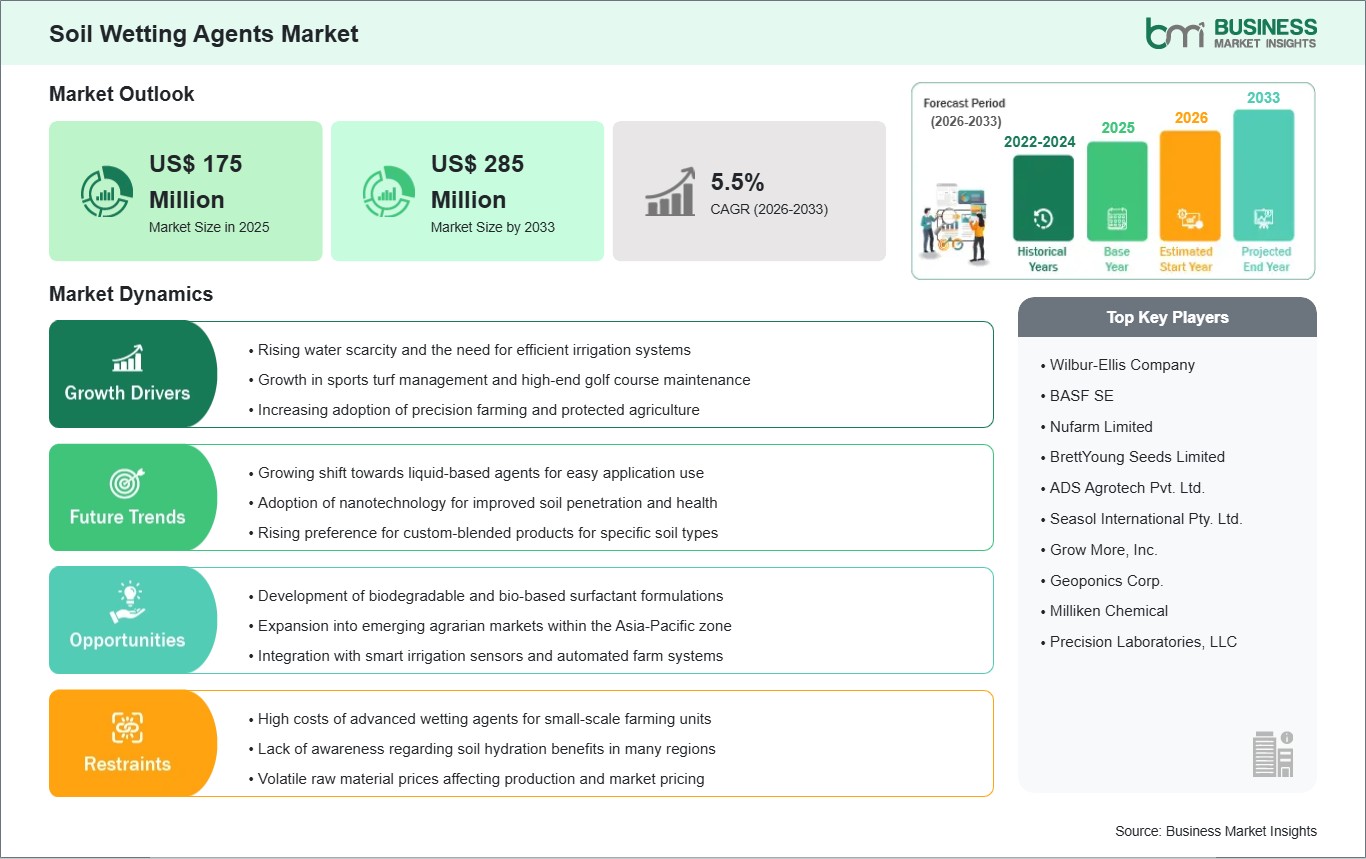

The Soil Wetting Agents market size is expected to reach US$ 285 Million by 2033 from US$ 175 Million in 2025. The market is estimated to record a CAGR of 5.5% from 2026 to 2033.

Soil wetting agents, or soil surfactants, are sophisticated chemical formulations engineered to reduce the surface tension of water, thereby facilitating its uniform infiltration and distribution throughout the soil profile. These agents are indispensable for managing soil hydrophobicity—a condition where organic coatings on soil particles repel water—ensuring that vital moisture and nutrients reach the root zone rather than being lost to surface runoff or deep leaching. They serve as a cornerstone for high-performance turf management in professional sports and intensive agricultural production, where optimizing irrigation efficiency is paramount for operational success. The market currently benefits from the global shift toward "water-wise" land management and the increasing integration of surfactants into precision fertigation systems to maximize crop yields.

However, the industry faces significant challenges, including the volatility of raw material prices for petroleum-derived surfactants and the tightening of environmental regulations concerning the use of non-biodegradable chemical inputs. Technical hurdles, such as ensuring compatibility with diverse agrochemical tanks and avoiding phytotoxicity during extreme heat, also act as potential growth deterrents.

