The growth of the North America sewer machine market is attributed to various key driving factors, such as the increasing demand for sewer jetter equipment and the increasing uptake of sewer inspection cameras. However, the high cost of maintenance is likely to hinder the growth of this market during the forecast period. The long lifespan of these machines is also expected to limit their demand over the next few years.

Sewage jetter equipment is becoming more popular in sewer and drainage cleanup activities, particularly in metropolitan areas. Their usage in the cleaning of industrial pipelines has grown in popularity. Sewage jetter equipment is in high demand due to the usage of powered cleaning equipment in municipal sewer machines. The rising public awareness of hygiene and cleanliness is also aiding the demand for these machines.

Municipalities are paying more attention to sewage management, particularly in metropolitan areas, increasing the usage of sewer jetter equipment. Using power drain cleaning equipment in routine drainage maintenance is also propelling the sewer machine market. The legislative push in many nations that see drainage and sewer cleaning as a part of providing a decent living to inhabitants increased the number of clean sanitation facilities in residential areas.

The rising use of powered equipment, such as sewer jetter equipment, results from the rising focus on eco-friendly sewage systems. The number of drain cleaning projects in the business sector is increasing, strengthening the possibilities. Various countries' governments are taking initiatives to improve sewage and drainage system maintenance and operation spending, thereby increasing the demand for sewer jetter equipment.

Furthermore, the World Health Organization (WHO) reports that the emphasis on providing clean sanitation facilities has grown significantly in both the household and business sectors. Thus, increasing the demand for sewer jetter equipment, driving the sewer machine market.

Due to the digital revolution, the sewage inspection camera has received much attention. This has resulted in substantial advancements in the camera in terms of technology, such as improved optical focus and resolution. Due to the origin of rental firms offering sewage inspection assembly to the appropriate places, countries, such as the US, have seen a lot of traction in the sewer inspection camera. The growing awareness of the need for hygiene is projected to encourage the establishment of a proper sewer system maintenance structure. Sewer repair and maintenance work is coordinated through the entire automated system in various world regions, propelling the market. Due to high sanitation standards and strict hygiene rules and regulations in nations, such as the US and Canada, there has been a substantial increase in the market in North America.

Furthermore, Skyriders, a work-at-height firm, added the Zenith robotic inspection device, a new vertical inspection technology, to its line of services in October 2021. The winch-operated pan-tilt-zoom camera drone enhances repeat inspection accuracy and efficiency in vertical downhole applications such as mine shafts, elevator shafts, tanks, and sewage systems.

Moreover, Perma-Liner Sectors, the leading developer and provider of trenchless pipeline rehabilitation equipment and supplies, extended its network of distributors, bringing dependable, easy sewer camera technology solutions to the wastewater and stormwater industries. Thus, the sewer machine market is expected to witness growth with the emergence of sewer inspection cameras in the coming years.

Strategic insights for the North America Sewer Machine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

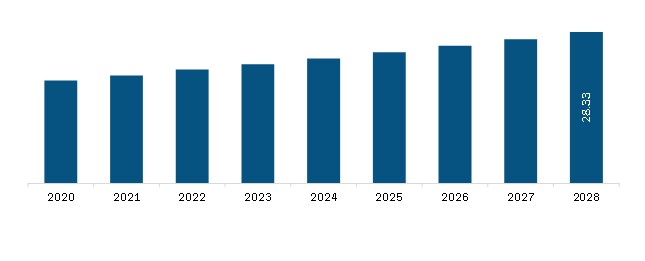

| Market size in 2021 | US$ 23.90 Million |

| Market Size by 2028 | US$ 28.33 Million |

| CAGR (2021 - 2028) | 2.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Sewer Machine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Based on product, the North America sewer machine market is segmented into suction and jetting machines. Based on tank capacity, the market is segmented into less than 500, 500‒1300, and greater than 1300 gallons based on tank capacity. Geographically, the market is divided into the US, Canada, and Mexico.

Gradall Industries, Inc.; GapVax, Inc.; Sewer Equipment; Vac-Con, Inc.; Vactor, Inc.; American Jetter; Jack Doheny Company; Spartan Tool; Veolia; and RIVARD are the leading companies operating in the

North America sewer machine market.

The North America Sewer Machine Market is valued at US$ 23.90 Million in 2021, it is projected to reach US$ 28.33 Million by 2028.

As per our report North America Sewer Machine Market, the market size is valued at US$ 23.90 Million in 2021, projecting it to reach US$ 28.33 Million by 2028. This translates to a CAGR of approximately 2.4% during the forecast period.

The North America Sewer Machine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Sewer Machine Market report:

The North America Sewer Machine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Sewer Machine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Sewer Machine Market value chain can benefit from the information contained in a comprehensive market report.