North America Synthetic Aperture Radar Market

No. of Pages: 105 | Report Code: BMIRE00030595 | Category: Electronics and Semiconductor

No. of Pages: 105 | Report Code: BMIRE00030595 | Category: Electronics and Semiconductor

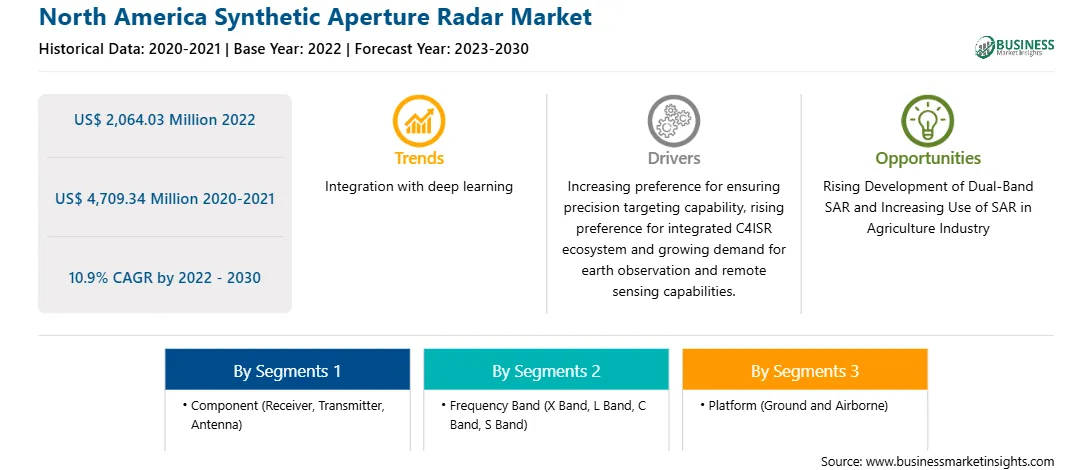

The North America synthetic aperture radar market was valued at US$ 2,064.03 million in 2022 and is expected to reach US$ 4,709.34 million by 2030; it is estimated to register a CAGR of 10.9% from 2022 to 2030. Increasing Preference for Ensuring Precision Targeting Capability Fuels North America Synthetic Aperture Radar Market

The increasing preference for ensuring precision targeting capability is driven by the integration of newer-generation aircraft with advanced electronically scanned array (AESA) radars, which enable the transmission and reception of information on multiple bandwidths. One of the major features of SAR is its ability to provide target information through inverse SAR (ISAR) images. ISAR technology uses radar imaging to generate high-resolution two-dimensional images of a target by tracking its movement. This capability is particularly valuable for precision targeting, as it allows for the detection and tracking of targets using SAR/ISAR radar images.

Precision targeting is of utmost importance in modern warfare and surveillance operations. The ability to accurately identify and track targets is crucial for military and defense organizations. SAR plays a crucial role in fulfilling this need by providing high-resolution imaging capabilities for precise target detection. The rising developments in precision targeting capability are expected to drive the demand for SAR and positively impact market growth. The integration of active electronically scanned array (AESA) radars, along with the use of X-band and Ku-band radars, enables finer target detection and enhances the overall effectiveness of precision targeting. Furthermore, ISAR radars play a significant role in maritime patrol aircraft, allowing for the detection, imaging, and classification of surface ships and other objects in all weather conditions. This capability is crucial for target recognition purposes and contributes to the demand for SAR systems.North America Synthetic Aperture Radar Market Overview

The North America synthetic aperture radar (SAR) market is segmented into the US, Canada, and Mexico. The increasing border security, surveillance, environmental monitoring, and government spending are anticipated to create demand for synthetic aperture radar during the forecast period. The climate crisis is driving temperatures higher and being the reason for the melting of the world's biggest ice sheet-the East Antarctic, could drive up sea level by many meters. Thus, organizations across North America are collaborating to create synthetic aperture radar to monitor changes in Earth's frozen regions, including ice sheets, glaciers, and sea ice. For instance, in January 2024, the US National Aeronautics and Space Administration (NASA) and the Indian Space Research Organization (ISRO) collaborated to develop the NASA-ISRO Synthetic Aperture Radar (NISAR). NISAR will employ advanced radar technology to monitor changes across Earth's land and ice surfaces, primarily focusing on the dynamics of ice shelves in polar regions. This initiative comes at a crucial time, as satellite imagery from East Antarctica has shown significant glacial collapse, highlighting the urgent need for detailed monitoring.

