South America Embedded Hypervisor Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Component (Software and Services), Technology (Desktop Virtualization, Server Virtualization, and Data Centre Virtualization), Enterprise Size (Small and Medium Enterprises and Large Enterprises), and Industry (BFSI, IT and Telecom, Aerospace and Defence, Automotive, Healthcare, Transportation, and Others)

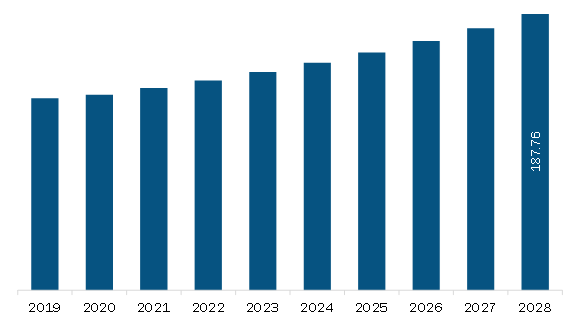

The SAM embedded hypervisor market is expected to grow from US$ 137.50 million in 2021 to US$ 187.76 million by 2028; it is estimated to grow at a CAGR of 4.6% from 2021 to 2028.

Steady progress in the development of autonomous vehicles is being witnessed, with a few renowned car manufacturers collaborating with technologically advanced companies. Autonomous vehicles have evolved on the platform built by Advanced Driver Assistance Systems (ADAS). Companies such as Ford, General Motors, Nissan, Tesla, Mercedes, and Honda, have been investing billions of dollars in the research & development of these cars. Also, technology giants, including Apple, IBM, and Intel, collaborated with the leading automotive manufacturers to remain competitive. It is anticipated that autonomous cars will be on roads and commercialized. The emergence of advanced-driver-assistance systems such as adaptive braking, self-parking, backup cameras, and automatic cruise control further increases the safety of passengers in vehicles. Shared mobility services are another trend in the automobile ecosystem. Highly advanced sensors are anticipated to be integrated into these vehicles for efficient communications to happen; therefore, these automotive electronic trends are expected to offer lucrative opportunities for the embedded hypervisor market players over the forecast period.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the SAM embedded hypervisor market. The SAM embedded hypervisor market is expected to grow at a good CAGR during the forecast period.

SAM Embedded Hypervisor Market Revenue and Forecast to 2028 (US$ Million)

Get more information on this report :

SAM Embedded Hypervisor Market Segmentation

The SAM embedded hypervisor market is segmented based on component, technology, enterprise size, industry, and country. Based on component, the SAM embedded hypervisor market is segmented into solution and services. The solution segment dominated the SAM embedded hypervisor market in 2020. Based on technology, the SAM embedded hypervisor market is segmented into desktop virtualization, server virtualization, and data center virtualization. The desktop virtualization segment dominated the SAM embedded hypervisor market in 2020. Based on enterprise size, SAM embedded hypervisor market is segmented into small and medium enterprises and large enterprises. The large enterprises segment dominated the SAM embedded hypervisor market in 2020. Based on industry, SAM embedded hypervisor market is segmented into BFSI, IT and telecom, aerospace and defense, automotive, healthcare, transportation, and others. The BFSI segment dominated the SAM embedded hypervisor market in 2020. Based on country, the SAM embedded hypervisor market is segmented into Brazil, Argentina, and the Rest of SAM. The Brazil segment dominated the SAM embedded hypervisor market in 2020.

Citrix System, Inc.; IBM Corporation; Microsoft Corporation; VMware, Inc.; Wind River System, Inc.; NXP Semiconductors; Thales Group; and Siemens AG are among the leading companies in the SAM embedded hypervisor market.

1. Introduction

1.1 Scope of the Study

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

1.3.1 SAM Embedded Hypervisor Market – By Component

1.3.2 SAM Embedded Hypervisor Market – By Technology

1.3.3 SAM Embedded Hypervisor Market – By Enterprise Size

1.3.4 SAM Embedded Hypervisor Market – By Industry

1.3.5 SAM Embedded Hypervisor Market – By Country

2. Key Takeaways

3. Research Methodology

3.1 Coverage

3.2 Secondary Research

3.3 Primary Research

4. SAM Embedded Hypervisor Market Landscape

4.1 Market Overview

4.2 PEST Analysis

4.2.1 SAM

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. SAM Embedded Hypervisor Market- Key Market Dynamics

