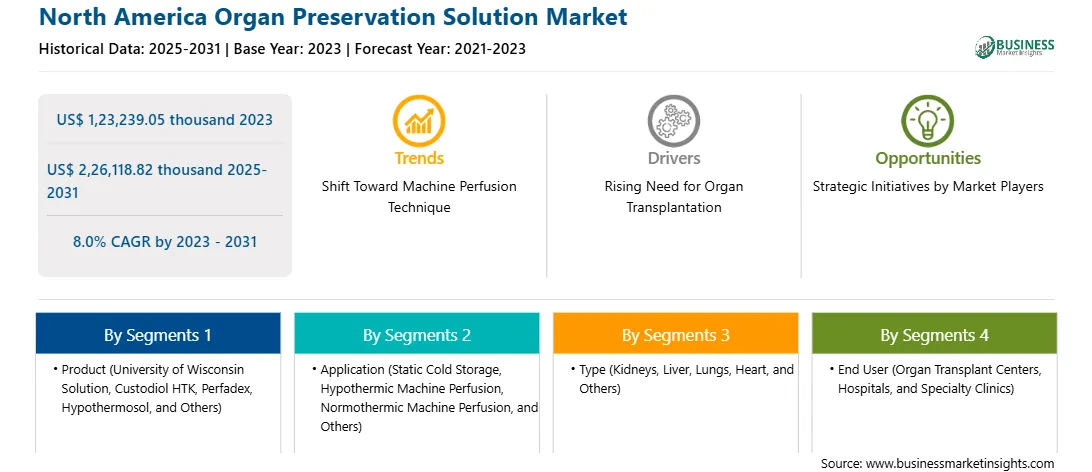

The North America organ preservation solution market was valued at US$ 1,23,239.05 thousand in 2023 and is expected to reach US$ 2,26,118.82 thousand by 2031; it is estimated to register a CAGR of 8.0% from 2024 to 2031.

Several chronic diseases are known to damage the functioning of the heart, lungs, liver, kidney, and other organs. A poor diet contributes to the development of renal and hepatic illnesses, which can also lead to organ failure. For instance, around 10% of the global population is impacted by chronic kidney disease. According to the US Department of Health & Human Services, more than 1 in 7 (i.e., ~15% or ~37 thousand adults) are estimated to have chronic kidney disease in the US. Further, excessive alcohol consumption leads to liver cirrhosis, resulting in the need for a liver transplant. The Scientific Registry of Transplant Recipients (SRTR) reports that irrespective of the success of medical treatments for heart failure, the number of candidates eligible for new heart transplants continues to rise. The COVID-19 pandemic had some impact on new listings. After a plateau from 2018 through 2020 and a slight decrease in 2020 (from 4,087 in 2019 to 4,000 in 2020), the number of new heart failure cases increased to 4,373 in 2021. Transplantation surgeries are becoming more common worldwide. In 2023, the United Network for Organ Sharing reported a record of more than 46,000 organ transplants in the US, marking an increase of over 8.7% from 2022. Additionally, the country crossed the mark of 27,000 kidney transplants for the first time in its history. Patients who are on the organ waiting list typically suffer from end-stage organ disease, which significantly affects their quality of life and may indicate that they are nearing the end of their life. The rising number of individuals with end-stage organ failure triggers the need for timely organ transplantation. Due to advancements in transplantation techniques, more such people are now eligible for organ transplants. Organ preservation solutions are used to maintain the viability and function of organs for a certain period, allowing for their transport and subsequent transplantation into a recipient. The success of organ transplantation is primarily determined by organ preservation, surgery, immunotherapy, and post-operative care. Thus, a rising demand for organ transplantation drives the organ preservation solution market toward growth.

The North America organ preservation solution market is segmented into the US, Canada, and Mexico. Increasing adoption of technologically advanced products and solutions, and surging number of organ transplants are the factors benefiting the organ preservation solution market in this region. The US is the largest organ preservation solution market across the world and is estimated to dominate the global market during the forecast period. The US market growth is attributed to the rising chronic kidney diseases (CKD) prevalence and the increasing geriatric population in the US. According to the National Chronic Kidney Disease fact sheet, ~37 thousand people in the US were suffering from chronic kidney diseases in 2021.

In June 2024, the American Kidney Fund, Inc. reported that up to 37 thousand Americans have kidney disease, and ~808,000 Americans are affected by kidney failure. More than 557,000 Americans are undergoing dialysis treatment. The prevalence of kidney disease is rising and currently affects over 1 in 7 (or 14%) of American adults. In 2021, around 135,000 Americans were newly diagnosed with kidney failure. Also, 9 out of 10 people affected by kidney disease are unaware they have it, and 1 in 3 of people with severely reduced kidney function are also unaware they have kidney disease. Furthermore, as per the same source stated that more than 250,000 Americans have undergone kidney transplants, and there are over 93,000 Americans on the kidney transplant waiting list. In 2023, only 27,332 people received kidney transplants, with 6,290 of those from living donors. The rising number of approvals from the US Food and Drug Administration (FDA) and the presence of market players in the country boost the US organ preservation solution market growth. In April 2022, TransMedics Group, Inc. announced that it received premarket FDA approval for its OCS Heart System, which can be used with organs from donors after circulatory death (DCD). The OCS Heart System is approved with the extended clinical indication for ex vivo reanimation, functional monitoring, and beating-heart preservation of donation-after-circulatory-death (DCD) hearts. Thus, the rising need for organ transplantation drives the organ preservation solutions market in the US. Organ preservation solution manufacturers in the US launch devices used for organ transportation. In August 2023, Paragonix Technologies, a leading organ transplant company, received FDA clearance for its next-generation donor lung preservation system, BAROguard. The system combines Paragonix's advanced hypothermic preservation technology with automated continuous and active airway pressure control. This ensures that an optimal temperature range and a clinically recommended inflation pressure range for donor lungs are maintained throughout the journey from the donor to the recipient patient. This novel combination of advanced technologies reinforces the company's ongoing commitment to improving and redefining the standard of care within transplant medicine.

Strategic insights for the North America Organ Preservation Solution provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Organ Preservation Solution refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Organ Preservation Solution Strategic Insights

North America Organ Preservation Solution Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,23,239.05 thousand

Market Size by 2031

US$ 2,26,118.82 thousand

CAGR (2023 - 2031) 8.0%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Product

By Application

By Type

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Organ Preservation Solution Regional Insights

The North America organ preservation solution market is categorized into product, application, type, end user, and country.

Based on product, the North America organ preservation solution market is categorized into University of Wisconsin solution, custodiol HTK, Perfadex, HypoThermosol, and others. The University of Wisconsin segment held the largest market share in 2023.

In terms of application, the North America organ preservation solution market is segmented into static cold storage, hypothermic machine perfusion, normothermic machine perfusion, and others. The static cold storage segment held the largest market share in 2023.

By type, the North America organ preservation solution market is categorized into kidneys, liver, lungs, heart, and others. The kidneys segment held the largest market share in 2023.

Based on end user, the North America organ preservation solution market is segmented into organ transplant centers, hospitals, and specialty clinics. The organ transplant centers segment held the largest market share in 2023.

By country, the North America organ preservation solution market is segmented into the US, Canada, and Mexico. The US dominated the North America organ preservation solution market share in 2023.

Waters Medical Systems LLC, XVIVO Perfusion, TransMedics, OrganOx Limited, Paragonix Technologies, Inc, Dr. Franz Koehler Chemie GmbH, Accord Healthcare, 21ST Century Medicine, and Bridge to Life Ltd., are among the leading companies operating in the North America organ preservation solution market.

The North America Organ Preservation Solution Market is valued at US$ 1,23,239.05 thousand in 2023, it is projected to reach US$ 2,26,118.82 thousand by 2031.

As per our report North America Organ Preservation Solution Market, the market size is valued at US$ 1,23,239.05 thousand in 2023, projecting it to reach US$ 2,26,118.82 thousand by 2031. This translates to a CAGR of approximately 8.0% during the forecast period.

The North America Organ Preservation Solution Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Organ Preservation Solution Market report:

The North America Organ Preservation Solution Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Organ Preservation Solution Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Organ Preservation Solution Market value chain can benefit from the information contained in a comprehensive market report.