South America Encoder Market Forecast to 2027 - COVID-19 Impact and Regional Analysis By Type (Linear Encoder and Rotary Encoder), Technology (Magnetic, Optical, and Others), and End-User (Aerospace, Automotive, Food and Beverages, Medical, Consumer Electronics, Printing, and Others)

Market Introduction

Encoders are used in several sectors to provide feedback about the movement of a rotating shaft and it also senses position, direction, and speed. It converts mechanical motion into an electrical signal, the signal transmitted back to a controlling device, such as a counter. Technologies involved in encoders are magnetic, optical and capacitive. The optical technology is the most broadly used encoder motion translating technology. The encoder has a broad range of uses, including servo or VFD (Variable Frequency Drive) control, measuring, and counts. For VFD control, one might be running a pump on a VFD to fill a tank with liquid, one might request for a certain speed and want to verify that the speed is at the required rate. An encoder on the VFD is used for feedback of the speed. VFD is used to control the motor speed; the actual speed is measured with an encoder. The automobile sector is experiencing a considerable development in advanced technologies; various connected and driverless cars are in the developing phase. Advanced encoder technologies encourage automotive OEMs to adopt encoder devices; thus, the automobile industry has a massive impact on the SAM encoder market. In the past few years, warehouse automation systems have progressed rapidly due to developments in software and communication and control technology. Automotive guided vehicles (AGV) have aided greatly from such advances, and have been applied to a broad range of applications. The primary sensors used in AGV motion and directional control are incremental rotary encoders. The incremental encoders are broadly used in material handling equipment as they are built to offer precise, real-time data about AGV motor. Thus, the wide use of industrial robots in manufacturing process is expected to create a significant demand for encoder in the coming years, which is further anticipated to drive the encoder market.

In SAM region, Brazil has the highest number of COVID-19 cases, followed by Ecuador, Chile, Peru, and Argentina, among others. The government of SAM has taken an array of actions to protect their citizens and contain COVID-19 spread. Containment measures in several countries of SAM will reduce economic activity in the manufacturing and service sectors for at least the next quarter, and is expected to rebound once the pandemic is contained. The emergence and rapid spread of COVID-19 has affected many developed and developing countries. The continuous surge in count of infected patients is threatening several industries across the SAM region. Since majority of the countries are exercising lockdowns, the demand for encoders are decreasing at a prominent rate. This is due to the fact that, the key encoder purchasing countries have been restricting their investment on these components, and are utilizing a fair percentage of their budget to combat COVID-19. The temporary shutdown of manufacturing facilities is also showcasing negative trend in the encoder market. The continuity of the COVID-19 spread, would be a negative factor for encoder market players. The semiconductor and automotive industry are among the victims of COVID-19, and since the start of 2020, these industries have been reflecting a declining growth trend. With the imposition of lockdown across SAM region, the industries have been witnessing shattering experience. The automotive industry requires a significant number of human labour, and as the COVID-19 virus is spreading through human involvement, the sector is unable to function properly. The declining trend in automotive and semiconductor industry is reflecting a negative impact on the SAM encoder market.

Get more information on this report :

