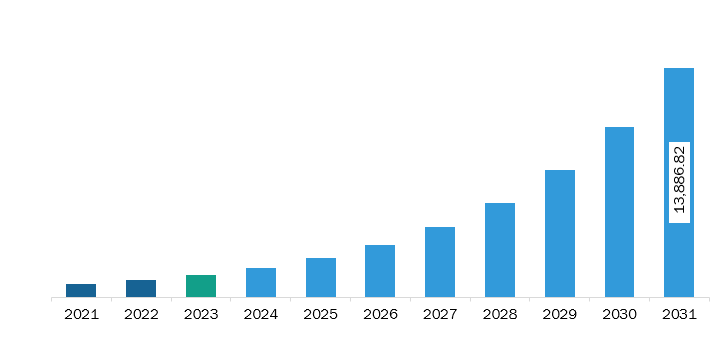

The North America real-time location systems market was valued at US$ 2,060.36 million in 2023 and is expected to reach US$ 13,886.82 million by 2031; it is estimated to register a CAGR of 26.9% from 2023 to 2031.

The demand for connected devices, including smartphones, tablets, and different wearable devices, such as smartwatches, fitness trackers, VR headsets, web-enabled glasses, smart jewelry, and Bluetooth headsets, is increasing across the world. Smartphones and tablets help the user accurately track location information in real time. The devices help the user to know the real-time traffic scenario and find the fastest route to the destination. It also assists parents to monitor the movement of their children through different location-tracking apps. Therefore, the adoption of smartphones and tablets is increasing tremendously. According to the Groupe Speciale Mobile Association (GSMA), smartphone adoption across the world was 76% in 2022, totaling 6.4 billion smartphone connections. The adoption is expected to rise to 92% by 2030, making 9 billion connections globally. According to the same report, smartphone adoption in North America was 84% in 2022 and is expected to climb to 90% by 2030.

Moreover, simultaneous localization and mapping (SLAM) technology plays a crucial role in enhancing the functionality of connected devices, especially in environments where traditional GPS signals are weak or unavailable. SLAM helps devices such as smartphones, tablets, and wearable devices create a map of their environment and track their location in real time. This technology is important for applications such as underground tracking, indoor navigation, and environments where there is signal interference. For instance, miners working deep underground can benefit from SLAM to maintain situational awareness and ensure safety in the absence of the GPS. Also, in healthcare, wearables used by dementia patients can use SLAM to accurately track their movements, reducing the risk of patients getting lost or placing themselves in dangerous situations. As the demand for connected devices grows in industries that require precise location tracking, the integration of SLAM technology innovates and improves the capabilities of real-time location systems.

The real-time location systems market in North America is segmented into the US, Canada, and Mexico. North America is a technologically advanced region owing to factors such as a positive outlook for advanced hardware adoption, a high inclination toward technological innovation, high GDP, developed infrastructure, and favorable economic policies. The region has a highly developed manufacturing sector. According to the National Institute of Standards and Technology, the manufacturing industry in the US accounted for a revenue of US$ 2.3 trillion in 2022, contributing to 11.4% of the total GDP of the country. The sector integrates RTLS and simultaneous localization and mapping (SLAM) to maintain a robust supply chain across verticals. The retail sector in North America is a major adopter of tracking hardware, which facilitates data transfer and details from tags attached to objects using scanning systems, thereby enabling automatic identification and tracking. According to the International Trade Administration (ITA), in 2022, there were ~27 million e-commerce users in Canada, accounting for 75% of the Canadian population, and the number is expected to reach 77.6% by 2025. In March 2022, e-commerce sales were ~US$ 2.34 billion and are estimated to reach US$ 40.3 billion by 2025.

Strategic insights for the North America Real-Time Location Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Real-Time Location Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Real-Time Location Systems Strategic Insights

North America Real-Time Location Systems Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,060.36 Million

Market Size by 2031

US$ 13,886.82 Million

CAGR (2023 - 2031) 26.9%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Offering

By Technology

By Industry Vertical

By Application

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Real-Time Location Systems Regional Insights

The North America real-time location systems market is categorized into offering, technology, industry vertical, application, and country.

By offerings, the North America real-time location systems market is divided into hardware, software, and services. The hardware segment held the largest share of the North America real-time location systems market share in 2023.

In terms of system type, the North America real-time location systems market is segmented into RFID, UWB, BLE, ultrasound, infrared, GPS, Wi-Fi, and ZIGBEE. The BLE segment held the largest share of the North America real-time location systems market share in 2023.

Based on industry vertical, the North America real-time location systems market is segmented into retail, government and defense, manufacturing, healthcare, logistics, heavy industries, construction, oil and gas, automotive, and others. The healthcare segment held the largest share of the North America real-time location systems market share in 2023.

By application, the North America real-time location systems market is divided into personnel or staff locating and monitoring, environmental monitoring, access control and security, warehouse management and monitoring, supply chain management and operation automation or visibility, and others. The supply chain management and operation automation or visibility segment held the largest share of the North America real-time location systems market share in 2023.

Based on country, the North America real-time location systems market is segmented into the US, Canada, and Mexico. The US held the largest share of North America real-time location systems market in 2023.

AiRISTA Flow Inc, Aruba Networks, Impinj Inc, Kudan Inc, Microsoft Corp, NavVis GmbH, Qorvo Inc, Sevensense Robotics AG, Siemens AG, Slamcore Ltd, Sonitor Technologies AS, Stanley Black & Decker Inc, TeleTracking Technologies Inc, Ubisense Ltd, and Zebra Technologies Corp are among the leading companies operating in the North America real-time location systems market.

The North America Real-Time Location Systems Market is valued at US$ 2,060.36 Million in 2023, it is projected to reach US$ 13,886.82 Million by 2031.

As per our report North America Real-Time Location Systems Market, the market size is valued at US$ 2,060.36 Million in 2023, projecting it to reach US$ 13,886.82 Million by 2031. This translates to a CAGR of approximately 26.9% during the forecast period.

The North America Real-Time Location Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Real-Time Location Systems Market report:

The North America Real-Time Location Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Real-Time Location Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Real-Time Location Systems Market value chain can benefit from the information contained in a comprehensive market report.