5.1 Market Drivers

5.1.1 Escalation in Demand for Safety & Security Systems

5.1.2 Demand in Preference for Real-Time Operating System in Industrial Automation Sector

5.2 Market Restraints

5.2.1 Shortage of Skilled Professionals for Deploying AI & IoT Solution

5.3 Market Opportunities

5.3.1 Raise Popularity of Cloud Computing & Virtualization Technology create Growth Opportunities

5.4 Future Trends

5.4.1 Growing Adoption of Embedded Hypervisor in Vertical of Industrial Applications

5.5 Impact Analysis of Drivers and Restraints

6. Embedded Hypervisor Market – SAM Market Analysis

6.1 SAM Embedded Hypervisor Market Forecast and Analysis

7. SAM Embedded Hypervisor Market Analysis – By Component

7.1 Overview

7.1.1 SAM Embedded Hypervisor, by Component (2020 and 2028)

7.2 Solution

7.2.1 Overview

7.2.2 Solution: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

7.3 Services

7.3.1 Overview

7.3.2 Services: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

8. SAM Embedded Hypervisor Market – By Technology

8.1 Overview

8.2 SAM Embedded Hypervisor, by Technology (2020 and 2028)

8.3 Desktop virtualization

8.3.1 Overview

8.3.2 Desktop virtualization: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

8.3.3 SAM Desktop virtualization: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

8.4 Server virtualization

8.4.1 Overview

8.4.2 Server virtualization: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

8.5 Datacentre virtualization

8.5.1 Overview

8.5.2 Datacentre virtualization: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

9. SAM Embedded Hypervisor Market – By Enterprise Size

9.1 Overview

9.1.1 SAM Embedded Hypervisor, by Enterprise Size (2020 and 2028)

9.2 Small and Medium Enterprises

9.2.1 Overview

9.2.2 Small and Medium Enterprises: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

9.3 Large Enterprises

9.3.1 Overview

9.3.2 Large Enterprises: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10. SAM Embedded Hypervisor Market – By Industry

10.1 Overview

10.1.1 SAM Embedded Hypervisor, by Industry (2020 and 2028)

10.2 BFSI

10.2.1 Overview

10.2.2 BFSI: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10.3 IT And Telecom

10.3.1 Overview

10.3.2 IT And Telecom: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10.4 Aerospace And Defence

10.4.1 Overview

10.4.2 Aerospace And Defence: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10.5 Automotive

10.5.1 Overview

10.5.2 Automotive: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10.6 Healthcare

10.6.1 Overview

10.6.2 Healthcare: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10.7 Transportation

10.7.1 Overview

10.7.2 Transportation: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

10.8 Others

10.8.1 Overview

10.8.2 Others: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

11. SAM Embedded Hypervisor Market – Country Analysis

11.1 SAM: Embedded Hypervisor Market

11.1.1 SAM: Embedded Hypervisor Market, by Key Country

11.1.1.1 Brazil: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

11.1.1.1.1 Brazil: Embedded Hypervisor Market, By Component

11.1.1.1.2 Brazil: Embedded Hypervisor Market, By Technology

11.1.1.1.3 Brazil: Embedded Hypervisor Market, By Enterprise Size

11.1.1.1.4 Brazil: Embedded Hypervisor Market, By Application

11.1.1.2 Argentina: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

11.1.1.2.1 Argentina: Embedded Hypervisor Market, By Component

11.1.1.2.2 Argentina: Embedded Hypervisor Market, By Technology

11.1.1.2.3 Argentina: Embedded Hypervisor Market, By Enterprise Size

11.1.1.2.4 Argentina: Embedded Hypervisor Market, By Application

11.1.1.3 Rest of SAM: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

11.1.1.3.1 Rest of SAM: Embedded Hypervisor Market, By Component

11.1.1.3.2 Rest of SAM: Embedded Hypervisor Market, By Technology

11.1.1.3.3 Rest of SAM: Embedded Hypervisor Market, By Enterprise Size

11.1.1.3.4 Rest of SAM: Embedded Hypervisor Market, By Application

12. Industry Landscape

12.1 Overview

12.2 Market Initiative

12.3 Merger and Acquisition

12.4 New Development

13. Company Profiles

13.1 1.1 Citrix Systems, Inc.

13.1.1 Key Facts

13.1.2 Business Description

13.1.3 Products and Services

13.1.4 Financial Overview

13.1.5 SWOT Analysis

13.1.6 Key Developments

13.2 IBM Corporation

13.2.1 Key Facts

13.2.2 Business Description

13.2.3 Products and Services

13.2.4 Financial Overview

13.2.5 SWOT Analysis

13.2.6 Key Developments

13.3 Microsoft Corporation

13.3.1 Key Facts

13.3.2 Business Description

13.3.3 Products and Services

13.3.4 Financial Overview

13.3.5 SWOT Analysis

13.3.6 Key Developments

13.4 VMware, Inc.

13.4.1 Key Facts

13.4.2 Business Description

13.4.3 Products and Services

13.4.4 Financial Overview

13.4.5 SWOT Analysis

13.4.6 Key Developments

13.5 Wind River Systems, Inc.

13.5.1 Key Facts

13.5.2 Business Description

13.5.3 Products and Services

13.5.4 Financial Overview

13.5.5 SWOT Analysis

13.5.6 Key Developments

13.6 NXP Semiconductors

13.6.1 Key Facts

13.6.2 Business Description

13.6.3 Products and Services

13.6.4 Financial Overview

13.6.5 SWOT Analysis

13.6.6 Key Developments

13.7 Thales Group

13.7.1 Key Facts

13.7.2 Business Description

13.7.3 Products and Services

13.7.4 Financial Overview

13.7.5 SWOT Analysis

13.7.6 Key Developments

13.8 Siemens AG

13.8.1 Key Facts

13.8.2 Business Description

13.8.3 Products and Services

13.8.4 Financial Overview

13.8.5 SWOT Analysis

13.8.6 Key Developments

14. Appendix

14.1 About The Insight Partners

14.2 Glossary

LIST OF TABLES

Table 1. SAM Embedded Hypervisor Market, Revenue and Forecast, 2019–2028 (US$ Mn)

