By continuously generating/absorbing adjustable reactive power, enhanced short-circuit strength, and frequency stability by providing synchronous inertia, this system provides improved voltage regulation and stability. The goal is not to transform electricity into mechanical power or vice versa, but to use the reactive power control capabilities of the machines and synchronous inertia. Since the Industrial Revolution, the energy production has been dominated by fossil fuels. This has important consequences for the environment as well as for human health. Thus, the use of renewable energy has increased to minimize carbon dioxide emissions, leading to a high demand for the same energy. This is thus, fueling the growth of the North America market. North America is the largest market of synchronous condensers. Currently, synchronous condenser adoption has increased in the US and Canada through industries such as electrical utilities and grid operators, metals and mining, marine and oil and gas. Furthermore, growing investment in the adoption of renewable energy by government bodies and private companies in the process is fueling the growth of the region's industry. In 2019, for example, US investments in renewable energy accounted for US$ 301.7 billion. Growing investment is therefore enabling companies to deliver advanced solutions around the local and regional sectors of power generation. Factors like changing the existing synchronous generators into synchronous condensers is expected to drive the North America synchronous condenser market.

Moreover, in case of COVID-19, North America is highly affected specially the US. North America has the highest adoption and growth levels of new technologies, with favorable government policies to boost innovation and improve infrastructure capabilities. Therefore, any effect on industries is expected to have a negative influence on the economic growth of the region. It is becoming apparent with the COVID-19 pandemic spreading across the US that few can escape its scope, presenting significant challenges to all industries. This had temporarily closed down all production plants across all industries and has also affected the supply chain and logistics industry of the country adversely. Though the demand for power was very high across the region especially arising from the healthcare sector to support all systems has influenced the rise in demand for renewable energy across the region. However, owing to nationwide lockdown across major economies like the US and Canada, the supply chain of major components of synchronous condenser was adversely affected, thereby impacted the manufacturing of the same. Thus, the above mentioned factors indicate that the outbreak of the pandemic has an adverse impact on the market across the region.

Strategic insights for the North America Synchronous Condenser provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

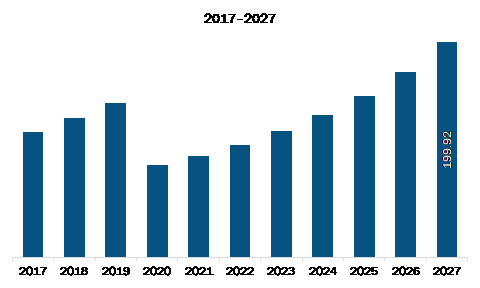

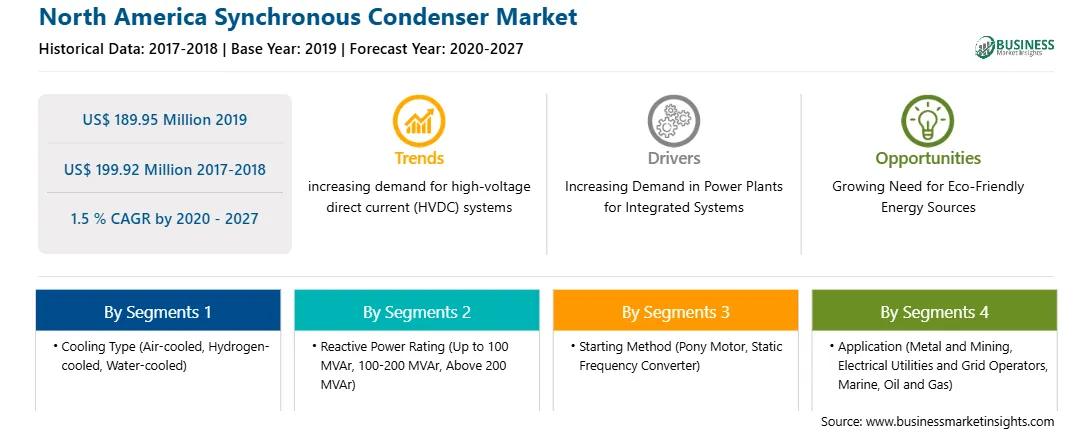

| Market size in 2019 | US$ 189.95 Million |

| Market Size by 2027 | US$ 199.92 Million |

| CAGR (2020 - 2027) | 1.5 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Cooling Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Synchronous Condenser refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America synchronous condenser market is expected to grow from US$ 189.95 million in 2019 to US$ 199.92 million by 2027; it is estimated to grow at a CAGR of 1.5 % from 2020 to 2027. Changing the existing synchronous generators into synchronous condensers is expected to upsurge the North America synchronous condenser market. The demand for traditional power generating sources is declining with aging power generation plants, decommissioning, environmental regulations, increasing competition from gas-fired turbines, and renewable energy sources. Several aged coal-fired power plants across North America are being shut down owing to these factors. Withdrawing a power generation unit decreases a plant's capacity for reactive power. There is a growing trend of turning aging power plants into synchronous condensers to stabilize the grid systems. These synchronous condensers provide the reactive power needed for areas previously reliant on large thermal power plants. A more affordable and efficient approach is to turn the current synchronous generators into synchronous condensers. Thus, the above-mentioned factors are expected to offer new opportunities for the North America synchronous condenser market.

In terms of cooling type, the hydrogen-cooled segment accounted for the largest share of the North America synchronous condenser market in 2019. In terms of reactive power rating, the above 200 MVAr segment held a larger market share of the North America synchronous condenser market in 2019. Similarly, in terms of starting method, the static frequency converter segment held a larger market share of the North America synchronous condenser market in 2019. Further, the electrical utilities and grid operators segment held a larger share of the North America synchronous condenser market based on application in 2019.

A few major primary and secondary sources referred to for preparing this report on the North America synchronous condenser market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are ABB Ltd.; Brush Group; Eaton Corporation plc; FUJI ELECTRIC CO., LTD.; General Electric Company; IDEAL ELECTRIC POWER CO.; Mitsubishi Electric Power Products, Inc. (Mitsubishi Electric Corporation); Siemens AG (Siemens Energy); Voith GmbH & Co. KGaA; WEG ELECTRIC CORP.

The North America Synchronous Condenser Market is valued at US$ 189.95 Million in 2019, it is projected to reach US$ 199.92 Million by 2027.

As per our report North America Synchronous Condenser Market, the market size is valued at US$ 189.95 Million in 2019, projecting it to reach US$ 199.92 Million by 2027. This translates to a CAGR of approximately 1.5 % during the forecast period.

The North America Synchronous Condenser Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Synchronous Condenser Market report:

The North America Synchronous Condenser Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Synchronous Condenser Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Synchronous Condenser Market value chain can benefit from the information contained in a comprehensive market report.