Despite these restraints, the market is rife with lucrative opportunities. The rapid development of bio-based, eco-friendly wetting agents derived from renewable feedstocks is opening new avenues among environmentally conscious growers and organic farming segments. Furthermore, the expansion of smart city landscapes and the rising global investment in high-quality recreational infrastructure provide a resilient foundation for long-term growth, as stakeholders increasingly prioritize technologies that ensure plant health while drastically reducing total water consumption.

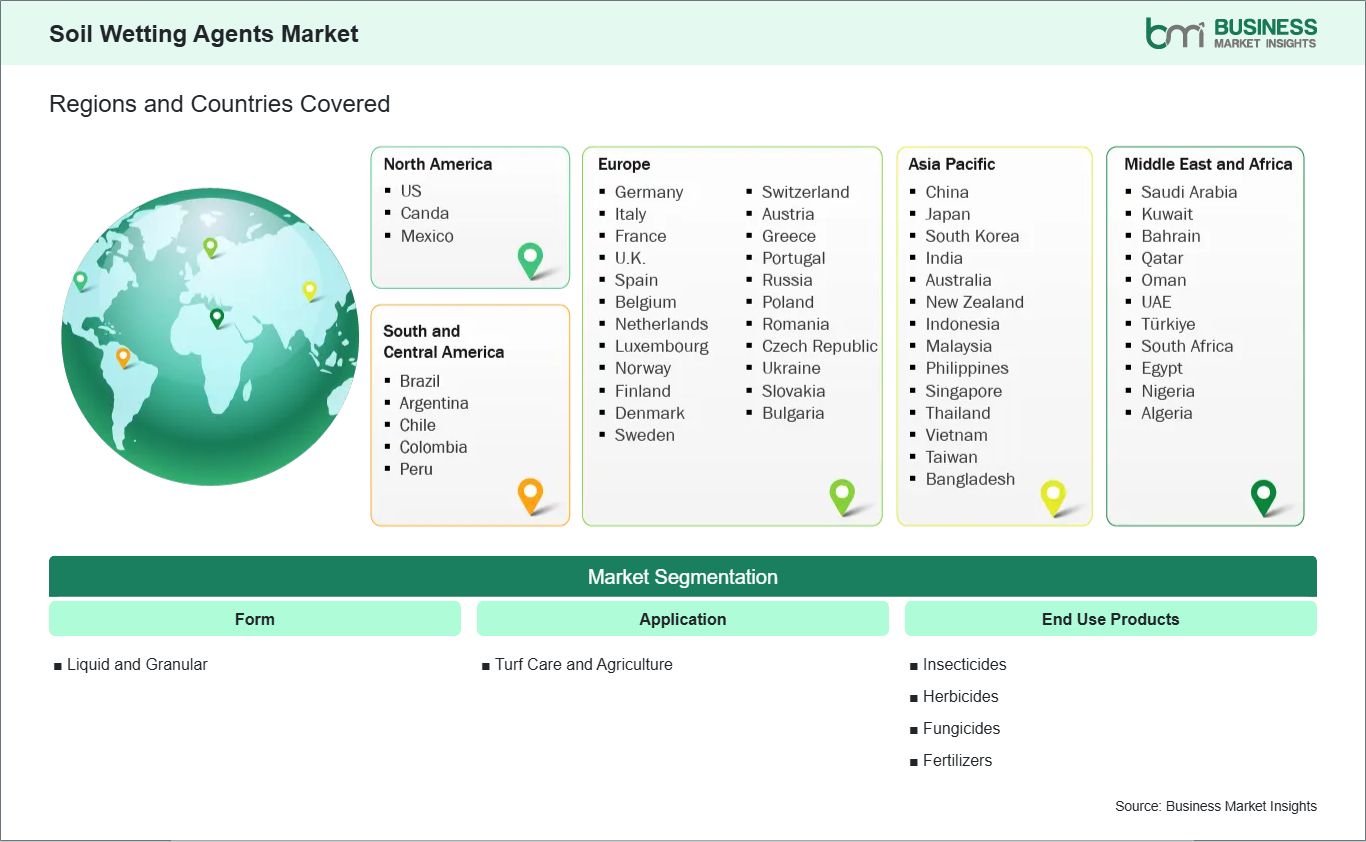

Key segments that contributed to the derivation of the Soil Wetting Agents market analysis are form, application, and end use products.

The primary driver propelling the soil wetting agents market is the escalating global water crisis and the consequent necessity for the agricultural and landscaping sectors to adopt more rigorous resource management protocols. As climate patterns become increasingly erratic, characterized by prolonged periods of intense heat and unpredictable rainfall, the natural ability of soil to absorb moisture is often compromised. In many regions, the development of hydrophobic soil layers—where the ground effectively repels water—leads to significant wastage through surface runoff and evaporation. Soil wetting agents directly address this fundamental physical barrier by lowering the surface tension of water, allowing it to break through the resistant topsoil and penetrate deep into the root zone.

