homeland Security Market Segmentation – Country

Figure 3. SAM Homeland Security Market Overview

Figure 4. SAM Homeland Security Market, By End User

Figure 5. SAM Homeland Security Market, By Security Type

Figure 6. SAM Homeland Security Market, By Country

Figure 7. SAM Porter’s Five Forces Analysis

Figure 8. SAM Homeland Security Market Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. SAM Homeland Security Market: Impact Analysis of Drivers and Restraints

Figure 11. SAM Homeland Security Market, Forecast and Analysis (US$ Million)

Figure 12. SAM Homeland Security Market Revenue Share, by End User (2021 and 2028)

Figure 13. SAM Public Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. SAM Private Sector: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. SAM Homeland Security Market Revenue Share, by Security Type (2021 and 2028)

Figure 16. SAM Border Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. SAM Mass Transit Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM Cyber Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 19. SAM Critical Infrastructure Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. SAM Aviation Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. SAM Maritime Security: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 22. SAM Others: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. SAM: Homeland Security Market Revenue Share, by Key Country- Revenue (2021) (US$ Million)

Figure 24. SAM: Homeland Security Market Revenue Share, by Key Country (2021 and 2028)

Figure 25. Brazil: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. Rest of SAM: Homeland Security Market – Revenue and Forecast to 2028 (US$ Million)

- Elbit Systems Ltd.

- IBM Corporation.

- LOCKHEED MARTIN Corporation.

- Leidos.

- Thales Group.

- Teledyne FLIR LLC.

- NORTHROP GRUMMAN Corporation.

- RAYTHEON TECHNOLOGIES Corporation.

- TEXTRON Systems.

- General Dynamic Information Technology.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the South America homeland security market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the South America homeland security market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth South America market trends and outlook coupled with the factors driving the homeland security market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution