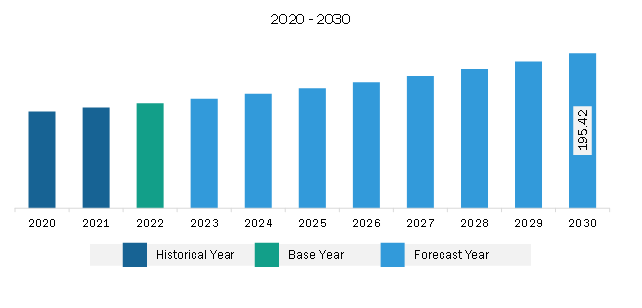

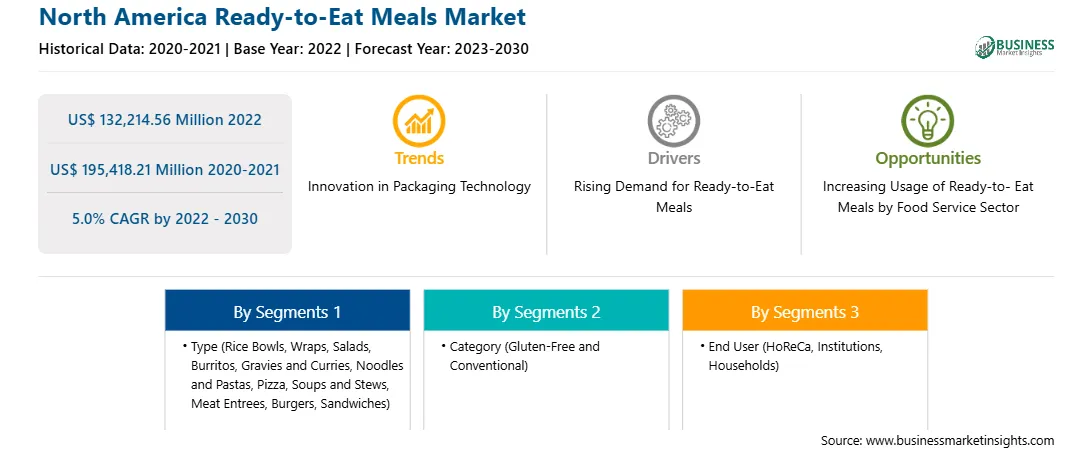

The North America ready-to-eat meals market was valued at US$ 132,214.56 million in 2022 and is expected to reach US$ 195,418.21 million by 2030; it is estimated to record a CAGR of 5.0% from 2022 to 2030.

Consumers are increasingly seeking healthy, nutritious food options, which has surged the demand for healthy alternatives to conventional foods, such as lactose-free, vegan, gluten-free, lactose-free, high-fiber, high-protein, or low-calorie ready-to-eat meals. Growing demand for healthy food has prompted manufacturers to develop and expand product portfolios according to specific customer requirements. Consumers are more concerned about synthetic additives in food products. Thus, the preference for naturally made products is increasing. Manufacturers are enhancing their product portfolio by launching ready-to-eat meals infusing natural ingredients.

According to data published by Veganuary, a non-profit organization encouraging people to adopt a vegan diet for January, ~5.8 million people signed up for the "Veganuary Campaign" in 2021. The growing adoption of a plant-based diet has prompted manufacturers to develop healthy and nutritious plant-based alternatives to conventional meals. For instance, the Nestlé-owned brand "Freshly" launched an entirely vegan meal line in August 2021. Under its new Purely Plant menu, the chef-prepared meal delivery service offers six options developed to showcase the nutritional benefits and delicious possibilities of plant-based foods. Thus, the growing consumers' inclination toward healthy diets and clean labels has prompted manufacturers to expand product offerings, fueling the North America ready-to-eat meals market growth globally.

The North America ready-to-eat meals market is segmented into the US, Canada, and Mexico. The regional market is influenced by multiple factors such as increasing disposable income, rising spending on convenience food categories and on-the-go food options. Growing emphasis on health-conscious choices propels the demand for ready-to-eat meal options such as rice bowls, wraps, salads, burritos, gravies, and curries made with fresh and nutritious ingredients. Meat entrées and chicken burgers and sandwiches are preferred by health-conscious consumers seeking protein-rich food options. Rising preference for healthy options and ethical considerations drive the demand for organic, gluten-free, and sustainably sourced ingredients in the ready-to-eat products. Ready-to-eat roasted vegetables, mashed vegetables, and vegetable rolls gain immense popularity across North America owing to the rising inclination toward plant-based diets and healthier alternatives. Also, with rising health concerns, people significantly avoid junk food. Therefore, the demand for healthy and nutritious ready-to-eat meals is rising across the food service sector in North America.

Busy urban population is inclined toward convenience food. According to the US Bureau of Labor Statistics (BLS), 69% of the people worked from the office in 2022. Ready-to-eat meals offer convenient solutions, allowing working professionals and other people to quickly access and consume food without spending time on cooking and preparing. Thus, working people are shifting toward ready-to-eat meals to save cooking time and effort, driving the North America ready-to-eat market growth. Since the COVID-19 pandemic, the convenience of online platforms has contributed to the increasing sales of ready-to-eat meals in North America. According to the Food Industry Association (FIA) and American Frozen Food Institute (AFFI), in 2020, ready-to-eat meal sales increased by 21%, and 39% of consumers were recorded as core ready-to-eat meal shoppers, as they consumed frozen ready-to-eat foods daily or every few days during the pandemic. Also, various corporates apply for meal subscriptions containing rice bowls, RTE burgers, frozen meat entrees, and other items to provide their employees with healthy and quick food options. With rising demand for RTE meal subscriptions, emerging market players adopt merger and acquisition, partnership, and collaboration strategies to expand their market share and meet the rising demand. In November 2020, Factor, America's leading ready-to-eat meal delivery service, acquired HelloFresh, another emerging meal kit delivery service in the region intending to expand its competitive position in the market. Thus, strategic developments by players are expected to open new opportunities in the North America ready-to-eat meals market in the coming years.

Strategic insights for the North America Ready-to-Eat Meals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 132,214.56 Million |

| Market Size by 2030 | US$ 195,418.21 Million |

| CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Ready-to-Eat Meals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America ready-to-eat meals market is segmented based on type, category, end user, and country.

Based on type, the North America ready-to-eat meals market is segmented into rice bowls, wraps, salads, burritos, gravies and curries, noodles and pastas, pizza, soups and stews, meat entrees, burgers, sandwiches, and others. The noodles and pastas segment held the largest share in 2022.

By category, the North America ready-to-eat meals market is bifurcated into gluten-free and conventional. The conventional segment held a larger share in 2022.

By end-use industry, the North America ready-to-eat meals market is segmented into HoReCa, institutions, households, and others. The HoReCa segment held the largest share in 2022.

Based on country, the North America ready-to-eat meals market is segmented into the US, Canada, and Mexico. The US dominated the North America ready-to-eat meals market in 2022.

Calavo Growers Inc, Dandee Sandwich Co, EA Sween Co, Fresh Grill Foods LLC, FreshRealm LLC, Hearthside Food Solutions LLC, Taylor Fresh Foods Inc, TripleSticks Inc, and Tyson Foods Inc are some of the leading companies operating in the North America ready-to-eat meals market.

The North America Ready-to-Eat Meals Market is valued at US$ 132,214.56 Million in 2022, it is projected to reach US$ 195,418.21 Million by 2030.

As per our report North America Ready-to-Eat Meals Market, the market size is valued at US$ 132,214.56 Million in 2022, projecting it to reach US$ 195,418.21 Million by 2030. This translates to a CAGR of approximately 5.0% during the forecast period.

The North America Ready-to-Eat Meals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Ready-to-Eat Meals Market report:

The North America Ready-to-Eat Meals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Ready-to-Eat Meals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Ready-to-Eat Meals Market value chain can benefit from the information contained in a comprehensive market report.