North America Industrial Networking Solution Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00032114 | Category: Electronics and Semiconductor

No. of Pages: 150 | Report Code: BMIRE00032114 | Category: Electronics and Semiconductor

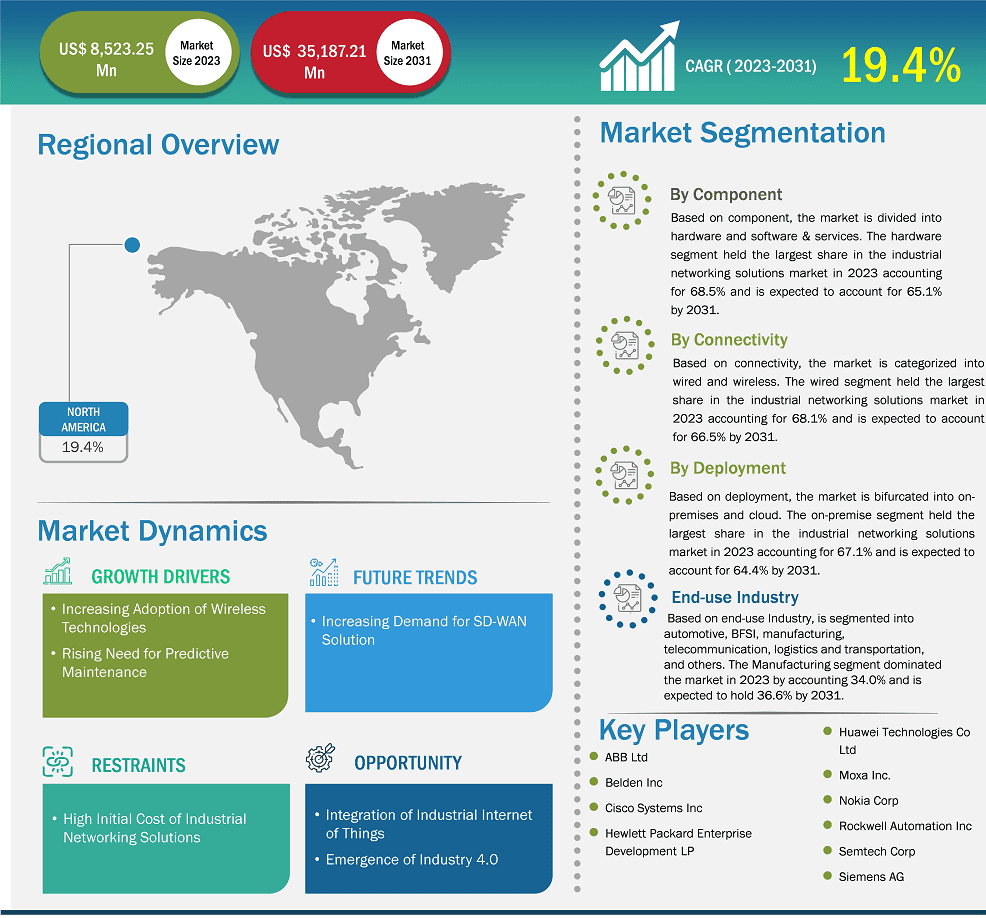

The North America industrial networking solution market size is expected to reach US$ 35,187.21 million by 2031 from US$ 8,523.25 million in 2023. The market is estimated to record a CAGR of 19.4% from 2023 to 2031.

The market in North America is witnessing substantial expansion. It holds a significant industrial networking solutions market share. It is poised to become a leading force in the global market. North America, notably the US, has been at the forefront of embracing cutting-edge technologies such as industrial automation, the Internet of Things (IoT), and Industry 4.0. As a result, there is a growing need for industrial networking solutions that facilitate seamless connectivity and data exchange within these advanced technological ecosystems. Prominent companies such as Cisco Systems Inc., Juniper Networks Inc., Rockwell Automation, Inc., and Sierra Wireless, Inc. play a significant role in driving innovation and growth in the North American market. These companies leverage their expertise to deliver robust networking solutions tailored to the specific requirements of industries in the region.

