Governments of various countries are imposing certain regulations to control the emissions of diesel and petrol engines, thus compelling engine manufacturers to opt for alternative fuel solutions such as natural gases. Gas engines release less emissions to generate a sufficient amount of with power high efficiency. The emission monitoring and regulatory bodies from various countries are imposing stringent regulations on the use of diesel engines and generators. To meet these regulatory standards, various industries are deploying gas engine and generators for power generation. Moreover, in December 2020, Rolls-Royce launched MTU Series 500, a new series of gas engines, with a power range of 250–550 kilowatt. The engines are specially designed to meet the emission goals by using hydrogen as a power source, which is offering low fuel costs and low fuel consumption for industrial and utility sectors. Similarly, in June 2020, Kawasaki Heavy Industries, Ltd., a heavy equipment manufacturer, launched a new model KG-18-T gas engine. The company introduced a two-stage turbocharging system with 51% electrical efficiency for power generation. Thus, the rise in such development’s activities owing to stringent regulations related to gas engines is propelling the North America market’s growth.

During the COVID-19 pandemic, approximately 2/3rd of the Americans is forced to work remotely. With businesses started to reopen, several companies are still choosing to opt for the WFH strategy and even to reduce their previous capacity for an extended period, which is expected to have negative impact on the gas engines market growth. Also, COVID-19 pandemic is having a huge impact on natural gas consumption and export of LNG gas in the US market. The slowdown of gas demand is further impacting the growth of the market. Moreover, the loss in revenues is expected to restrain several power plants to invest in new gas engines procurement as they are cutting their budgets to moderate the losses.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the gas engine market. The North America gas engine market is expected to grow at a good CAGR during the forecast period.

Strategic insights for the North America Gas Engine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

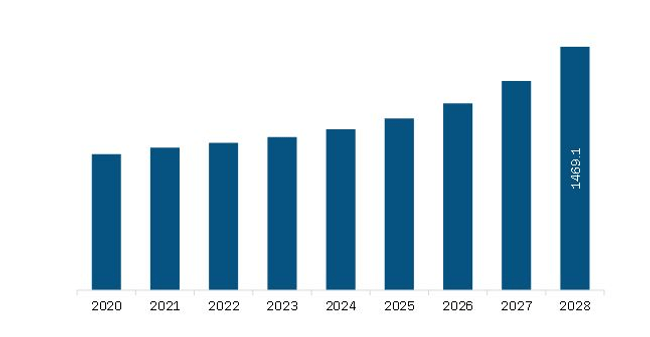

| Market size in 2021 | US$ 861.3 Million |

| Market Size by 2028 | US$ 1,469.1 Million |

| CAGR (2021 - 2028) | 7.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Fuel Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Gas Engine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America Gas Engine Market is valued at US$ 861.3 Million in 2021, it is projected to reach US$ 1,469.1 Million by 2028.

As per our report North America Gas Engine Market, the market size is valued at US$ 861.3 Million in 2021, projecting it to reach US$ 1,469.1 Million by 2028. This translates to a CAGR of approximately 7.9% during the forecast period.

The North America Gas Engine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Gas Engine Market report:

The North America Gas Engine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Gas Engine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Gas Engine Market value chain can benefit from the information contained in a comprehensive market report.