North America Pluggable Optics for Data Center Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 153 | Report Code: BMIRE00030706 | Category: Electronics and Semiconductor

No. of Pages: 153 | Report Code: BMIRE00030706 | Category: Electronics and Semiconductor

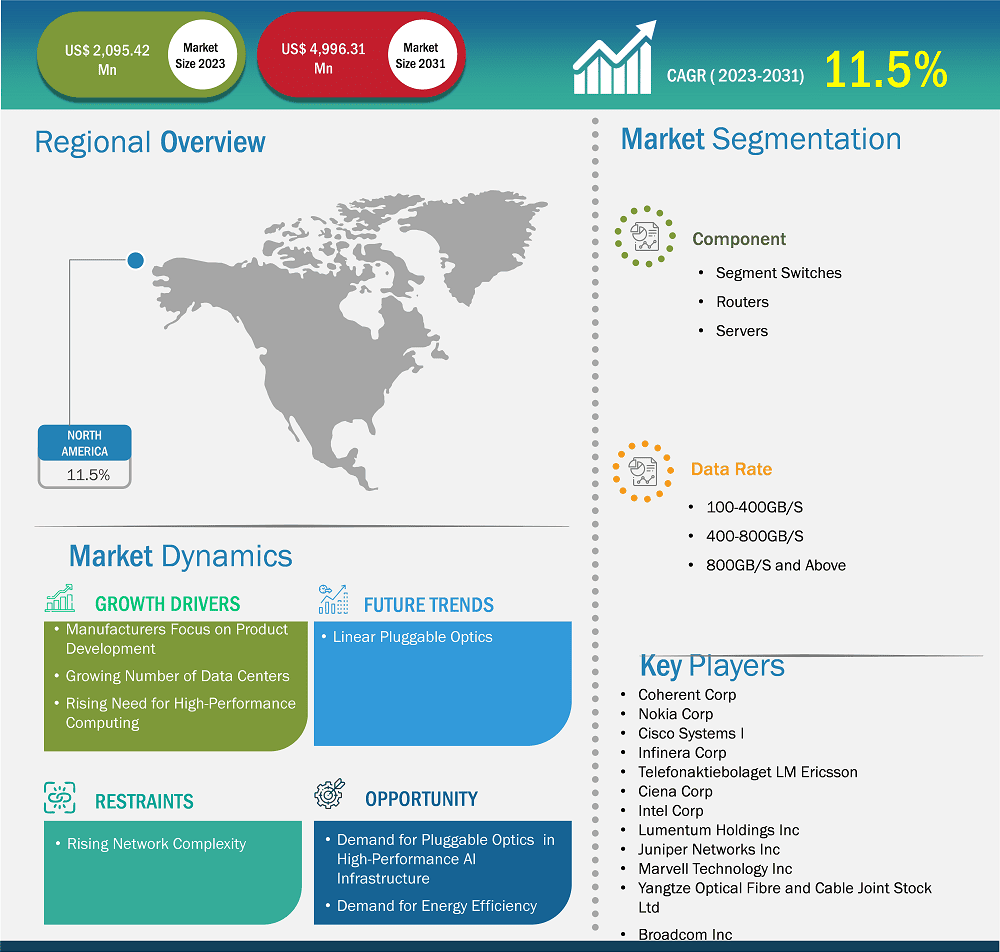

The North America pluggable optics for data center market size is expected to reach US$ 4,996.31 million by 2031 from US$ 2,095.42 million in 2023. The market is estimated to record a CAGR of 11.5% from 2023 to 2031.

In North America, the demand for tocotrienols is increasing due to the rising preference for consuming nutraceuticals The rapid expansion of data-intensive applications and cloud computing has resulted in a considerable increase in the number of data centers in North America, leading to an increased demand for pluggable optics. These data centers require high-speed and dependable optical communication, which fuels the demand for pluggable optics. These optics enable efficient data transfer and meet the ever-increasing bandwidth demands of contemporary data centers. Furthermore, the rise of smartphones, IoT devices, and streaming services has resulted in unprecedented data flow. Businesses now recognize the need for seamless, high-quality data transport. Pluggable optics provide the required capacity and scalability to manage the current spike in data traffic, making them a crucial component of data center infrastructure. Furthermore, as per the CBRE North America Data Center Trend Analysis, the top seven wholesale data center markets in North America are in the US: Northern Virginia, Dallas/Fort Worth, Silicon Valley, Chicago, Phoenix, New York Tri-State Area, and Atlanta.

The market in North America is anticipated to expand at a significant rate during the forecast period owing to the surging demand for pluggable optics from the data center operator. This encourages market players to develop advanced high performance pluggable optics to support their customers to easily add or replace optical modules. For instance, according to Coherent Pluggable Optics: A 2023 Heavy Reading Survey, the data indicates that North American operators have a more aggressive demand for pluggable optics compared to their Rest of World counterparts. According to the research, 2025 and 2026 will be crucial years for 800G coherent pluggable adoption, with more than half of respondents expecting deployment in those years. Thus, the rising demand for pluggable optics among cloud providers and hyperscale data centers are driving the market.

North America Pluggable Optics for Data Center Market Strategic Insights

North America Pluggable Optics for Data Center Market Segmentation Analysis

Key segments that contributed to the derivation of the pluggable optics for data center market analysis are component and data rate.

Rising adoption of the Internet of Things (IoT), increasing need for storage for massive amounts of data, and growing digitalization are increasing the demand for data centers. It is an excellent data storage solution that provides companies with fast and secure access to vast data. The benefits offered by data centers, such as centralized data management, scalability, and security, encourage businesses to adopt these solutions to achieve a data-driven business landscape. Thus, several companies are investing in the development of data centers in North America. According to Linklaters, North America has maintained its lead in data center transaction values, accounting for an impressive 62% of the global total in 2023 and 69% of investments through April 2024, totaling US$ 15 billion, with the US accounting for the largest share of the total. A few instances are mentioned below:

Various technologies, devices, and components are required to build these data centers and ensure their efficient operation. Fiber optics or optical interconnect technologies enable unprecedented scale, bandwidth, flexibility, and efficiency in modern, highly interconnected data centers. Pluggable optics are required to connect network components to convert high-speed electrical signals into optical signals and vice versa. Thus, the growing number of data centers in North America fosters the demand for pluggable optics for these data centers.

Based on country, the North America pluggable optics for data center market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

The US is home to ~2,700 data centers. The growth of mega data centers, which require high-speed and reliable connections between different components, is driving the demand for pluggable optics. These data centers need to scale their computing resources to meet the increasing data demands. Northern Virginia has the most data centers in the US. Over 300 Cloud and hyperscale data center providers, including Amazon Web Services, Microsoft Azure, and Google, have committed millions of square feet and hundreds of megawatts to the region, and they continue to expand. Northern Virginia is anticipated to have about 3,500 megawatts of data center inventory, which is more than triple that of any other US market.

Silicon Valley is still a strong market for data centers, creating more demand for pluggable optics. The San Francisco Bay Area, particularly Santa Clara, is a hub for tech giants, startups, and venture capital firms due to its lower power costs. Companies such as Apple, Google, Intel, Salesforce, NVIDIA, and Facebook/Meta have their headquarters in this area. Additionally, Silicon Valley's need for data centers is driven by the desire to be "near to home" and support of the tech ecosystem's innovative and digital services.

North America Pluggable Optics for Data Center Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 2,095.42 Million

Market Size by 2031

US$ 4,996.31 Million

CAGR (2023 - 2031) 11.5%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By Data Rate

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Pluggable Optics for Data Center Market Company Profiles

Some of the key players operating in the market include Coherent Corp, Nokia Corp, Cisco Systems I, Infinera Corp, Telefonaktiebolaget LM Ericsson, Ciena Corp, Intel Corp, Lumentum Holdings Inc, Juniper Networks Inc, Marvell Technology Inc, and Broadcom Inc among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Pluggable Optics for Data Center Market is valued at US$ 2,095.42 Million in 2023, it is projected to reach US$ 4,996.31 Million by 2031.

As per our report North America Pluggable Optics for Data Center Market, the market size is valued at US$ 2,095.42 Million in 2023, projecting it to reach US$ 4,996.31 Million by 2031. This translates to a CAGR of approximately 11.5% during the forecast period.

The North America Pluggable Optics for Data Center Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Pluggable Optics for Data Center Market report:

The North America Pluggable Optics for Data Center Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Pluggable Optics for Data Center Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Pluggable Optics for Data Center Market value chain can benefit from the information contained in a comprehensive market report.