The modern powertrains of hybrid or full-battery electric vehicles operate at high acceleration and deceleration, thus requiring bearing with high-speed capabilities. The rising demand for such durable and lightweight bearings from the automotive industry is encouraging bearing manufacturers to invest in research and development to explore the use of new raw materials in the production process. Moreover, they focus on the development of specialized custom bearings to meet the evolving needs of the electric vehicle industry. They are also investing in the development of efficient and technologically smart bearings that can monitor and communicate operating conditions such as speed, temperature, and overall bearing condition, among others. These abilities would enable end-use industries to regulate the lifecycle of components, thereby enhancing reliability and machinery uptime, and reducing maintenance costs. Bearing manufacturers utilize new raw materials such as through hardening bearing steel, high carbon–chromium alloy steel, and high-carbon bearing steel for offering bearings that support lightweight applications, increase power density, and improve the fuel efficiency of final products. In 2022, Schaeffler Technologies AG & Co KG launched two innovative bearing solutions—TriFinity triple-row wheel bearing and the high-efficiency ball bearing with centrifugal disc—for the electric vehicle market. Smart bearing technology has a huge demand in robotic control processes in the paper & print, wood processing, chemical manufacturing, textile, agriculture, and food processing industries, among others. In 2022, NTN Corporation launched sensor-integrated bearings that can be incorporated into sensor systems, power generation units, and wireless devices for industrial applications. Thus, the development of smart and efficient bearings for advanced automotive and industrial applications propels the demand for bearing steel.

North America offers an extensive growth opportunity for the North America bearing steel market players due to the growing utilization of bearing steel by its end use industries, including automotive, construction, aerospace, and electronics. Bearing steel is utilized for bearing applications in wheels, electric motors, steering columns, driveshafts, engines, and automotive transmission systems of automobiles. According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2021, North America registered a production of 13.42 million vehicles. Bearing steel is used in the automotive industry for enhancing vehicle performance and efficiency, thus reducing shocks and vibrations caused by sudden brakes. Moreover, the construction sector in North America is witnessing growth due to increased federal and state financing for the construction of commercial and institutional structures. According to a report by the US Census Bureau, the total construction (private and public) investment in 2022 was US$ 1,792.9 billion, a 10.2% increase from investments in 2021. Thus, the growth of the construction sector is expected to fuel the North America bearing steel market during the forecast period.

Strategic insights for the North America Bearing Steel provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Bearing Steel refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Bearing Steel Strategic Insights

North America Bearing Steel Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,175.89 Million

Market Size by 2028

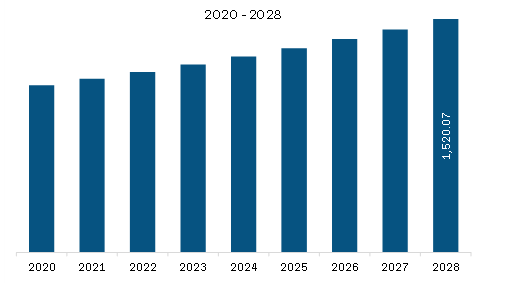

US$ 1,520.07 Million

CAGR (2022 - 2028) 4.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Type

By End Use

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Bearing Steel Regional Insights

The North America bearing steel market is segmented into type, end use, and country.

Based on type, the North America bearing steel market is segmented into carbon steel, stainless steel, and others. In 2022, the carbon steel segment registered a largest share in the North America bearing steel market.

Based on end use, the North America bearing steel market is segmented into energy and power, industrial machinery, automotive, electrical and electronics, aerospace, and others. In 2022, the automotive segment registered a largest share in the North America bearing steel market.

Based on country, the North America bearing steel market is segmented into the US, Canada, Mexico. In 2022, the US segment registered a largest share in the North America bearing steel market.

Baosteel Group Corp; Benxi Iron and Steel Group Co Ltd; Dongbei Special Steel Group Co Ltd; EZM Edelstahlzieherei Mark GmbH; Fushun Special Steel Co Ltd; HBIS Group Co Ltd; Kobe Steel Ltd; Ovako AB; Saarstahl AG; and Sanyo Special Steel Co Ltd are the leading companies operating in the North America bearing steel market.

The North America Bearing Steel Market is valued at US$ 1,175.89 Million in 2022, it is projected to reach US$ 1,520.07 Million by 2028.

As per our report North America Bearing Steel Market, the market size is valued at US$ 1,175.89 Million in 2022, projecting it to reach US$ 1,520.07 Million by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The North America Bearing Steel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Bearing Steel Market report:

The North America Bearing Steel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Bearing Steel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Bearing Steel Market value chain can benefit from the information contained in a comprehensive market report.