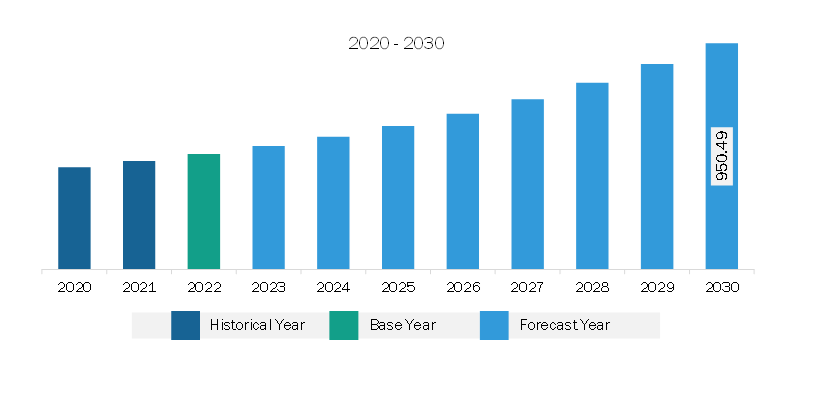

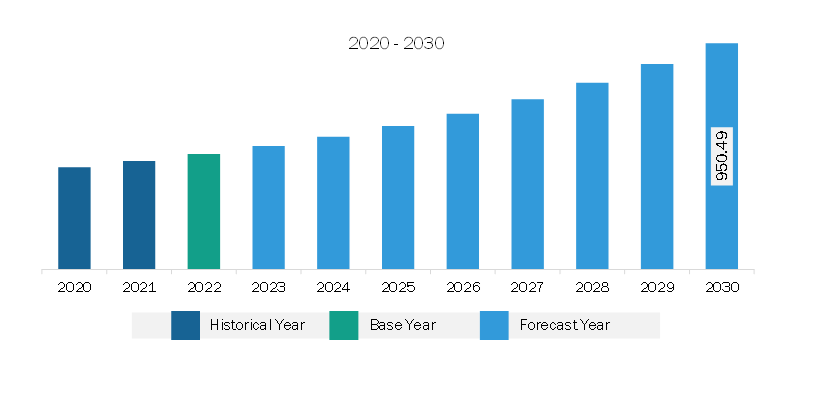

The North America submarine cable systems market was valued at US$ 2,688.80 million in 2022 and is expected to reach US$ 6,222.78 million by 2030; it is estimated to register a CAGR of 11.1% from 2022 to 2030.

Rise in Data Traffic Fuels North America Submarine Cable Systems Market

With the rise of digitalization, cloud computing, and the Internet of Things (IoT), there is a growing need for high-speed and reliable connectivity across various countries and oceans. To cater to such needs, submarine cable systems act as the foundation of global internet connectivity, offering unparalleled speed and bandwidth capabilities. These undersea cables provide a massive capacity for data transmission, supporting businesses with increased bandwidth requirements and ensuring efficient and high-performance internet connectivity.

According to Ericsson, by the end of 2023, the total global mobile data traffic, excluding Fixed Wireless Access (FWA), is projected to reach 130 exabytes (EB) per month. This figure is expected to grow nearly threefold and reach 403 EB per month by 2029. When including FWA, the total mobile network traffic is estimated to reach approximately 160 EB per month by the end of 2023, and it is predicted to rise further to 563 EB per month by the end of 2029. These projections consider the assumption that the adoption of XR-type services, including AR, VR, and mixed reality (MR), will begin in the latter part of the forecast period. In addition, video traffic is estimated to represent 73% of all mobile data traffic by the end of 2023. Hence, in a progressively interconnected world, the demand for undersea communication cables is growing substantially. Advancements in cable technology, including the deployment of higher-capacity cables and the implementation of advanced transmission techniques, play a key role in enhancing global connectivity. By leveraging these innovations, businesses focus on improving communication capabilities and enhancing access to global networks to manage growing data traffic. Thus, the rise in data traffic drives the submarine cable systems market.

North America Submarine Cable Systems Market Overview

The North America submarine cable systems market is segmented into the US, Canada, and Mexico. The submarine cable systems market in North America is witnessing prominent growth due to the rising number of offshore wind projects in North America, particularly in the US. Offshore wind farms require submarine power cables to transmit electricity from wind turbines to the mainland. The need to enhance oil output and surge in demand for clean energy are driving the installation of these offshore wind projects. According to the US Department of Energy's Wind Vision Report, there are quantified benefits associated with the installation of offshore wind capacity in the US. The report states that by 2030, the country is expected to record up to 22 gigawatts of installed offshore wind with significant advantages, and this figure is likely to reach 86 gigawatts by 2050.

In the US, the Biden administration has also expressed its commitment to support the development of offshore wind energy. In 2021, the administration announced its plan to achieve 30 GW of offshore wind energy capacity by 2030. This ambitious target aligns with the goal of creating a sustainable future, supporting local communities, creating jobs, and minimizing environmental impacts. Additionally, the expansion of offshore telecommunication infrastructure supports the submarine cable systems market growth. Submarine communication cables are essential for establishing reliable and high-capacity communication networks between countries. The increasing demand for seamless international communication and data transfer drives the deployment of submarine communication cables.

North America Submarine Cable Systems Market Revenue and Forecast to 2030 (US$ Million)

North America Submarine Cable Systems Market Segmentation

The North America submarine cable systems market is categorized into services, cable capacity, application, type, and country.

Based on services, the North America submarine cable systems market is bifurcated into installation services and maintenance & upgrade services. The installation services segment held a larger market share in 2022.

In terms of cable capacity, the North America submarine cable systems market is segmented into less than 10 Tb/S, 10-20 Tb/S, 20-30 Tb/S, and more than 30 Tb/S. The 20-30 Tb/S segment held the largest share of North America submarine cable systems market in 2022.

By application, the North America submarine cable systems market is bifurcated into communication and energy & power. The communication segment held a larger share of North America submarine cable systems market in 2022.

Based on type, the North America submarine cable systems market is bifurcated into single core and multi-core. The single core segment held a larger share of North America submarine cable systems market in 2022.

By country, the North America submarine cable systems market is segmented into the US, Canada, and Mexico. The US dominated the North America submarine cable systems market share in 2022.

Sumitomo Electric Industries Ltd; SubCom, LLC; Prysmian SpA; Alcatel Submarine Networks; Nexans SA; NEC Corp; Mitsubishi Electric Corp; Fujitsu Ltd; Vodafone Group Plc; and HMN Technologies Co., Ltd. are the some of the leading companies operating in the North America submarine cable systems market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,688.80 Million |

| Market Size by 2030 | US$ 6,222.78 Million |

| CAGR (2022 - 2030) | 11.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Services

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

1. Sumitomo Electric Industries Ltd

2. SubCom, LLC

3. Prysmian SpA

4. Alcatel Submarine Networks

5. Nexans SA

6. NEC Corp

7. Mitsubishi Electric Corp

8. HMN Technologies Co., Ltd.

9. Fujitsu Ltd

10. Vodafone Group Plc

The North America Submarine Cable Systems Market is valued at US$ 2,688.80 Million in 2022, it is projected to reach US$ 6,222.78 Million by 2030.

As per our report North America Submarine Cable Systems Market, the market size is valued at US$ 2,688.80 Million in 2022, projecting it to reach US$ 6,222.78 Million by 2030. This translates to a CAGR of approximately 11.1% during the forecast period.

The North America Submarine Cable Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Submarine Cable Systems Market report:

The North America Submarine Cable Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Submarine Cable Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Submarine Cable Systems Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)