Several macroeconomic factors across the North America have created a severely hostile environment for businesses. The pandemic caused severe disruptions, which led to huge losses for several industry verticals. Severe economic downturns in several countries have decreased consumer spending on discretionary or optional goods.

While the definition of such goods varies depending on a family's income, it is undeniable that most industry verticals have endured or are enduring losses due to such a decrease in consumption. With respect to such factors, enterprises are adopting different measures to remain competitive by reducing capital expenditure. Hence, enterprises prefer economical and flexible expenses while focusing on core business. Availing of managed network services can aid organizations in reducing costs while maintaining a competitive edge. Thus, companies can save on operational costs while increasing productivity. MSPs can increase productivity through the replacement of inefficient IT systems and the reduction of downtime.

Additionally, expenditure on network security and cyber threat can also be minimized through such services. Generally, an annual or multi-year contract, known as a service level agreement (SLA), is signed between the MSP and enterprises for managed network services. Depending on the parameters of the service being requested, prices vary. Hence, enterprises have a clear knowledge of operations expense budgets for IT. Hence, variable expenditures under capital expenses for purchasing new equipment or maintaining old equipment are removed. Enterprises can remain unaffected by price rises or similar unforeseen circumstances with a multi-year deal.

Managed network services (MNS) offer potential opportunities to small and medium enterprises (SMEs) to grow and achieve business goals. IT spending among SMEs is predicted to increase because SMEs are expanding their businesses by implementing innovative and enhanced IT services. The rise in IT spending by SMEs is expected to fuel the demand for managed service providers (MSPs), as SMEs are adopting automating services, cloud, and advanced digital technologies. MNS providers offer solutions to help SMEs manage total cost of ownership (TCO), support newer applications in demand, reduce capital expenditures (CAPEX) & operating expenses, sustain their business operations, and connect efficiently with customers and partners. MNS providers offer cost-effective services that secure network functions, which has helped SMEs grow and focus on their core businesses. SMEs rely on MNS providers to connect with several sites and manage their networks. The MNS providers are opening new opportunities for SMEs to remain competitive, expand, and grow their businesses. For instance, the leader in Unified SASE solutions Aryaka, announced enhanced SD-WAN and SASE offerings specifically designed to meet the needs of small to medium-sized enterprises (SMEs). With entry pricing of under $150/site, Aryaka delivers a more comprehensive set of managed service capabilities compared to alternatives including application optimization, network security, multi-cloud connectivity, and cloud-based observability and control, all supported by lifecycle services management. Moreover, the current business environment has increased the demand for accelerated digital transformation, with SMEs needing more IT assistance than ever. With limited resources, SMEs need safe and reliable solutions and a technology partner for maintaining business continuity and connections with colleagues and customers. Cisco Systems, Inc., a US-based company, provides a series of simple, affordable, and reliable cloud-based IT solutions to help SMEs transform their businesses to operate more effectively in digital workplaces.

Strategic insights for the North America Managed Network Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

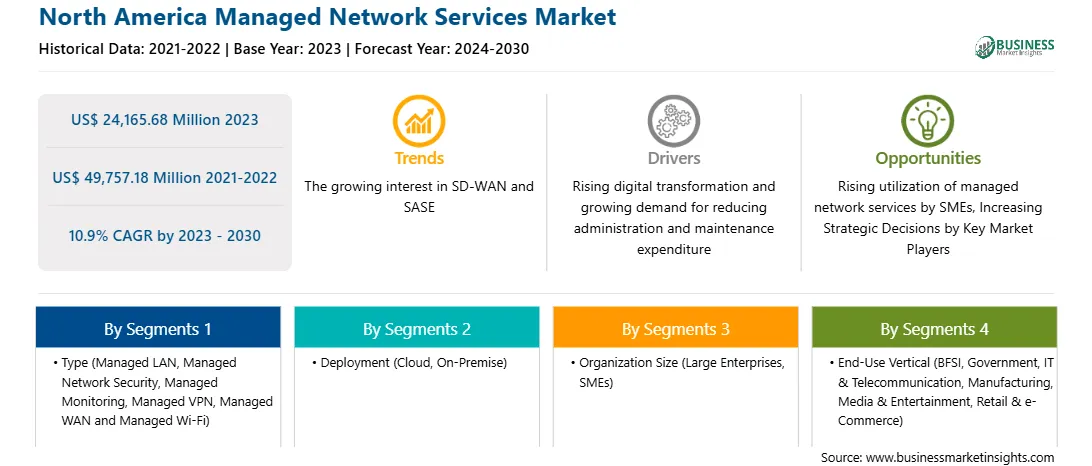

| Market size in 2023 | US$ 24,165.68 Million |

| Market Size by 2030 | US$ 49,757.18 Million |

| CAGR (2023 - 2030) | 10.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Managed Network Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America managed network services market is segmented into type, deployment, organization size, end use, and country.

Based on type, the North America managed network services market is segmented into managed LAN, managed network security, managed monitoring, managed VPN, managed WAN, and managed Wi-Fi. The managed LAN segment registered the largest North America managed network services market share in 2023.

Based on deployment, the North America managed network services market is segmented into cloud and on-premise. The on-premise segment held a larger North America managed network services market share in 2023.

Based on organization size, the North America managed network services market is segmented into large enterprises and SMEs. The large enterprises segment is sub-segmented into BFSI, government, IT & telecommunication, manufacturing, media & entertainment, retail & e-commerce, and others. The IT & telecommunication segment registered the largest North America managed network services market share in 2023.

The SMEs segment is sub-segmented into BFSI, government, IT & telecommunication, manufacturing, media & entertainment, retail & e-commerce, and others. The IT & telecommunication segment registered the largest North America managed network services market share in 2023.

Based on end-use vertical, the North America managed network services market is segmented into BFSI, government, IT & telecommunication, manufacturing, media & entertainment, retail & e-commerce, and others. The IT & telecommunication segment held the largest North America managed network services market share in 2023.

Based on country, the North America managed network services market has been categorized into the US, Canada, and Mexico. The US dominated the North America managed network services market share in 2023.

Accenture Plc; Cisco Systems Inc; Cognizant Technology Solutions Corp; Fujitsu Ltd; HCL Technologies Ltd; Huawei Investment & Holding Co Ltd; Kyndryl Holdings Inc; NTT Ltd; Tata Consultancy Services Ltd; and Verizon Communications Inc are some of the leading companies operating in the North America managed network services market.

The North America Managed Network Services Market is valued at US$ 24,165.68 Million in 2023, it is projected to reach US$ 49,757.18 Million by 2030.

As per our report North America Managed Network Services Market, the market size is valued at US$ 24,165.68 Million in 2023, projecting it to reach US$ 49,757.18 Million by 2030. This translates to a CAGR of approximately 10.9% during the forecast period.

The North America Managed Network Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Managed Network Services Market report:

The North America Managed Network Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Managed Network Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Managed Network Services Market value chain can benefit from the information contained in a comprehensive market report.