Key factors contributing to the market growth are rise in demand for tilt sensors based on MEMS technology and upsurge in demand for construction equipment. However, high cost of tilt sensors based on force balance technology may hamper the market growth.

Tilt sensors have been widely used in many applications, such as instrumentation leveling, oil drilling and structural health monitoring. With the rapid development of the micro-electromechanical system (MEMS) technology. MEMS accelerometer-based high-performance tilt sensors are capable of replacing conventional tilt sensors in most application domains, owing to the rapid development of micro-electromechanical system (MEMS) technology. MEMS resonant accelerometers (MRAs) with high sensitivity are completely qualified for tilt sensing. MRA chips, on the other hand, must be vacuum packaged and require complicated circuits, making them difficult to miniaturize and sell. For low-cost, high-sensitivity, low power consumption, and downsizing, the suggested MEMS sensor uses simplified fabrication procedures, an area-change-based capacitive displacement transducer, and a capacitance-to-voltage conversion application-specific integrated circuit (ASIC). Many industrial and commercial applications, such as mobile phone motion sensors and car airbags, have demonstrated this operating concept. Low-grade accelerometer cells with accuracies of less than 1 degree are commonly required for these consumer applications. Unlike low-cost consumer-grade inclinometer cells, MEMS sensors in inclinometers have an array of fine electrodes that improve the measurement's resolution and accuracy. The moving mass in the MEMS in inclinometers designed for static or near-static measurements is physically damped to limit the sensitivity of these sensors to frequencies exceeding 29 Hz.

MEMS tilt sensors are low-cost, robust, virtually immune to shock, and exhibit very good long-term stability. Biaxial tilt sensors contain two MES sensors oriented at 90 degrees to one another to allow perpendicular tilt measurement. They are readily adaptable for automated data acquisition, which allows a series of sensors to be continuously monitored for profiling purposes.

According to the American Institute of Architects (AIA), the construction sector in the US has been hit hard by the COVID-19 outbreak. The construction activity declined in 2020 and continued the same way through 2021. Construction activities are reduced by approximately 20% in the hospitality industry, 8% in the retail sector, and close to 11% in commercial offices. However, the construction of healthcare facilities and public safety surged in 2020. Industries that install higher volumes of sensor systems have been hit at various levels of degree by the COVID-19 pandemic. Construction, electronics, and automotive have been struggling due to concerns over contracting the virus, even after they could reopen. Similarly, the Canadian and Mexican tilt sensor market also witnessed the same and are experiencing similar tremors due to the COVID-19 outbreak. The commercial sector in the two countries has been witnessing significant shocks.

| Report Attribute | Details |

|---|---|

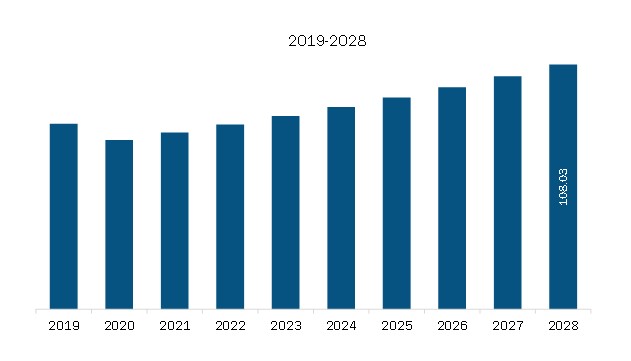

| Market size in 2021 | US$ 75.69 Million |

| Market Size by 2028 | US$ 108.03 Million |

| CAGR (2021 - 2028) | 5.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Material

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Tilt Sensor Market is valued at US$ 75.69 Million in 2021, it is projected to reach US$ 108.03 Million by 2028.

As per our report North America Tilt Sensor Market, the market size is valued at US$ 75.69 Million in 2021, projecting it to reach US$ 108.03 Million by 2028. This translates to a CAGR of approximately 5.2% during the forecast period.

The North America Tilt Sensor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Tilt Sensor Market report:

The North America Tilt Sensor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Tilt Sensor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Tilt Sensor Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)