Improving power distribution architecture and rising electrification of vehicles across the globe are fueling the market growth. However, a continuous decline in vehicle production volume is expected to restrict the market growth during the forecast period.

The automotive industry is growing with the advancements in electronics and electrical systems of vehicles. The advent of connected cars, electric cars, and hybrid cars is accelerating the automotive industry's growth due to enhanced features in these vehicles. Automobile companies are offering maximum features for the customers to enhance their driving experience. The numerous developments in vehicles have increased vehicles' electrical systems' count as more connected technologies are integrated into vehicles. There is an increase in the importance of automotive electrical connectors as they form an efficient connection for power transmission. Electrical connectors such as busbars and fuse boxes play a vital role in the automotive industry.

To distribute power effectively, specifically in electric vehicles, the demand for high voltage busbars is rising, which is driving the market. For instance, in March 2020, Royal Power Solutions, a supplier of automotive components, introduced a new connector and conductor product for electric vehicles and hybrid vehicles. The company introduced a new High-Power Lock Box (HPLB) connector and RigiFlex busbar with integrated HPLB terminals. Similarly, in March 2021, Furukawa Electric Co., Ltd started to deliver high-voltage power distribution component modules, such as busbars, for Toyota MIRAI and other hydrogen fuel cell vehicles. The increasing electrification in vehicles creates a need for advanced connectors such as high voltage busbars and fuse boxes, which is driving the market.

The US is the most affected country in North America due to the COVID-19 outbreak. The growing number of infections has led the government to impose various containment measures such as factory shutdowns, travel restrictions, closure of international borders, and lockdowns. The massive increase in the number of confirmed cases and rise in reported deaths in the country has affected both manufacturing and sales of materials associated with automotive electrical connectors.

The automotive original equipment manufacturers (OEMs) and the players within the electronic vehicle industry are the ones among the hardest hit due to the pandemic. COVID-19 is likely to pose a lasting impact on mobility as it has led to a dramatic change in consumer behaviors, macroeconomic environment, and regulatory changes. The market witnessed a downfall at the beginning of the pandemic; however, with the increased recovery of patients and slowdown in the exponential growth of the COVID-infected patients, the scenario started to improve and witness an uptrend in the case of the electric vehicle industry as well.

The region is expecting market recovery and economic improvement with the start of the COVID-19 vaccination. However, companies' risk remains with the market uncertainties from a tough business environment associated with the unfavorable foreign exchange rate, raw material price, and logistics cost.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 199.48 Million |

| Market Size by 2028 | US$ 328.56 Million |

| CAGR (2021 - 2028) | 7.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

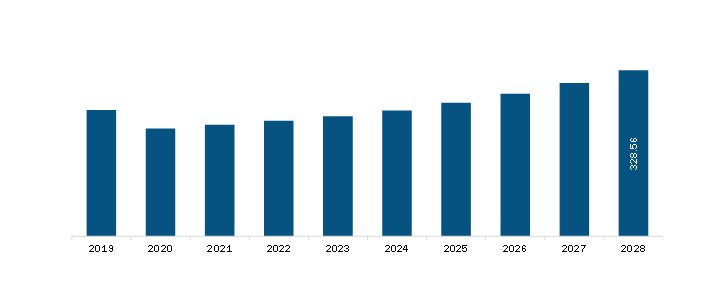

The North America Automotive Electrical Connector Market is valued at US$ 199.48 Million in 2021, it is projected to reach US$ 328.56 Million by 2028.

As per our report North America Automotive Electrical Connector Market, the market size is valued at US$ 199.48 Million in 2021, projecting it to reach US$ 328.56 Million by 2028. This translates to a CAGR of approximately 7.4% during the forecast period.

The North America Automotive Electrical Connector Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Automotive Electrical Connector Market report:

The North America Automotive Electrical Connector Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Automotive Electrical Connector Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Automotive Electrical Connector Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)