Market Overview and Dynamics

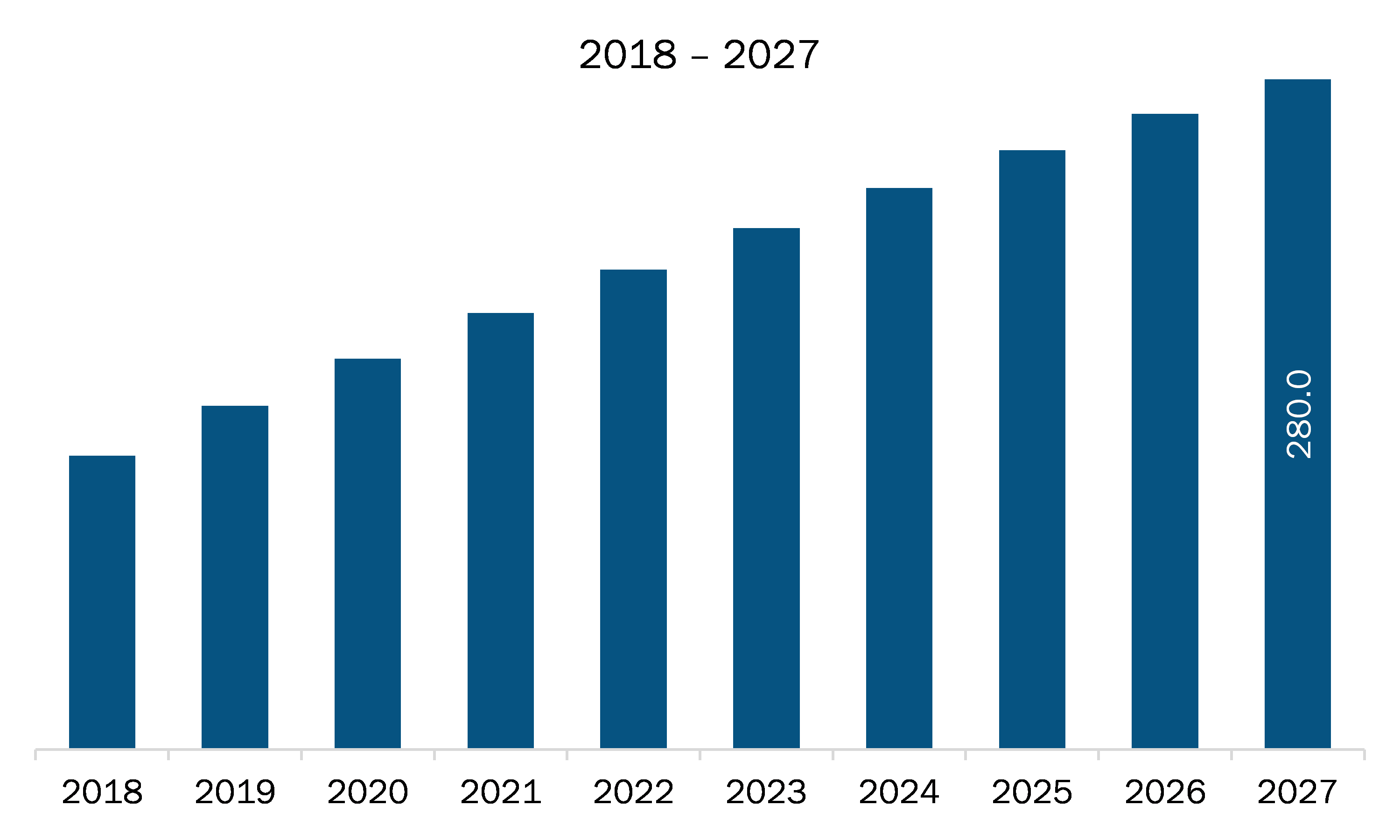

The encoder market in SAM is expected to grow from US$ 143.5 million in 2019 to US$ 280.0 million by 2027; it is estimated to grow at a CAGR of 8.0% from 2020 to 2027. There has been an enormous wave in the development of technologies, which has impacted the design of encoders. Also, the semiconductor industry is driven by tech innovations, consumer trends, and better production processes. One of the biggest trends in encoder industry is the increasing demand and requirement for lighter, smaller, and high-performing encoders. Various vendors across the region are highly emphasized on designing products that are smaller and embed with more functionality. Prominent players in the market are focusing on the introduction of miniaturized designs of their products in order to sync with changing trends in various industries. The robotics industry is importantly observing the growth of this miniaturization trend, the demand for miniaturized devices in this industry would see a substantial boost in the near future, which, in turn will propel the growth of the encoder market.