Table 2. SAM: Embedded Hypervisor Market, by Country – Revenue and Forecast to 2028 (US$ Million)

Table 3. Brazil: Embedded Hypervisor Market, By Component – Revenue and Forecast to 2028 (US$ Million)

Table 4. Brazil: Embedded Hypervisor Market, By Technology – Revenue and Forecast to 2028 (US$ Million)

Table 5. Brazil: Embedded Hypervisor Market, By Enterprise Size – Revenue and Forecast to 2028 (US$ Million)

Table 6. Brazil: Embedded Hypervisor Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 7. Argentina: Embedded Hypervisor Market, By Component – Revenue and Forecast to 2028 (US$ Million)

Table 8. Argentina: Embedded Hypervisor Market, By Technology – Revenue and Forecast to 2028 (US$ Million)

Table 9. Argentina: Embedded Hypervisor Market, By Enterprise Size – Revenue and Forecast to 2028 (US$ Million)

Table 10. Argentina: Embedded Hypervisor Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 11. Rest of SAM: Embedded Hypervisor Market, By Component – Revenue and Forecast to 2028 (US$ Million)

Table 12. Rest of SAM: Embedded Hypervisor Market, By Technology – Revenue and Forecast to 2028 (US$ Million)

Table 13. Rest of SAM: Embedded Hypervisor Market, By Enterprise Size – Revenue and Forecast to 2028 (US$ Million)

Table 14. Rest of SAM: Embedded Hypervisor Market, By Application – Revenue and Forecast to 2028 (US$ Million)

Table 15. Glossary of Terms, Embedded Hypervisor Market

LIST OF FIGURES

Figure 1. SAM Embedded Hypervisor Market Segmentation

Figure 2. SAM Embedded Hypervisor Market Segmentation – Country

Figure 3. SAM Embedded Hypervisor Market Overview

Figure 4. SAM Embedded Hypervisor Market, By Component

Figure 5. SAM Embedde

Figure 6. d Hypervisor Market, By Technology

Figure 7. SAM Embedded Hypervisor Market, By Enterprise Size

Figure 8. SAM Embedded Hypervisor Market, By Industry

Figure 9. SAM Embedded Hypervisor Market, By Region

Figure 10. SAM: PEST Analysis

Figure 11. SAM Embedded Hypervisor Market Ecosystem Analysis

Figure 12. Expert Opinion

Figure 13. SAM Embedded Hypervisor Market Impact Analysis of Drivers and Restraints

Figure 14. SAM Embedded Hypervisor Market, Forecast and Analysis (US$ Mn)

Figure 15. SAM Embedded Hypervisor Market Revenue Share, by Component Type (2020 and 2028)

Figure 16. SAM Solution: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. SAM Services: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 18. SAM Embedded Hypervisor Market Revenue Share, by Deployment (2020 and 2028)

Figure 19. SAM Server virtualization: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 20. SAM Datacenter virtualization: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 21. SAM Embedded Hypervisor Market Revenue Share, by Enterprise Size (2020 and 2028)

Figure 22. SAM Small and Medium Enterprises: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 23. SAM Large Enterprises: Embedded Hypervisor Market– Revenue and Forecast to 2028 (US$ Million)

Figure 24. SAM Embedded Hypervisor Market Revenue Share, by Industry (2020 and 2028)

Figure 25. SAM BFSI: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 26. SAM IT And Telecom: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 27. SAM Aerospace And Defense: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 28. SAM Automotive: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 29. SAM Healthcare: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 30. SAM Transportation: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 31. SAM Others: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 32. SAM Embedded Hypervisor Market, by Key Country – Revenue (2020) (US$ Million)

Figure 33. SAM: Embedded Hypervisor Market Revenue Share, by Key Country (2020 & 2028)

Figure 34. Brazil: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 35. Argentina: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

Figure 36. Rest of SAM: Embedded Hypervisor Market – Revenue and Forecast to 2028 (US$ Million)

- Citrix System, Inc.

- IBM Corporation

- Microsoft Corporation

- VMware, Inc.

- Wind River System, Inc.

- NXP Semiconductors

- Thales Group

- Siemens AG

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the SAM embedded hypervisor market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the SAM embedded hypervisor market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth SAM market trends and outlook coupled with the factors driving the SAM embedded hypervisor market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution