North America is segmented into the US, Canada, and Mexico. The presence of world’s leading defense spending countries such as the US is the key driver for the growth of MIL-DTL-81714 Series II connectors market in the region. North America has the largest defense industry as the region is the innovation and manufacturing hub of technologically advanced military aircraft, vehicles, and defense systems, owing to presence of majority of defense manufacturers. High emphasis on developing military strength as a strategic priority is driving the investments in building defense industrial base across North America, especially in the US. In 2020, the military expenditure of countries such as the US and Canada reached US$ 778 billion (US$ 734 billion last year), and US$ 23 billion, respectively. The military expenditure of Mexico was US$ 6.1 billion in 2020 (US$ 6.6 billion last year). One of the key trends observed in the military procurement is the growing adoption of unmanned aerial vehicles and unmanned ground vehicles. For instance, in August 2020, Remotec, a business unit of Northrop Grumman, was awarded contract of US$ 48 million for providing unmanned ground vehicles. In May 2019, QinetiQ was awarded a CAD 51 million contract by Canadian Armed Forces for providing unmanned aircraft systems. Thus, such developments are subsequently driving the adoption of MIL-DTL-81714 Series II connectors in North America.

North America is known for the highest rate of adoption of advanced technologies due to favorable government policies to boost innovation and strengthen infrastructure. As a result, any factor affecting performance of industries in the region hinders its economic growth. Currently, the US is the world's worst-affected country due to the COVID-19 outbreak, which has led governments to impose several limitations on industrial, commercial, and public activities to control the spread of infection in the country. The leading aircraft manufacturers and aircraft MRO service providers are witnessing significant losses amid the pandemic. Drastic dip in aircraft manufacturer’s production volumes has hampered the adoption rate of different connectors. However, the governments of the US and Canada have maintained their defense spending levels at normal. For instance, the defense spending in the US reached US$ 778 billion in 2020, with a yearly increase on 4.4%, which led several UAV manufacturers, UGV manufacturers, and weapon and combat system manufacturers to expedite the procurement of power connectors. As a result, the COVID-19 pandemic and its consequences have had a nominal impact on the MIL-DTL-81714 Series II Connectors market in North America.

Strategic insights for the North America MIL-DTL-81714 Series II Connectors provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 21,204.02 thousand |

