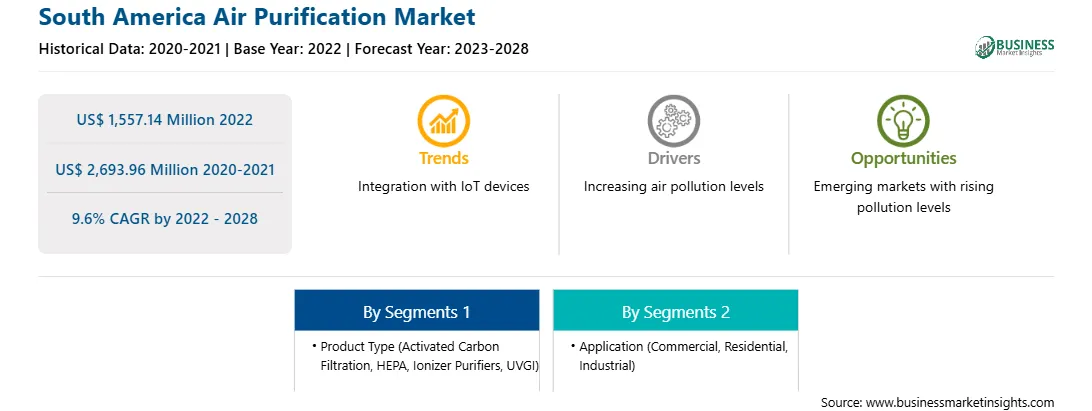

The air purification market in South America is expected to grow from US$ 1,557.14 million in 2022 to US$ 2,693.96 million by 2028. It is estimated to grow at a CAGR of 9.6% from 2022 to 2028.

Rising Urbanization and Industrialization Propelling Market Growth

The increase in urbanization would necessarily augment the need for air filter products in residential and commercial applications at a large scale, which would help drive the market. Countries in developing economies are most predominantly experiencing the rise in urbanization at a faster pace. The rise in population is also aiding the people in urbanizing, helping the market grow. The growing income and spending capacity of people in developing economies and increasing demand in various end-use sectors, such as automotive, healthcare & medical, building & construction, manufacturing, and energy & utilities, are the major factors driving the growth of the air purification market. The rise in urbanization includes the expansion of schools, colleges, hospitals, commercial complexes, residential houses, and other factors, wherein the need for clean air emerges, which helps drive the market. The increase in urbanization led to enormous indoor and outdoor air pollution, further accelerating the demand for air purifiers. Growth prospects in industrial activities are primarily attributed to the improving economic conditions of developing countries, formulation of new business practices, and supportive government policies, which encourage new investment in businesses and technologies. The rise in industrial operations would increase emissions in the environment and the working environment. Thus, strict regulations pertaining to industrial emissions and concern about occupational health and safety of the workers have led the industrial and commercial sectors to prioritize the need for air purification products at the operating and manufacturing facilities. Industrial output increased in all sectors: Manufacturing from 12.5% in June 2021 to 20.6% in 2022 and mining from 7.5% to 10.9%. Thus, such growth prospects in the industrial sector are fueling the need for air purification for the health and safety of workers. Urbanization and industrialization lead to the increased usage of fossil fuels for running various types of automobiles and industries in developing countries. Rapid automobile usage in major cities causes air pollution and directly impacts public health, creating an alarming situation for using air purifiers in industries on a large scale. Accelerated urbanization, growth in infrastructural activities, and increasing industrialization have increased the rate of air pollution in the environment, which has increased the need for air purification systems South America .

Market Overview

Brazil and Argentina are among the key countries in South America. This region is one of the rapidly developing markets for air purification. The latest developments in the South America air purification market include mechanical filtration systems. These use internal fans to draw particle-laden air into the machine and force it through an intricate web of fibers in a pleated filter. HEPA filter technology can filter out 99.97% of particles as small as 0.3 microns. Molecule claims its air purification can capture and destroy all common indoor air contaminants, from gas-based paint fumes to bacterial spores. The SAM market for air purification has witnessed significant growth in recent years due to rapid urbanization, increased construction activity in various countries and deteriorating air quality index in various cities. Additionally, increasing indoor air pollution and vehicle emissions are the major causes of air pollution that have created opportunities for air purification in the South America market .

Strategic insights for the South America Air Purification provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South America Air Purification refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South America Air Purification Market Revenue and Forecast to 2028 (US$ Million)

South America Air Purification Strategic Insights

South America Air Purification Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,557.14 Million

Market Size by 2028

US$ 2,693.96 Million

CAGR (2022 - 2028) 9.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Application

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South America Air Purification Regional Insights

South America Air Purification Market Segmentation

The South America air purification market is segmented into product, application, and country. Based on product, the market is segmented into activated carbon filtration, HEPA, ionizer purifiers, UVGI, and others. The HEPA segment held the largest market share in 2022.

Based on application, the market is segmented into commercial, residential, and industrial. The commercial segment held the largest market share in 2022.

Based on country, the market is segmented into Brazil, Argentina, and Rest of South America. The Brazil dominated the market share in 2022.

Whirlpool Corporation; Camfil; DAIKIN INDUSTRIES, Ltd.; Honeywell International Inc.; Koninklijke Philips N. V; LG Electronics; Panasonic Corporation; Unilever PLC; and IQAir are the leading companies operating in the air purification market in the region.

The South America Air Purification Market is valued at US$ 1,557.14 Million in 2022, it is projected to reach US$ 2,693.96 Million by 2028.

As per our report South America Air Purification Market, the market size is valued at US$ 1,557.14 Million in 2022, projecting it to reach US$ 2,693.96 Million by 2028. This translates to a CAGR of approximately 9.6% during the forecast period.

The South America Air Purification Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South America Air Purification Market report:

The South America Air Purification Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South America Air Purification Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South America Air Purification Market value chain can benefit from the information contained in a comprehensive market report.