5G and Wi-Fi6/6E wireless technologies now enable standard, real-time communication in control operations, which was previously only possible via cable connectivity or bespoke wireless solutions. This opens up new opportunities for industrial automation and smart manufacturing processes in North America. The use of wireless technology in industrial automation systems has a number of possible benefits, ranging from the apparent cost savings caused by the elimination of wires to the availability of better plant information, increased productivity, and enhanced asset management. Thus, the adoption of wireless technologies in industrial automation in North America is expected to grow during the forecast period, supplementing the growth of the industrial networking solutions market.

North America Industrial Networking Solution Market Strategic Insights

North America Industrial Networking Solution Market Segmentation Analysis

Key segments that contributed to the derivation of the North America industrial networking solution market analysis are component, deployment, connectivity, and end-use industry.

The increasing need for predictive maintenance is a key factor contributing to the growing industrial networking solutions market size. Industrial networking solutions offer the capability to monitor operations in real time and predict maintenance requirements, enabling organizations to optimize their maintenance activities and minimize downtime. By utilizing technologies such as the Industrial Internet of Things (IIoT) and advanced analytics, organizations can proactively identify potential equipment failures before they happen. This enables planned repairs and reduces the occurrence of unexpected breakdowns, ultimately leading to enhanced operational efficiency and cost savings. The adoption of industrial networking solutions facilitates seamless connectivity and empowers organizations to make informed decisions based on data for optimal maintenance optimization.

Industrial networking solutions are technologies and services that enable reliable and efficient communication and connectivity within industrial processes and operations. These solutions play a crucial role in optimizing industrial processes, improving efficiency, and enabling real-time monitoring and control. The increasing need for predictive maintenance in industrial settings is fueling the demand for industrial networking solutions. These solutions enable real-time monitoring, data collection, and analysis, allowing for proactive maintenance and minimizing downtime. Thus, rising need for industrial networking solutions is expected to boost the market growth.

Based on country, the North America industrial networking solution market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

The landscape of the manufacturing sector of the US is transforming, boosted by the growing dependence on information and data for decision-making. The convergence of operational technology (OT) and information technology (IT) is expected to create opportunities for the US industrial networking solutions market during the forecast period. As OT and IT networks converge, OT cyberattacks become more common, posing major threats to manufacturing firms. Manufacturing networks and enterprise IT systems existed in separate domains from inception. The term OT is used to differentiate the systems and technologies used to control physical processes in industrial settings from the more traditional IT used in office environments. However, IT and OT have converged technically since the development of the Industrial Internet of Things (IIoT).

Key market participants in the region are focusing on technological advancements and product developments. For instance, in January 2022, Cisco announced the expansion of the Cisco Catalyst 9000 portfolio, based on the powerful Unified Access Data Plane (UADP) ASIC silicon, to bring more enterprise-grade switching capabilities to the industrial edge for industries operating in harsh environments and supporting critical infrastructure like utilities, oil and gas, roadways, and rail. Operational connectivity in industrial spaces is growing as organizations seek to improve efficiency, employee safety, business agility, and hybrid work support. As the operational world evolves, IT expertise is required to scale and secure the network as operational technology (OT) systems are brought onto the corporate networks.

North America Industrial Networking Solution Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 8,523.25 Million

Market Size by 2031

US$ 35,187.21 Million

CAGR (2023 - 2031) 19.4%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Component

By Deployment

By End-use Industry

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Industrial Networking Solution Market Company Profiles

Some of the key players operating in the market include ABB Ltd; Belden Inc; Cisco Systems Inc; Hewlett Packard Enterprise Development LP; Huawei Technologies Co Ltd; Moxa Inc.; Nokia Corp; Rockwell Automation Inc; Semtech Corp; and Siemens AG among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Industrial Networking Solution Market is valued at US$ 8,523.25 Million in 2023, it is projected to reach US$ 35,187.21 Million by 2031.

As per our report North America Industrial Networking Solution Market, the market size is valued at US$ 8,523.25 Million in 2023, projecting it to reach US$ 35,187.21 Million by 2031. This translates to a CAGR of approximately 19.4% during the forecast period.

The North America Industrial Networking Solution Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Industrial Networking Solution Market report:

The North America Industrial Networking Solution Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Industrial Networking Solution Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Industrial Networking Solution Market value chain can benefit from the information contained in a comprehensive market report.