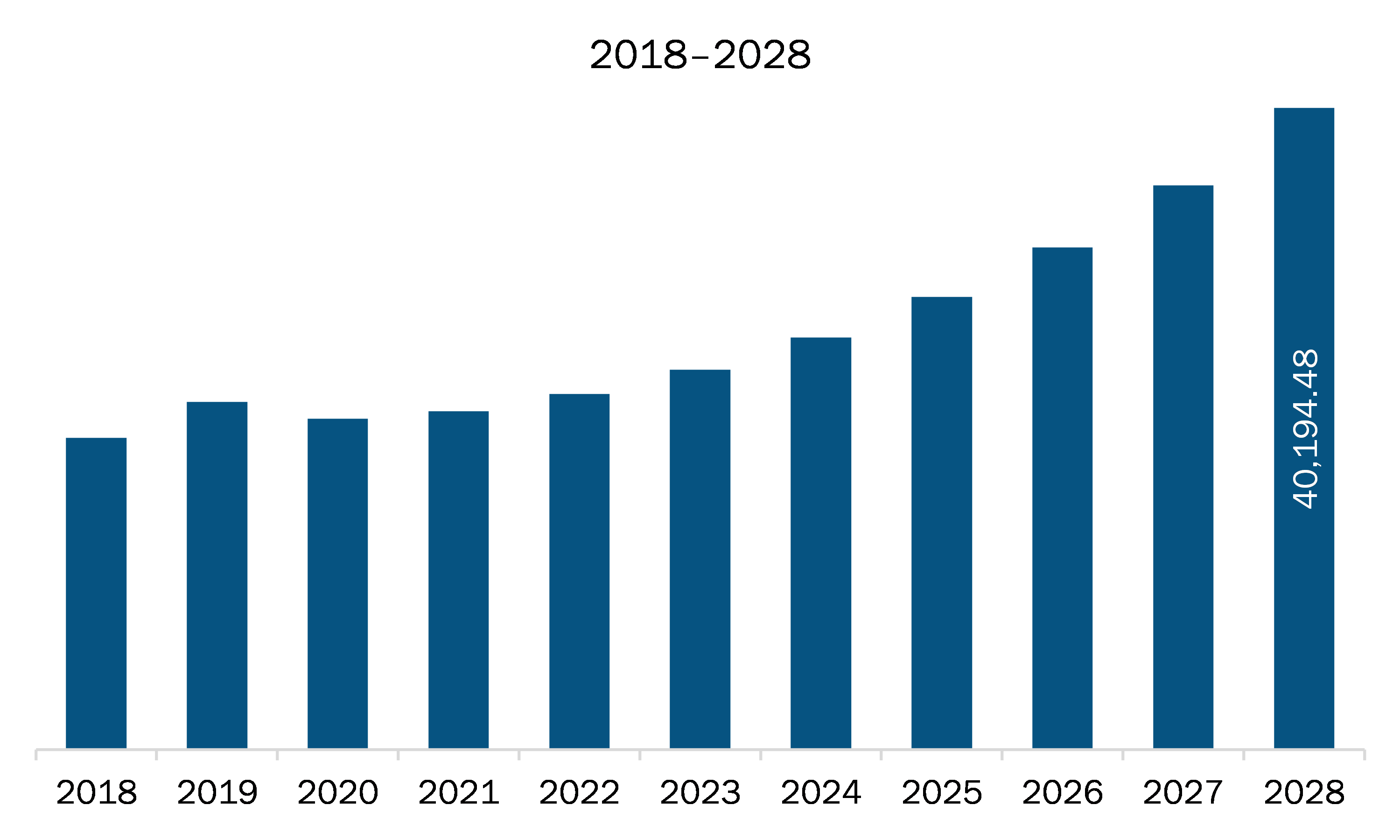

| Market Size by 2028 | US$ 40,194.48 thousand |

| CAGR (2021 - 2028) | 9.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America MIL-DTL-81714 Series II Connectors refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The MIL-DTL-81714 Series II Connectors market in North America is expected to grow from US$ 21,204.02 thousand in 2021 to US$ 40,194.48 thousand by 2028; it is estimated to grow at a CAGR of 9.6% from 2021 to 2028. Underground vehicles (UGVs) are being deployed in areas with hostile weather conditions or in areas that are inaccessible to humans. The deployment of UGVs helps operators in ensuring safe operations at various plant sites by avoiding any harms to human employees. These vehicles are being deployed in warzones for conducting Intelligence, Surveillance, and Reconnaissance (ISR) operations, thereby preventing human casualties. Also, UGVs are deployed for search & rescue operations to evaluate damages and locate victims in disasters. Exposure to nuclear radiations and harmful gases, among others, during certain disasters might set humans at hazardous conditions. The UGV and UAV are being utilized for various operations amid COVID-19 pandemic. Thus, the growing adoption of UGVs in military and commercial applications is providing significant opportunities for the future growth of the MIL-DTL-81714 Series II Connectors market players.

The North America MIL-DTL-81714 Series II Connectors market is segmented based on application and end user. Based on application, the North America MIL-DTL-81714 Series II Connectors market is segmented into aircraft lighting, unmanned aerial vehicle, unmanned ground vehicle, and combat systems & weaponry. The aircraft lighting segment held the largest share in 2020 based on application. Similarly, based on end user, the North America MIL-DTL-81714 Series II Connectors market is segmented aircraft manufacturers, UAV manufacturers, UGV manufacturers, aircraft MRO service providers, weaponry manufacturers, and combat system integrators. The aircraft manufacturers segment held the largest share in 2020 based on end user.

A few major primary and secondary sources referred to for preparing this report on the MIL-DTL-81714 Series II Connectors market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Amphenol Pcd, Daniels Manufacturing Corporation, DME Interconnect, Souriau SAS,

The North America MIL-DTL-81714 Series II Connectors Market is valued at US$ 21,204.02 thousand in 2021, it is projected to reach US$ 40,194.48 thousand by 2028.

As per our report North America MIL-DTL-81714 Series II Connectors Market, the market size is valued at US$ 21,204.02 thousand in 2021, projecting it to reach US$ 40,194.48 thousand by 2028. This translates to a CAGR of approximately 9.6% during the forecast period.

The North America MIL-DTL-81714 Series II Connectors Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America MIL-DTL-81714 Series II Connectors Market report:

The North America MIL-DTL-81714 Series II Connectors Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America MIL-DTL-81714 Series II Connectors Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America MIL-DTL-81714 Series II Connectors Market value chain can benefit from the information contained in a comprehensive market report.