The move toward high-efficiency irrigation systems, such as drip and micro-sprinkler technology, further amplifies the need for these surfactants. Without a wetting agent, water delivered through precision systems may channel through specific narrow paths in the soil, leaving large areas of the root zone entirely dry and leading to localized plant stress. By ensuring a uniform lateral and vertical spread of moisture, these agents enable growers to maximize the productivity of every drop of water applied. This transition is being accelerated by global food security initiatives that emphasize "more crop per drop," where the optimization of soil-water dynamics is viewed as a critical component of modern agronomy. Consequently, the demand for these agents is expanding from niche turf applications into large-scale commercial farming for staple crops and high-value horticulture.

A significant opportunity within the soil wetting agents market lies in the rapid development and commercialization of bio-based, biodegradable surfactants that align with the principles of regenerative agriculture and "green chemistry." Historically, many industrial soil conditioners were formulated using synthetic compounds that, while effective, raised concerns regarding their long-term persistence in the environment and potential impact on soil microbial health. There is now a growing and lucrative opportunity for manufacturers to pioneer biosurfactants derived from microbial fermentation or plant-based lipids, such as those sourced from vegetable oils and sugars. These next-generation products offer the dual benefit of high performance and ecological compatibility, appealing to a massive and expanding segment of organic producers and environmentally conscious urban planners.

The integration of these "green" wetting agents into regenerative farming practices—which focus on restoring soil organic matter and enhancing biodiversity—creates a specialized market niche. Bio-based agents are increasingly viewed not just as water-management tools, but as soil-health enhancers that can be utilized as carbon sources by beneficial soil microbes. Furthermore, as regulatory bodies in major agricultural hubs introduce stricter guidelines on chemical residues and non-toxic agricultural inputs, companies that have invested in certified, eco-friendly formulations are positioned to gain a significant competitive advantage. This shift toward sustainability is expected to foster deep partnerships between surfactant manufacturers and precision-agtech firms, leading to the creation of holistic soil-management solutions that reduce the overall chemical footprint of modern food systems while ensuring resilient yields in a changing environment.

The Soil Wetting Agents market demonstrates steady growth, with size and share analysis revealing evolving trends and competitive positioning among key players. The report further examines subsegments categorized within form, application, and end-use products, offering insights into their contribution to overall market performance.

Within the Form segment, the Liquid sub-segment commands a significant share due to its ease of integration into existing fertigation and spray systems, allowing for rapid and uniform soil treatment.

In terms of Application, the Turf Care sub-segment remains a dominant contributor as the high aesthetic and performance standards of golf courses and sports stadiums necessitate consistent moisture management.

By End-Use Products, the Fertilizers sub-segment is particularly prominent, as manufacturers increasingly blend wetting agents with liquid nutrients to ensure that the fertilizers are absorbed efficiently into the root zone rather than remaining trapped in hydrophobic topsoil layers.

| Report Attribute | Details |

|---|---|

| Market size in 2025 | US$ 175 Million |

| Market Size by 2033 | US$ 285 Million |

| Global CAGR (2026 - 2033) | 5.5% |

| Historical Data | 2022-2024 |

| Forecast period | 2026-2033 |

| Segments Covered | By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The "Soil Wetting Agents Market Size and Forecast (2022 - 2033)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Soil Wetting Agents market report is divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

In North America, the market is characterized by a mature landscape where high-performance surfactants are integrated into data-centric precision farming and the maintenance of extensive professional turf networks. European markets are increasingly defined by a stringent regulatory framework that prioritizes the adoption of biodegradable and eco-friendly formulations to align with regional environmental sustainability mandates. The Asia-Pacific region serves as a primary engine for volume growth, driven by the aggressive modernization of agricultural infrastructure in emerging economies and the critical need to stabilize crop yields amid fluctuating groundwater levels.

In the Middle East & Africa, market activity centers on the implementation of advanced moisture-retention technologies essential for large-scale desert greening initiatives and the management of high-value urban landscapes in arid climates. Meanwhile, South & Central America are witnessing a steady rise in adoption as major agricultural exporters utilize soil wetting agents to enhance the efficiency of irrigation systems in the production of export-oriented specialty crops. This collective regional progress ensures a robust global market as industries worldwide pivot toward more resilient and resource-efficient land management strategies.

The Soil Wetting Agents market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Soil Wetting Agents market are:

The Soil Wetting Agents Market is valued at US$ 175 Million in 2025, it is projected to reach US$ 285 Million by 2033.

As per our report Soil Wetting Agents Market, the market size is valued at US$ 175 Million in 2025, projecting it to reach US$ 285 Million by 2033. This translates to a CAGR of approximately 5.5% during the forecast period.

The Soil Wetting Agents Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Soil Wetting Agents Market report:

The Soil Wetting Agents Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Soil Wetting Agents Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Soil Wetting Agents Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)