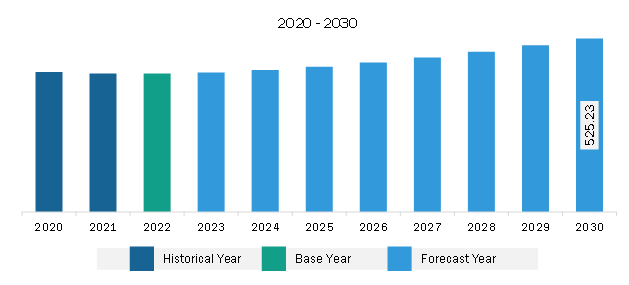

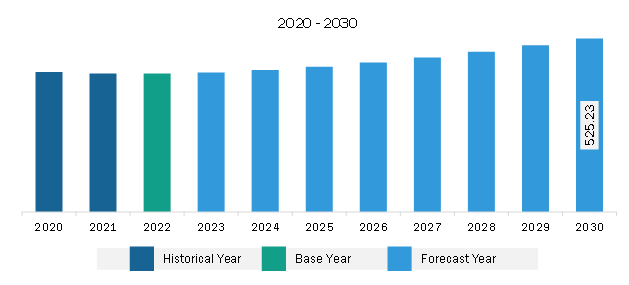

The South & Central America distributed control systems market was valued at US$ 418.69 million in 2022 and is expected to reach US$ 525.23 million by 2030; it is estimated to register at a CAGR of 2.9% from 2022 to 2030.

With the increasing industrialization and economic development, the demand for electricity is growing at an impressive pace. Electricity is one of the fastest-growing sources of energy worldwide, and during the forecast period, it is expected to dominate the overall energy demand worldwide. The power sector is one of the most promising sectors, especially in developing and underdeveloped regions. It is attracting more investments, majorly due to power infrastructure development, upgrade of aging infrastructure, change in energy requirements, clean energy initiatives, and urbanization. Moreover, per the International Energy Agency (IEA), renewable capacity will meet 35% of global power generation by 2025. It also predicts that renewable energy sources such as wind and solar power, together with nuclear, are likely to, on average, meet more than 90% of the rise in global demand by 2025. In addition, the growing demand for cooling and heating applications in both industrial and residential sectors is another factor fueling the electricity demand worldwide. All these factors are expected to drive the demand for electricity, which is further rising the need to install distributed control systems, as it help to centralize control, real-time monitoring of all the operations, and ensure efficient and safety, boosting the market growth.

The South America distributed control systems market showcases the ongoing trends in Brazil, Argentina, and the Rest of South America. Countries such as Venezuela and Brazil are oil-rich and have significant numbers of oil rigs, both on-shore and off-shore. Venezuela was South America's largest oil producer. Its oil reserves (18% of the world's total) outstrip those of Saudi Arabia. In addition, governments are focusing on attracting foreign direct investments (FDI) in order to enhance industries and adopt newer and more robust technologies. For instance, according to UNCTAD's World Investment Report 2023, foreign direct investment (FDI) flows to Latin America and the Caribbean rose by 51% to US$ 208 billion in 2022, sustained by higher demand for commodities and critical minerals. These factors are crucial parameters influencing the distributed control systems market.

According to the latest worldwide industry forecast report published by the European Solar Energy Industry Association, the installed capacity of solar power generation in Latin America grew by 9.6 million KW, or 44%, in 2021. Policy will propel future improvements in the Latin America solar power market. The installed solar power generation capacity in the region is expected to rise by 30.8 million KW annually by 2026.

Brazil is the most developed country with a balanced economic condition among the countries in South America. The demand for power generation is one of the most demanding factors, and the government continuously emphasizes the heavy need to meet the ever-rising requirement. Hence, in order to fulfil this electricity requirements the government is adopting DCS, which facilitates the power generating and distribution authority to supply sufficient quantity, along with continued monitoring and control of electricity flow. This is catalyzing the demand for distribution control systems in the country.

The South & Central America distributed control systems market is segmented based on component, industry, and country.

Based on component, the South & Central America distributed control systems market is segmented into hardware, software, and services. The hardware segment held the largest share in 2022.

In terms of industry, the South & Central America distributed control systems market is segmented into power generation, oil and gas, pharmaceutical, food and beverages, chemicals, and others. The oil and gas segment held the largest share in 2022.

Based on country, the South & Central America distributed control systems market is categorized into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America distributed control systems market in 2022.

Honeywell International Inc, General Electric Co, ABB Ltd, Yokogawa Electric Corp, Toshiba Corp, Siemens AG, Emerson Electric Co, NovaTech LLC, Schneider Electric SE, and Rockwell Automation Inc are some of the leading companies operating in the South & Central America distributed control systems market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 418.69 Million |

| Market Size by 2030 | US$ 525.23 Million |

| CAGR (2022 - 2030) | 2.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Distributed Control Systems Market is valued at US$ 418.69 Million in 2022, it is projected to reach US$ 525.23 Million by 2030.

As per our report South & Central America Distributed Control Systems Market, the market size is valued at US$ 418.69 Million in 2022, projecting it to reach US$ 525.23 Million by 2030. This translates to a CAGR of approximately 2.9% during the forecast period.

The South & Central America Distributed Control Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Distributed Control Systems Market report:

The South & Central America Distributed Control Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Distributed Control Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Distributed Control Systems Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)