Key Market Segments

In terms of type, the rotary encoder segment accounted for a larger share of the SAM encoder market in 2019. In terms of technology, the magnetic segment held the largest share of the encoder market in 2019. Further, the consumer electronics segment held the largest share of the market based on end-user in 2019.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on the encoder market in SAM are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Dahua Technology Co., Ltd.; Renishaw Plc; LTN Servotechnik GmbH; OMRON Corporation; Delta Electronics; and Rockwell Automation, Inc. are among the major companies listed in the report.

Reasons to buy report

- To understand the SAM encoder market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for the SAM encoder market

- Efficiently plan M&A and partnership deals in the SAM encoder market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment of the SAM encoder market

- Obtain market revenue forecast for market by various segments from 2020 to 2027 in SAM region.

SAM Encoder Market Segmentation

- Linear Encoder

- Incremental

- Absolute

- Rotary Encoder

- Incremental

- Absolute

By Technology

- Magnetic

- Optical

- Others

- Aerospace

- Automotive

- Food and Beverages

- Medical

- Consumer Electronics

- Printing

- Others

By Country

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- Dahua Technology Co., Ltd.

- Renishaw Plc

- LTN Servotechnik GmbH

- OMRON Corporation

- Delta Electronics

- Rockwell Automation, Inc.

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Encoder Market Landscape

4.1 Market Overview

4.2 SAM PEST Analysis

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Encoder Market – Market Dynamics