The growing government investment and increasing military & defense spending empower the growth of synthetic aperture radar. Moreover, commercial and government investments are preceding rapid growth in Earth-observation satellites and remote-sensing data. For instance, as of March 2022, the US military researchers announced the Fiddler program (DARPA-SN-22-23), intended to improve automatic object recognition in synthetic aperture radar images. The unique imaging capability of SAR makes it particularly useful for time-critical applications such as change detection after natural disasters and identifying illegal fishing operations. Further, several key players are taking strategic initiatives such as mergers and acquisitions for commercial remote sensing systems. For instance, in November 2023, NASA acquired ICEYE's synthetic-aperture radar data for evaluation by scientific and academic communities to determine the rightness for advancing NASA's Earth Science research objectives. Thus, such acquisitions and developments propel the growth of the synthetic aperture radar market share in North America.

North America Synthetic Aperture Radar Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the North America Synthetic Aperture Radar provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Synthetic Aperture Radar refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Synthetic Aperture Radar Strategic Insights

North America Synthetic Aperture Radar Report Scope

Report Attribute

Details

Market size in 2022

US$ 2,064.03 Million

Market Size by 2030

US$ 4,709.34 Million

CAGR (2022 - 2030) 10.9%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Frequency Band

By Platform

By Mode

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Synthetic Aperture Radar Regional Insights

North America Synthetic Aperture Radar Market Segmentation

The North America synthetic aperture radar market is categorized into component, frequency band, application, platform, mode, and country.

Based on component, the North America synthetic aperture radar market is categorized into receiver, transmitter, and antenna. The antenna segment held the largest market share in 2022.

In terms of frequency band, the North America synthetic aperture radar market is categorized into x band, l band, c band, s band, and others. The x band segment held the largest market share in 2022.

By application, the North America synthetic aperture radar market is segmented into commercial and defense. The defense segment held a larger market share in 2022.

Based on platform, the North America synthetic aperture radar market is bifurcated into ground and airborne. The airborne segment held a larger market share in 2022.

In terms of mode, the North America synthetic aperture radar market is bifurcated into single and multi. The multi segment held a larger market share in 2022.

By country, the North America synthetic aperture radar market is segmented into the US, Canada, and Mexico. The US dominated the North America synthetic aperture radar market share in 2022.

Northrop Grumman Corp, BAE Systems Plc, Leonardo SpA, Lockheed Martin Corp, Raytheon Technologies Corp, Thales SA, General Atomics Aeronautical Systems Inc, and Saab AB are some of the leading companies operating in the North America synthetic aperture radar market.

1. Northrop Grumman Corp

2. BAE Systems Plc

3. Leonardo SpA

4. Lockheed Martin Corp

5. Raytheon Technologies Corp

6. Thales SA

7. General Atomics Aeronautical Systems Inc

8. Saab AB

The North America Synthetic Aperture Radar Market is valued at US$ 2,064.03 Million in 2022, it is projected to reach US$ 4,709.34 Million by 2030.

As per our report North America Synthetic Aperture Radar Market, the market size is valued at US$ 2,064.03 Million in 2022, projecting it to reach US$ 4,709.34 Million by 2030. This translates to a CAGR of approximately 10.9% during the forecast period.

The North America Synthetic Aperture Radar Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Synthetic Aperture Radar Market report:

The North America Synthetic Aperture Radar Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Synthetic Aperture Radar Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Synthetic Aperture Radar Market value chain can benefit from the information contained in a comprehensive market report.