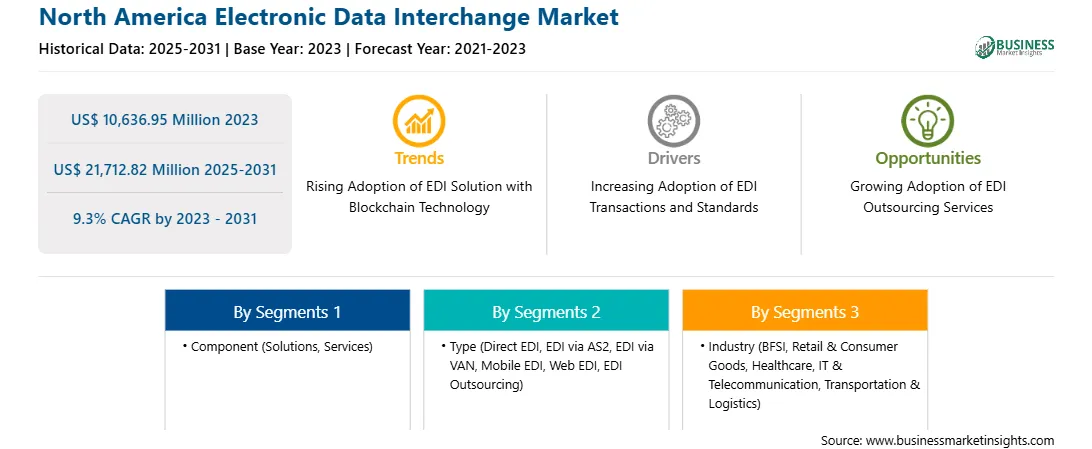

The North America electronic data interchange market was valued at US$ 10,636.95 million in 2023 and is expected to reach US$ 21,712.82 million by 2031; it is estimated to register a CAGR of 9.3% from 2023 to 2031.

An electronic data interchange (EDI) document comprises minimum vital data to ensure smooth EDI transactions. The organizations are required to adhere to stringent EDI formatting rules as this helps retrieve the document's relevant information. The EDI document consists of several transaction numbers from the EDI public format. For example, the purchase order (PO) is assigned to the invoice transaction number 810 and the EDI transaction number 850. Thus, the EDI translator obtains an EDI 850 PO document that easily recognizes the order number, items in the order, the company name of the buyer, and the price per item. An efficient EDI transaction enhances the overall data exchange process with seamless automation of B2B workflows and effective integration of the external and internal systems, cloud ecosystems, and applications. Many governments are authorizing the adoption of EDI solutions in specific countries for receiving and sending data from organizations to trading partners. EDI solution providers offer various solutions with benefits such as compliance features to tackle the complex country regulations and guard against any risk associated with the regulatory compliances that affect "procure to pay" and "order to cash" business processes. The EDI standard formats of a document on which the data interchange depends are managed and efficiently interpreted by computers so that both parties can easily understand it.

Every country has a different set of regulations, and companies are required to stay updated to avoid penalties or fines (also known as chargebacks). Therefore, the implementation of such compliances by the organizations further drives the market. Various providers are developing EDI systems to deliver a more robust and user-friendly experience. For instance, in July 2023, Jitterbit, Inc. launched its self-managed, cloud-based EDI solution fully integrated into the Jitterbit Harmony platform. With Harmony EDI, users can fully self-serve and self-manage EDI processes. Data is automatically transferred between trading partners (i.e., Amazon.com, Inc., Home Depot, Inc., Lowe's, and Walmart Inc.) and merchants into the merchant's Enterprise resource planning (ERP), Customer relationship management (CRM), and shipping systems. Harmony EDI system helps to streamline processes and automate workflows, eliminating the manual processing and approvals of EDI transactions and ensuring the accuracy of information being transmitted between systems. Such developments propel the adoption of the EDI system to automate the workflow process.