5.1 Market Drivers

5.1.1 Wide use of Industrial Robots in Manufacturing Process

5.2 Market Restraints

5.2.1 Less accuracy of Encoder Technologies

5.3 Market Opportunities

5.3.1 Broad Application of IoT

5.4 Future Trend

5.4.1 Demand for miniaturized devices

5.5 Impact Analysis of Drivers and Restraints

6. SAM Encoder Market Analysis

6.1 SAM Encoder Market Overview

6.2 Encoder Market –Revenue, and Forecast to 2027 (US$ Million)

6.3 SAM Market Positioning – Five Key Players

7. SAM Encoder Market Analysis – By Type

7.1 Overview

7.2 SAM Encoder Market Breakdown, by Type, 2019 & 2027

7.3 Linear Encoder

7.3.1 Overview

7.3.2 Linear Encoder Market Revenue and Forecast to 2027 (US$ Million)

7.3.3 Incremental

7.3.3.1 Overview

7.3.3.2 Incremental Encoder: Linear Encoder Market Revenue and Forecast to 2027 (US$ Million)

7.3.4 Absolute

7.3.4.1 Overview

7.3.4.2 Absolute Encoder: Linear Encoder Market – Revenue and Forecast to 2027 (US$ Million)

7.4 Rotary Encoder

7.4.1 Overview

7.4.2 Rotary Encoder Market Revenue and Forecast to 2027 (US$ Million)

7.4.3 Incremental

7.4.3.1 Overview

7.4.3.2 Incremental Encoder: Rotary Encoder Market Revenue and Forecast to 2027 (US$ Million)

7.4.4 Absolute

7.4.4.1 Overview

7.4.4.2 Absolute Encoder: Rotary Encoder Market – Revenue and Forecast to 2027 (US$ Million)

8. SAM Encoder Market Analysis – By Technology

8.1 Overview

8.2 SAM Encoder Market Breakdown, by Technology, 2019 & 2027

8.3 Magnetic

8.3.1 Overview

8.3.2 Magnetic Market Revenue and Forecast to 2027 (US$ Million)

8.4 Optical

8.4.1 Overview

8.4.2 Optical Market Revenue and Forecast to 2027 (US$ Million)

8.5 Others

8.5.1 Overview

8.5.2 Others Market Revenue and Forecast to 2027 (US$ Million)

9. SAM Encoder Market Analysis – By End User

9.1 Overview

9.2 SAM Encoder Market Breakdown, by End User, 2019 & 2027

9.3 Aerospace

9.3.1 Overview

9.3.2 Aerospace Market Revenue and Forecast to 2027 (US$ Million)

9.4 Automotive

9.4.1 Overview

9.4.2 Automotive Market Revenue and Forecast to 2027 (US$ Million)

9.5 Food and Beverages

9.5.1 Overview

9.5.2 Food and Beverages Market Revenue and Forecast to 2027 (US$ Million)

9.6 Medical

9.6.1 Overview

9.6.2 Medical Market Revenue and Forecast to 2027 (US$ Million)

9.7 Consumer Electronics

9.7.1 Overview

9.7.2 Consumer Electronics Market Revenue and Forecast to 2027 (US$ Million)

9.8 Printing

9.8.1 Overview

9.8.2 Printing Market Revenue and Forecast to 2027 (US$ Million)

9.9 Others

9.9.1 Overview

9.9.2 Others Market Revenue and Forecast to 2027 (US$ Million)

10. SAM Encoders Market – Country Analysis

10.1 Overview

10.1.1 SAM: Encoders Market, by Key Country

10.1.1.1 Brazil: Encoders Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.1.1 Brazil: Encoders Market, by Type

10.1.1.1.1.1 Brazil: Encoders Market, by Linear Encoder

10.1.1.1.1.2 Brazil: Encoders Market, by Rotary Encoder

10.1.1.1.2 Brazil: Encoders Market, by Technology

10.1.1.1.3 Brazil: Encoders Market, by End-User

10.1.1.2 Argentina: Encoders Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.2.1 Argentina: Encoders Market, by Type

10.1.1.2.1.1 Argentina: Encoders Market, by Linear Encoder

10.1.1.2.1.2 Argentina: Encoders Market, by Rotary Encoder

10.1.1.2.2 Argentina: Encoders Market, by Technology

10.1.1.2.3 Argentina: Encoders Market, by End-User

10.1.1.3 Rest of SAM: Encoders Market – Revenue and Forecast to 2027 (US$ Million)

10.1.1.3.1 Rest of SAM: Encoders Market, by Type

10.1.1.3.1.1 Rest of SAM: Encoders Market, by Linear Encoder

10.1.1.3.1.2 Rest of SAM: Encoders Market, by Rotary Encoder

10.1.1.3.2 Rest of SAM: Encoders Market, by Technology

10.1.1.3.3 Rest of SAM: Encoders Market, by End-User

11. SAM Encoder Market - COVID-19 Impact Analysis

11.1 SAM: Impact Assessment of COVID-19 Pandemic

12. Industry Landscape

12.1 Market Initiatives

12.2 New Product Development

13. Company Profiles

13.1 Dahua Technology Co., Ltd.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 Renishaw Plc

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 LTN Servotechnik GmbH

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 OMRON Corporation

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Delta Electronics

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 Rockwell Automation, Inc.

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Word Index

LIST OF TABLES

Table 1. Encoder Market –Revenue and Forecast to 2027 (US$ Million)

Table 2. Brazil: Encoders Market, by Type – Revenue and Forecast to 2027 (US$ Million)

Table 3. Brazil: Encoders Market, by Linear Encoder –Revenue and Forecast to 2027 (US$ Million)

Table 4. Brazil: Encoders Market, by Rotary Encoder –Revenue and Forecast to 2027 (US$ Million)

Table 5. Brazil: Encoders Market, by Technology – Revenue and Forecast to 2027 (US$ Million)

Table 6. Brazil: Encoders Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 7. Argentina: Encoders Market, by Type – Revenue and Forecast to 2027 (US$ Million)

Table 8. Argentina: Encoders Market, by Linear Encoder –Revenue and Forecast to 2027 (US$ Million)

Table 9. Argentina: Encoders Market, by Rotary Encoder –Revenue and Forecast to 2027 (US$ Million)

Table 10. Argentina: Encoders Market, by Technology – Revenue and Forecast to 2027 (US$ Million)

Table 11. Argentina: Encoders Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 12. Rest of SAM: Encoders Market, by Type – Revenue and Forecast to 2027 (US$ Million)

Table 13. Rest of SAM: Encoders Market, by Linear Encoder –Revenue and Forecast to 2027 (US$ Million)

Table 14. Rest of SAM: Encoders Market, by Rotary Encoder –Revenue and Forecast to 2027 (US$ Million)

Table 15. Rest of SAM: Encoders Market, by Technology – Revenue and Forecast to 2027 (US$ Million)

Table 16. Rest of SAM: Encoders Market, by End-User – Revenue and Forecast to 2027 (US$ Million)

Table 17. List of Abbreviation

LIST OF FIGURES

Figure 1. SAM Encoder Market Segmentation

Figure 2. SAM Encoder Market Segmentation – By Country

Figure 3. SAM Encoder Market Overview

Figure 4. SAM Encoder Market - By Country

Figure 5. SAM Encoder Market - By Type

Figure 6. SAM Encoder Market – Country Analysis

Figure 7. SAM – PEST Analysis

Figure 8. SAM Encoder Market Impact Analysis of Drivers And Restraints

Figure 9. SAM Encoder Market – Revenue and Forecast to 2027 (US$ Million)

Figure 10. SAM Encoder Market Breakdown, by Type (2019 and 2027)

Figure 11. SAM Linear Encoder Market Revenue and Forecast To 2027(US$ Million)

Figure 12. SAM Incremental Encoder: Linear Encoder Market Revenue and Forecast To 2027(US$ Million)

Figure 13. SAM Absolute Encoder: Linear Encoder Market Revenue and Forecast To 2027(US$ Million)

Figure 14. SAM Rotary Encoder Market Revenue and Forecast To 2027(US$ Million)

Figure 15. SAM Incremental Encoder: Rotary Encoder Market Revenue and Forecast To 2027(US$ Million)

Figure 16. SAM Absolute Encoder: Rotary Encoder Market Revenue and Forecast To 2027(US$ Million)

Figure 17. SAM Encoder Market Breakdown, by Technology (2019 and 2027)

Figure 18. SAM Magnetic Market Revenue and Forecast to 2027(US$ Million)

Figure 19. SAM Optical Market Revenue and Forecast to 2027(US$ Million)

Figure 20. SAM Others Market Revenue and Forecast to 2027(US$ Million)

Figure 21. SAM Encoder Market Breakdown, by End User (2019 and 2027)

Figure 22. SAM Aerospace Market Revenue and Forecast to 2027(US$ Million)

Figure 23. SAM Automotive Market Revenue and Forecast to 2027(US$ Million)

Figure 24. SAM Food and Beverages Market Revenue and Forecast to 2027(US$ Million)

Figure 25. SAM Medical Market Revenue and Forecast to 2027(US$ Million)

Figure 26. SAM Consumer Electronics Market Revenue and Forecast to 2027(US$ Million)

Figure 27. SAM Printing Market Revenue and Forecast to 2027(US$ Million)

Figure 28. SAM Others Market Revenue and Forecast to 2027(US$ Million)

Figure 29. SAM: Encoders Market Revenue Share, by Key Country (2019 and 2027)

Figure 30. Brazil: Encoders Market – Revenue and Forecast to 2027 (US$ Million)

Figure 31. Argentina: Encoders Market – Revenue and Forecast to 2027 (US$ Million)

Figure 32. Rest of SAM: Encoders Market – Revenue and Forecast to 2027 (US$ Million)

Figure 33. IMPACT OF COVID-19 PANDEMIC IN SAM COUNTRY MARKETS

- Dahua Technology Co., Ltd.

- Renishaw Plc

- LTN Servotechnik GmbH

- OMRON Corporation

- Delta Electronics

- Rockwell Automation, Inc.

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the SAM encoder market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the SAM encoder market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the encoder market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution.