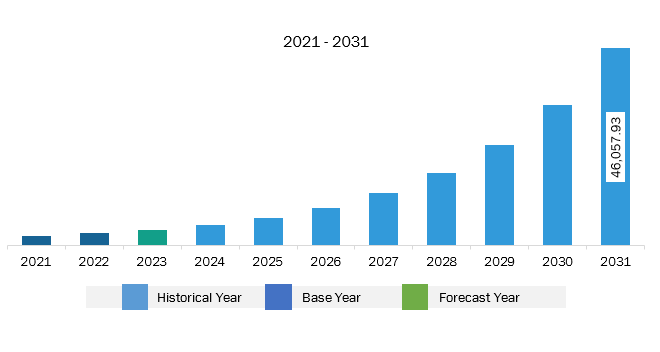

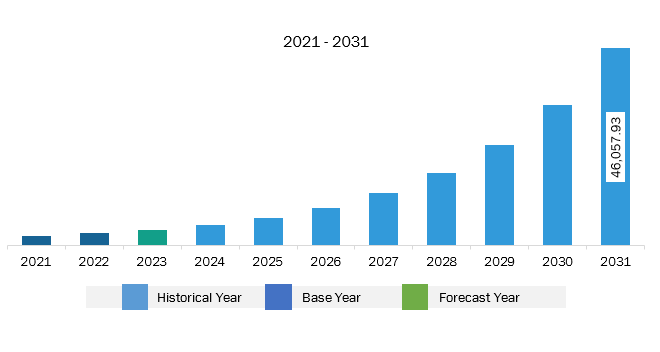

The North America digital twin market was valued at US$ 3,651.00 million in 2023 and is expected to reach US$ 46,057.93 million by 2031; it is estimated to register a CAGR of 37.3% from 2023 to 2031.

Integration of AI, AR, VR, and Other Advanced Technologies Fuels North America Digital Twin Market

Digital twins are the accurate replica build of a system, product, process, or gadget to use it for development, testing, and validation purposes. Monitoring machinery and plant environments in the physical and virtual worlds is a crucial aspect for businesses in sectors such as manufacturing, transportation, and energy, wherein large machinery and other equipment are at the core of operations. Integrating these tangible assets with IT applications and infrastructure is necessary to boost productivity, enhance customer support, and generate crucial business insights that offer businesses a competitive edge. Hence, businesses might benefit from digital twins, AR, and VR to automate and modernize their operations in line with Industry 4.0. Integrating technologies such as AI, machine learning, VR, and AR with digital twins enhances the decision-making capabilities of users and businesses. Virtual reality and augmented reality enable a more immersive experience, allowing users to interact with virtual models and thoroughly analyze all aspects related to them. Artificial intelligence and machine learning provide meaningful insights into the data generated from these simulations. This enables better decision-making while designing, developing, and optimizing complex industrial systems. For instance, Unilever has generated an AI-powered digital twin for approximately 300 plants to monitor their manufacturing closely, implement real-time changes, increase productivity, reallocate materials and reduce waste. Thus, the integration of advanced technologies such as AI, AR, and VR is expected to emerge as a significant digital twin market trend in the coming years.

North America Digital Twin Market Overview

The North America digital twin market is segmented into the US, Canada, and Mexico. In terms of revenue, North America dominated the North America digital twin market share in 2023. North America is one of the fastest-growing regions in terms of technological innovations and adoption of advanced technologies. The region has witnessed huge adoptions of technologies such as machine learning (ML), artificial intelligence (AI), and blockchain in the past three years across all the major industry verticals. With the rising penetration of digitization in various industries, the digital twin has become a vital component of business. In addition, the region is home to a majority of key market players such as IBM Corporation; Oracle; Microsoft; ANSYS, Inc; and PTC, leading to the North America digital twin market growth.

Moreover, North America is focused on introducing digital twin technology for the semiconductor industry. The government authorities are investing in fostering the semiconductor industry. In May 2024, the Biden-Harris Administration issued a Notice of Funding Opportunity (NOFO) seeking proposals from eligible applicants for activities to establish and operate a CHIPS Manufacturing USA institute focused on digital twins for the semiconductor industry. Digital twins are virtual models that mimic the structure, context, and behavior of a physical counterpart. The CHIPS for America Program anticipates ?US$ 285 million for a first-of-its-kind institute focused on the development, validation, and use of digital twins for semiconductor manufacturing, advanced packaging, assembly, and test processes. The CHIPS Manufacturing USA Institute is the first Manufacturing USA institute launched by the Department of Commerce under the Biden Administration.

The North America digital twin market players are expanding their businesses in North America, which is contributing to the regional market growth. In April 2024, Datech, the specialist design software business of TD SYNNEX, and Unity, the platform of tools for creators to build and grow real-time apps, games, and experiences across multiple platforms, announced an agreement for Datech to offer Unity Pro and Unity Industry across North America and Europe, alongside its existing Unity offering in Asia Pacific and Japan. Unity is used to create dynamic digital twins, resulting in highly realistic models of products and constructions for simulation and testing. The result helps accelerate business decision-making, forecasting, and experimentation.

North America Digital Twin Market Segmentation

The North America digital twin market is categorized into type, enterprise size, end user and country.

Based on type, the North America digital twin market is segmented into asset twin, system twins process twin, and parts/component twin. The asset twins segment held the largest share of the North America digital twin market share in 2023.

In terms of enterprise size, the North America digital twin market is bifurcated into large enterprises & SMES. The large enterprises segment held a larger share of the North America digital twin market in 2023.

Based on end user, the North America digital twin market is categorized into manufacturing, automotive, aerospace & defense, healthcare, retail, and others. The manufacturing segment held the largest share of North America digital twin market in 2023.

By country, the North America digital twin market is segmented into the US, Canada, and Mexico. The US dominated the North America digital twin market share in 2023.

General Electric Co; Microsoft Corp; Siemens AG; Dassault Systemes SE; PTC Inc.; Robert Bosch GmbH; International Business Machines Corp; Oracle Corp; Ansys, Inc.; Autodesk, Inc. are the among leading companies operating in the North America digital twin market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3,651.00 Million |

| Market Size by 2031 | US$ 46,057.93 Million |

| CAGR (2023 - 2031) | 37.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Digital Twin Market is valued at US$ 3,651.00 Million in 2023, it is projected to reach US$ 46,057.93 Million by 2031.

As per our report North America Digital Twin Market, the market size is valued at US$ 3,651.00 Million in 2023, projecting it to reach US$ 46,057.93 Million by 2031. This translates to a CAGR of approximately 37.3% during the forecast period.

The North America Digital Twin Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Digital Twin Market report:

The North America Digital Twin Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Digital Twin Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Digital Twin Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)