Impact of Digitalization is Driving the South America Event Apps Market

Digitalization is paving the way for events and conferences in several end-use verticals, including science, education, government, and health care. Digitalization is helping event planners efficiently host and manage events, convention, or trade show that brings new revenue to industries across the country. For instance, in January 2022, ON24 released its Go Live app to help marketers stream live video events. ON24 Go Live enables event planners to create digital events and deliver an interactive and engaging experience for audiences. It provides the users with multiple ways to run virtual events, from multisession and live-streamed digital events to interactive webinars. Expanding digital experiences allows customers to create and set up events, capture data, and analyze actionable insights to enhance product sales. ON24 Go Live features pre-built event templates for different interactive virtual events, such as roadshows, training, town halls, and company meetings. Furthermore, digitalization is driving the South America event apps market growth by keeping audiences engaged with event and in-session chats, polls, and breakout sessions, providing the ability to track event activity and attendee engagement. It also provides customers with a one-stop platform to drive an interactive, engaging experience that provides opportunities for two-way discussion, networking, and relationship-building.

South America Event Apps Market Overview

Brazil, Chile, Argentina, Peru, and Colombia are among the key countries in South America. The event and business meeting industries in the region are booming. The number of events and meetings expanded in every category, including product showcases, training seminars, customer-centric meetings, and leadership summits, in 2019. Businesses conduct customer-centric meetings to expand their businesses. As a result, virtual event planners are projected to witness a considerable increase in the number of conferences and seminars. The use of technologies in events and meetings has increased in recent months. Further, event planners are demanding virtual solutions for remote participants to ensure a high number of attendees and for easy operations and cost savings. These factors will fuel the growth of the South America event apps market in the forecasted period. Virtual meetings and online conferences are gaining popularity in South America due to the impact of COVID-19 pandemic. Event planners pay close attention to countries such as Brazil, Argentina, Colombia, Ecuador, and Peru. Moreover, in August 2021, the UFI LatAm Conference 2021 reconnected a pandemic-affected exhibition industry community across South America. The digital event led by Ana-Maria Arango, UFI regional director for Latin America, had a mix of keynote sessions and expert material, as well as networking and business development possibilities. The next SPE Latin American and Caribbean Petroleum Engineering Conference (LACPEC) was held virtually in July 2020, after over 25 years as one of the most important technical meetings for the exploration & production (E&P) sector in South America. The region is utilizing virtual networking with specialists and professionals from across the world. As a result, through the virtual lounge, the event apps allow attendees and hosts to boost networking with other colleagues and professionals. Hence, the ongoing transition of the event industry is promoting the growth of the South America event apps market in South America.

South America Event Apps Market Segmentation

South America Event Apps Market Segmentation

The South America event apps market is segmented into type, operating system, end user, and country.

Based on type, the South America event apps market is segmented into enterprise event apps, hybrid apps, corporates meeting apps, conference apps, trade show apps, festival apps, and sports event apps. In 2022, the enterprise event apps segment registered a largest share in the South America event apps market.

Based on operating system, the South America event apps market is segmented into iOS, android, and web-based. In 2022, the android segment registered a largest share in the South America car care products market.

Based on end user, the South America event apps market is segmented into event organizer and planners, corporates, government, education, and others. In 2022, the event organizer and planners segment registered a largest share in the South America event apps market.

Based on country, the South America event apps market is segmented into Brazil, Argentina, and the Rest of South America. In 2022, Brazil segment registered a largest share in the South America event apps market.

Cvent Inc.; Evenium; Meeting Application; ON24, Inc.; SpotMe; WebEx Events; and Whova are the leading companies operating in the South America event apps market.

| Report Attribute | Details |

|---|---|

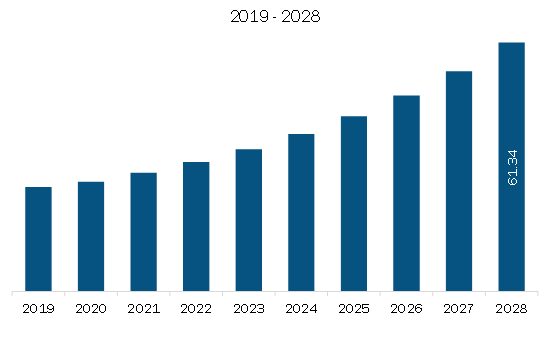

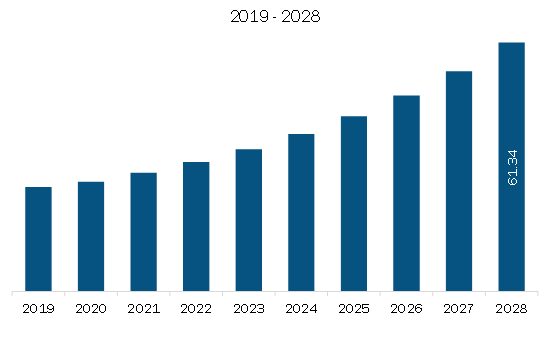

| Market size in 2022 | US$ 31.90 Million |

| Market Size by 2028 | US$ 61.34 Million |

| CAGR (2022 - 2028) | 11.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South America Event Apps Market is valued at US$ 31.90 Million in 2022, it is projected to reach US$ 61.34 Million by 2028.

As per our report South America Event Apps Market, the market size is valued at US$ 31.90 Million in 2022, projecting it to reach US$ 61.34 Million by 2028. This translates to a CAGR of approximately 11.5% during the forecast period.

The South America Event Apps Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Event Apps Market report:

The South America Event Apps Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Event Apps Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Event Apps Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)