The US, Canada, and Mexico are major economies in North America. The US is a developed country in terms of modern technology and developed IT infrastructure. Technological advancements have led to highly competitive markets across North America. The region hosts several technological giants that invest significant amounts in developing robust technologies. The US has clearly passed the phase of early adoption of EDI solutions. With continuous increases in data transactions in B2C, B2B, and more, many organizations and their partners are projected to report business growth in the future. Huge numbers of enterprises are showing interest in EDI solutions to interchange their data accurately, efficiently, and safely. The US has several service providers offering automated EDI solutions. The country’s organizations and government are showing interest in opting and promoting EDI solutions. The adoption of EDI solutions has resulted in increased efficiency and cost savings throughout the US government, which motivates other organizations to follow the same. EDI implementation is rising in the region at a sustainable pace due to emerging technologies and rising investments in on-the-cloud systems by organizations. The growing spending on adoption of cloud services in North America and the presence of potential opportunities across next-generation IT technology in the healthcare and BFSI sectors propel the EDI market growth. The demand for EDI services is rising in the healthcare sector due to the emerging trend of outsourcing activities, including claims handling and management, revenue cycle management, and partner management services. The region has a developed healthcare infrastructure, favorable regulatory scenarios, and broad insurance coverage. It also reports rising demand for healthcare supply chain management solutions, the growing number of private healthcare market players, and the presence of well-known healthcare IT companies. In North America, various electronic data interchange (EDI) service providers are launching their platforms for the healthcare industry. In September 2022, Prodigo Solutions, Inc launched its next-generation EDI platform for the healthcare industry to improve the processing time between trading partners. Healthcare clients of Prodigo Solutions, Inc. continue to use EDI as a key enabler of their supply chain modernization activities to increase vendor community penetration and automate transactions. In February 2018, Global Healthcare Exchange, LLC launched a new GHX EDI Mapping solution for healthcare suppliers to reduce costs and increase e-commerce connections to trading partners without adding internal EDI resources. The GHX EDI Mapping provides a cloud-based platform to translate supply chain trading partner transactional information into ERP-specific formats. New product launches are driving the adoption of electronic data interchange services in the healthcare industry in North America.

Strategic insights for the North America Electronic Data Interchange provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10,636.95 Million |

| Market Size by 2031 | US$ 21,712.82 Million |

| CAGR (2023 - 2031) | 9.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Electronic Data Interchange refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The North America electronic data interchange market is categorized into component, type, industry, and country.

Based on component, the North America electronic data interchange market is bifurcated into solutions and services. The solutions segment held a larger market share in 2023.

In terms of type, the North America electronic data interchange market is categorized into direct EDI, EDI via AS2, EDI via VAN, mobile EDI, web EDI, EDI outsourcing, and others. The EDI via AS2 segment held the largest market share in 2023.

By industry, the North America electronic data interchange market is segmented into BFSI, retail & consumer goods, healthcare, IT & telecommunication, transportation & logistics, and others. The retail & consumer goods segment held the largest market share in 2023.

By country, the North America electronic data interchange market is segmented into the US, Canada, and Mexico. The US dominated the North America electronic data interchange market share in 2023.

MuleSoft, LLC; Optum Inc; SPS Commerce Inc; TrueCommerce Inc; Cerner Corp; International Business Machines Corp; Boomi, Inc; GoAnywhere MFT; Cleo; The Descartes Systems Group Inc; Crossinx GmbH; EDICOM; Comarch SA; and InterTrade Systems, Inc. are some of the leading companies operating in the North America electronic data interchange market.

The North America Electronic Data Interchange Market is valued at US$ 10,636.95 Million in 2023, it is projected to reach US$ 21,712.82 Million by 2031.

As per our report North America Electronic Data Interchange Market, the market size is valued at US$ 10,636.95 Million in 2023, projecting it to reach US$ 21,712.82 Million by 2031. This translates to a CAGR of approximately 9.3% during the forecast period.

The North America Electronic Data Interchange Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Electronic Data Interchange Market report:

The North America Electronic Data Interchange Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Electronic Data Interchange Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Electronic Data Interchange Market value chain can benefit from the information contained in a comprehensive market report.