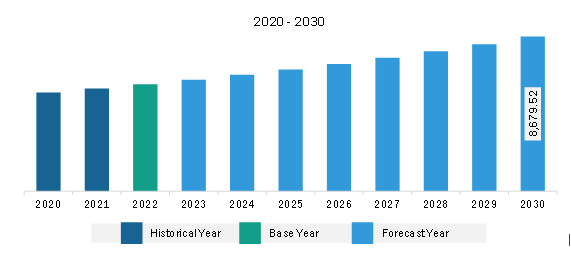

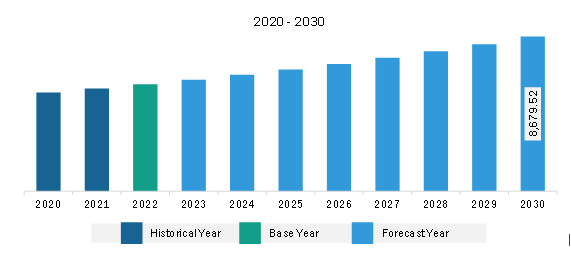

The North America high-speed engine market was valued at US$ 5,996.80 million in 2022 and is expected to reach US$ 8,679.52 million by 2030; it is estimated to register a CAGR of 4.7% from 2022 to 2030.

Increasing Preferences for Alternate Fuel-powered Engines Fuel North America High-Speed Engine Market

The demand for alternative fuel powered engines is growing globally owing to a rising carbon footprint. As per the data published by the International Energy Agency in March 2024, the carbon emissions in 2023 witnessed a growth of 1.1% in emissions compared to 2022, reaching 35 billion metric tonnes of carbon emissions. To overcome this environmental issue, governments of many countries across the globe are taking initiatives to reduce their carbon emissions. There is an increased focus on the development and adoption of alternative fuel powered engines. For instance, the US Department of Energy (DOE) provides grants of up to US$200,000 for the R&D of commercial developments in fuel cell, hydrogen, and biodiesel vehicle technologies and infrastructure for charging electric vehicles (EVs). With the rise in such government initiatives, the need for alternative fuel high-speed engines is also increasing. Hence, many high-speed engine manufacturers started manufacturing alternative fuel-powered engines. For instance, in March 2023, Man Energy Solution received formal approval for the 100% use of biofuel for its MAN 175D high-speed engine. In December 2023, The Department of Energy's Oak Ridge National Laboratory and Caterpillar Inc. signed a research and development agreement (CRADA) to examine using methanol as an alternate fuel source for four-stroke internal combustion marine engines. Thus, owing to the increasing preference for eco-friendly engines, the demand and adoption of alternative fuel-powered engines are projected to grow, which is expected to fuel the high-speed engine market growth in the coming years.

North America High-Speed Engine Market Overview

North America is the second-largest contributor to the high-speed engine market, followed by Europe. The North America high-speed engine market is segmented into the US, Canada, and Mexico. The US accounts for most of the share in the North America high-speed engine market. As the US is one of the top developed economies across the globe, the demand for energy is more compared to other North American countries. According to the data published by the US government in 2022, the energy demand increased by 2.5% from 2021. However, in the coming years, the demand is anticipated to increase by 4.7%, owing to the expansion of the manufacturing industry and a surge in the number of data centers across the country. Moreover, trading activities in Canada are growing significantly; for instance, as per the data published by the Canadian government in 2023, cargo volume carried through the Port of Vancouver increased by 6% in 2023, with terminal operators and supply chain partners handling a record 150.4 million metric ton (MMT) of commerce. The rise in such trading activities has fueled the need for vessels in the country. This increased demand for the vessels is directly affecting the demand for high-speed engines for power generation applications in cargo vessels.

North America High-Speed Engine Market Revenue and Forecast to 2030 (US$ Million)

North America High-Speed Engine Market Segmentation

The North America high-speed engine market is categorized into speed, power output, end user, and country.

Based on speed, the North America high-speed engine market is segmented into 1000-1500, 1500-1800, and above 1800. The 1500-1800 segment held the largest share of North America high-speed engine market share in 2022.

In terms of power output, the North America high-speed engine market is categorized into less than 2 MW, 2-4 MW, and above 4 MW. The less than 2 MW segment held the largest share of North America high-speed engine market in 2022.

By end user, the North America high-speed engine market is divided into marine, power generation, railway, and oil and gas. The marine segment held the largest share of North America high-speed engine market in 2022.

Based on country, the North America high-speed engine market is segmented into the US, Canada, and Mexico. The US dominated the North America high-speed engine market share in 2022.

AB Volvo, Caterpillar Inc, MAN Energy Solutions SE, Mitsubishi Heavy Industries Ltd, Rolls-Royce Holdings Plc, Wartsila Corp, Weichai Heavy Machinery Co Ltd, Yanmar Holdings Co Ltd, and Cummins Inc are some of the leading companies operating in the North America high-speed engine market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 5,996.80 Million |

| Market Size by 2030 | US$ 8,679.52 Million |

| CAGR (2022 - 2030) | 4.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Speed

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America High-Speed Engine Market is valued at US$ 5,996.80 Million in 2022, it is projected to reach US$ 8,679.52 Million by 2030.

As per our report North America High-Speed Engine Market, the market size is valued at US$ 5,996.80 Million in 2022, projecting it to reach US$ 8,679.52 Million by 2030. This translates to a CAGR of approximately 4.7% during the forecast period.

The North America High-Speed Engine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America High-Speed Engine Market report:

The North America High-Speed Engine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America High-Speed Engine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America High-Speed Engine Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)