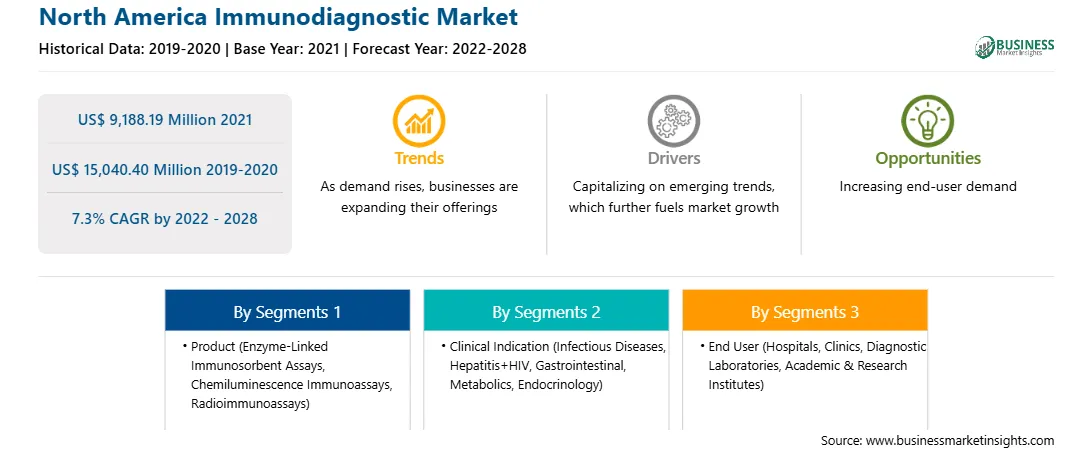

The North America immunodiagnostics market is expected to reach US$ 15,040.40 million by 2028 from US$ 9,188.19 million in 2021; it is estimated to grow at a CAGR of 7.3% during 2022–2028.

Immunodiagnostics primarily uses antigen–antibody reactions as its primary means of detection. Antibodies specific to the desired antigen can be conjugated with a radiolabel, fluorescent label, or color-forming enzyme and are used as a probe to detect it. The speed, accuracy, and simplicity of such tests have promoted them as rapid techniques for the diagnosis of diseases and the detection of illegal drugs. The growth of the North America immunodiagnostics market is attributed to the increasing prevalence of infectious diseases and the rising use of point-of-care immunodiagnostics solutions. However, the inadequate reimbursement scenario is hampering the market growth.

Market Insights

Increasing Prevalence of Infectious Diseases Fuels North America Immunodiagnostics Market Growth

The need for diagnosing & managing infections and other disease is contributing to the rising number of prescriptions for immunodiagnostics tests. There are several immunodiagnostic tests and technologies, such as agglutination tests, complement fixation, precipitation tests, line blot assays, Western blot assays, enzyme immunoassays (EIA), and immunofluorescence tests, developed for infectious diseases.

HIV is a major public health issue worldwide. According to the US Department of Health & Human Services, ~1.2 million people in the US have HIV. The Centers for Disease Control and Prevention (CDC) states that there were ~34,800 new HIV infections in the US in 2019. Similarly, the increasing prevalence of hepatitis, a viral infection that results in liver inflammation, is one of the major factors driving the North America immunodiagnostics market. In 2018, according to the US Department of Health & Human Services (HHS), 2.4 million people live with hepatitis C in the US; the actual upper limit reported is 4.7 million, while the lower limit reported is 2.5 million. Additionally, the WHO's global hepatitis strategy, endorsed by all WHO member states, aims to reduce new hepatitis infections by 90% and deaths by 65% during 2016–2030. The increasing prevalence of infectious diseases fuels North America immunodiagnostics market growth.

The medical industry in North American countries witnessed a chaotic situation, with increased demand for clinical diagnostics and therapeutic systems in hospitals. With the growing infection rate and the rising demand for diagnosis, the immunodiagnostics market experienced a positive impact in the region. Healthcare facilities, clinical laboratories, and pharmaceutical and biotech companies preferred advanced diagnostic techniques and systems to handle the burden of COVID-19.

In March 2021, Eurofins' Clinical Enterprise, Inc. obtained an Emergency Use Authorization (EUA) from the US Food and Drug Administration (FDA) for a direct-to-consumer (DTC) version of its EmpowerDX COVID-19 Home Collection Kit. The Eurofins at-home COVID-19 nasal PCR kit is one of the first over-the-counter SARS-CoV-2 at-home test kits. Similarly, in March 2020, the US FDA issued Emergency Use Authorization (EUA) to Abbott for its fastest available molecular point-of-care test to detect novel coronavirus (COVID-19), which delivers positive results in ~5 minutes and negative results in ~13 minutes. Thus, the rise in product launches during this global health crisis has supported the growth of the North America immunodiagnostics market.

Product-Based Insights

Based on product, the North America immunodiagnostics market is segmented into enzyme-linked immunosorbent assays (ELISA), chemiluminescence immunoassays (CLIA), radioimmunoassays (RIA), and others. The enzyme-linked immunosorbent assays (ELISA) segment held the largest share of the market in 2021. Moreover, the chemiluminescence immunoassays (CLIA) segment is expected to grow at the fastest CAGR during the forecast period.

Clinical Indication -Based Insights

Based on clinical indication, the North America immunodiagnostics market is segmented into infectious diseases, hepatitis+HIV, gastrointestinal endocrinology. The infectious diseases segment held the largest share of the market in 2021, and the same segment is expected to grow at the highest CAGR during the forecast period.

End User-Based Insights

Based on end user, the North America immunodiagnostics market is segmented into hospitals, clinics, diagnostics laboratories, academic & research institutes, and others. The hospitals segment held the largest share of the market in 2021. However, the clinics segment is expected to register the highest CAGR during the forecast period.

Strategic Insights

Product launches and approvals are the commonly adopted strategies by companies to expand their global footprints and product portfolios. Companies in the North America immunodiagnostics market focus on the collaboration strategy to enlarge their clientele, which, in turn, permits them to maintain their brand name across the world.

A few of the companies included in our research scope are Abbott Laboratories; F. Hoffmann-La Roche Ltd; DiaSorin S.p.A.; Danaher Corp, Thermo Fisher Scientific Inc; Siemens Healthineers AG; PerkinElmer Inc.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; and bioMerieux SA

Strategic insights for the North America Immunodiagnostic provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 9,188.19 Million |

| Market Size by 2028 | US$ 15,040.40 Million |

| CAGR (2022 - 2028) | 7.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Immunodiagnostic refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Immunodiagnostic Market is valued at US$ 9,188.19 Million in 2021, it is projected to reach US$ 15,040.40 Million by 2028.

As per our report North America Immunodiagnostic Market, the market size is valued at US$ 9,188.19 Million in 2021, projecting it to reach US$ 15,040.40 Million by 2028. This translates to a CAGR of approximately 7.3% during the forecast period.

The North America Immunodiagnostic Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Immunodiagnostic Market report:

The North America Immunodiagnostic Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Immunodiagnostic Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Immunodiagnostic Market value chain can benefit from the information contained in a comprehensive market report.