Market Introduction

Manufacturing is an important sector in North America; with a high real output worth US$ 2.00 trillion (adjusted for inflation in 2009 ) in Q1 2018, the US is the world's third-largest manufacturer, after the People's Republic of China and the European Union. This is well above the US$ 1.95 trillion peak before the Great Recession in 2007. In December 2016, the manufacturing sector in the US employed 12.35 million people, up from 12.56 million in December 2017, recording an increase of 207,000 or 1.7%. Such developed manufacturing sector across the region, necessitates the need for efficient industrial equipment and other systems related to them, such as brakes. Furthermore, the adoption of new chemical manufacturing technologies may boost their resistance capacities. The production capacity of chemicals such as ethylene, propylene, and paraxylene is expected to grow at a rate more than 4% per year until 2022. A strong demand for these chemicals is allowing big petrochemical corporations to continue developing and ramping up their capacities. Furthermore, changes in crude oil and natural gas prices are likely to have a significant impact on the addition of base chemicals capacities in the future, providing significant opportunities for industrial brakes vendors. Growth of manufacturing sector is the major factor driving the growth of the North America industrial brakes market.

North America has the highest rate of adoption and advancement of new technologies due to favorable government policies to boost innovation and strengthen infrastructure capabilities. As a result, any effects on industries are expected to have a negative impact on the region's economic growth. After the first wave of pandemic-driven shutdowns, segment recoveries have been non-uniform across various manufacturing industries. Some manufacturers have experience forced work stoppages or supply disruption, pulling down capacity utilization rates and impairing productivity. However, the implementation of digital twin, i.e., a digital representation of a physical thing, like production process or physical production environment, has enabled manufacturing units across North America to virtually simulate the product, its production and its performance in the real world. Thus, the adoption of mechanical Equipments of manufacturing processes across different industries in North America has the potential to mitigate the historic losses in productivity and output of manufacturers, thereby neutrally affecting the industrial brakes market in this region.

Strategic insights for the North America Industrial Brakes provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Industrial Brakes refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.North America Industrial Brakes Strategic Insights

North America Industrial Brakes Report Scope

Report Attribute

Details

Market size in 2021

US$ 275.35 Million

Market Size by 2028

US$ 372.06 Million

Global CAGR (2021 - 2028)

4.4%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Type

By Application

By Industry Vertical

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Industrial Brakes Regional Insights

Market Overview and Dynamics

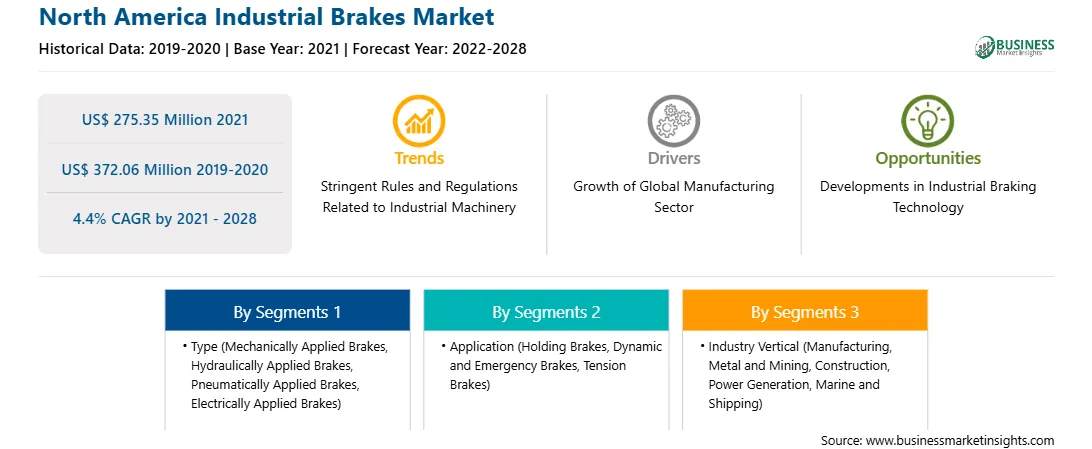

The industrial brakes market in North America is expected to grow from US$ 275.35 million in 2021 to US$ 372.06 million by 2028; it is estimated to grow at a CAGR of 4.4% from 2021 to 2028. When designing equipment systems, it's crucial to think about how the braking system will affect the operation of subsequent machines. Fail-safe brakes assist in shutting off the machines movement quickly in accidents, performance failure, or power failure, among others. Companies are also working on hydraulic release brakes that are spring-loaded braking systems using hydraulic energy to produce adjustable torque. The need for industrial brakes is high in mining winches, overhead cranes, steel rolling systems, and other similar devices. Furthermore, warehousing, medical, steel mills, and food processing industries hold significant potential for the industrial brakes market. Companies are actively working on the spring-applied brakes with high permitted braking energies, high torques, and wear resistance. For instance, Kor-Pak, an OEM and distributor of industrial brakes and clutches, is developing end-to-end braking systems for the mining and manufacturing industries.

Key Market Segments

The North America industrial brakes market is segmented into type, application, industry vertical, and country. Based on type, the industrial brakes market is segmented into mechanically applied brakes, hydraulically applied brakes, pneumatically applied brakes, electrically applied brakes, and others. The hydraulically applied brakes segment dominated the market in 2020 and electrically applied brakes segment is expected to be the fastest growing during the forecast period. Based on application, industrial brakes market is sub segmented into holding brakes, dynamic and emergency brakes, and tension brakes. The holding brakes segment dominated the market in 2020 and dynamic and emergency brakes segment is expected to be the fastest growing during the forecast period. Based on industry vertical, the industrial brakes market is categorized into manufacturing, metal and mining, construction, power generation, marine and shipping, and others. The manufacturing segment dominated the market in 2020 and others segment is expected to be the fastest growing during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on industrial brakes market in North America are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Akebono Brake Industry Co., Ltd.; Altra Industrial Motion Corp.; AMETEK Inc.; Carlisle Companies Incorporated; Coremo Ocmea S.p.A.; DELLNER BUBENZER; Eaton Corporation plc; Jiangxi Huawu Brake Co., Ltd.; KTR Systems GmbH; RINGSPANN GmbH; and SIBRE Siegerland Bremsen GmbH are among others.

Reasons to buy report

North America Industrial Brakes Market Segmentation

North America Industrial Brakes Market –By

Type

North America Industrial Brakes Market –By Application

North America Industrial Brakes Market –By Industry Vertical

North America Industrial Brakes Market -By Country

North America Industrial Brakes Market -

Company Profiles

The North America Industrial Brakes Market is valued at US$ 275.35 Million in 2021, it is projected to reach US$ 372.06 Million by 2028.

As per our report North America Industrial Brakes Market, the market size is valued at US$ 275.35 Million in 2021, projecting it to reach US$ 372.06 Million by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The North America Industrial Brakes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Industrial Brakes Market report:

The North America Industrial Brakes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Industrial Brakes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Industrial Brakes Market value chain can benefit from the information contained in a comprehensive market report.