North America Anti-Money Laundering Solution Market

No. of Pages: 156 | Report Code: TIPRE00018131 | Category: Technology, Media and Telecommunications

No. of Pages: 156 | Report Code: TIPRE00018131 | Category: Technology, Media and Telecommunications

An anti-money laundering (AML) solution is deployed to meet the financial institutions' legal requirements for preventing and reporting the activities of money laundering. Increasing online transactions and rising concerns regarding fraudulent transactions have steered the adoption of anti-money laundering solutions across North America. Further, supportive government regulations supplement the growth of the North America anti-money laundering solution market to a significant extent. North America comprises some of the significant associations responsible for designing and implementing the anti-money laundering regulations. For instance, the Financial Action Task Force (FTAF) is an intergovernmental organization in the region that creates international policies for battling money laundering. The US, Canada, and Mexico are members of the FTAF. In addition, SAS Institute is a significant AML provider in the region. The factors, including increasing developments in the FinTech sector and rising government initiatives, fuel the demand for anti-money laundering solutions for North America. Further, rising adoption of crypto-currency is expected to supplement the need for anti-money laundering solutions across the North America.

Furthermore, in case of COVID-19, North America is highly affected specially the US. North America is one of the most important regions for adopting and developing new technologies due to favorable government policies to boost innovation, a huge industrial base, and high purchasing power, especially in developed countries such as the US and Canada. Hence, any impact on the growth of industries is expected to affect the economic growth of the region negatively. The US is a prominent market for anti-money laundering solutions. Criminals in the region have been exploiting the disturbance created by the global pandemic to gain profits from numerous crimes such as fraud via electronic means, the sale of counterfeit products, and cybercrime. In order to prevent such threats, communities engaged in action against money laundering are taking measures to identify challenges. International cooperation against terrorist financing and money laundering does not appear to be negatively impacted by the global pandemic.

Strategic insights for the North America Anti-Money Laundering Solution provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 550.25 Million |

| Market Size by 2027 | US$ 1,897.82 Million |

| CAGR (2020 - 2027) | 14.6 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Anti-Money Laundering Solution refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

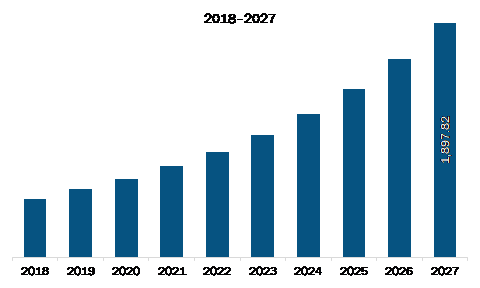

The North America anti-money laundering solution market is expected to grow from US$ 550.25 million in 2019 to US$ 1,897.82 million by 2027; it is estimated to grow at a CAGR of 14.6 % from 2020 to 2027. Rising focus on limiting risks related to digital payment methods is expected to upsurge the North America anti-money laundering solution market. Several countries in North America are witnessing high growth in digitalization in the banking sector. Government initiatives for digitalization have increased the importance of digital payments among consumers. This factor has resulted in the emergence of several digital payment wallets giving tough competition to the banks. Presently, financial technology enables consumers to make transactions through various platforms, such as laptops and mobile devices. The ability to perform financial transactions on laptops and mobile devices is so unified that consumers take it for granted. However, the growing digital payments services is surging new risks in the financial system. In the past years, banks traditionally performed financial assessing of their direct customers and their transactions and payments. With the emergence of digital payments, intermediaries are the link between the bank and the end client, leaving banks vulnerable to customer malfeasance. At present, in North America, the regulatory focus is centered on limiting money-laundering risks related to digital payment methods, such as e-payments and mobile wallets. Further, the top priority is being given to combat cybercrime and limit potential money-laundering risks. Regulators are focused on financial crime and cybersecurity risks in digital payments. Thus, the huge focus of financial institutions on limiting the digital payment issues is anticipated to propel the North America anti-money laundering solution market.

In terms of component, the software segment accounted for the largest share of the North America anti-money laundering solution market in 2019. In terms of deployment type, the on-premises segment held a larger market share of the North America anti-money laundering solution market in 2019. Similarly, in terms of product, the transaction monitoring segment held a larger market share of the North America anti-money laundering solution market in 2019. Further, the BFSI segment held a larger share of the North America anti-money laundering solution market based on industry in 2019.

A few major primary and secondary sources referred to for preparing this report on the North America anti-money laundering solution market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Accenture; ACI WORLDWIDE, INC.; BAE Systems plc; EastNets.com; LexisNexis Risk Solutions Group; Nasdaq Inc.; NICE Ltd.; Open Text Corporation; Oracle Corporation; SAS Institute Inc.

Some of the leading companies are:

The North America Anti-Money Laundering Solution Market is valued at US$ 550.25 Million in 2019, it is projected to reach US$ 1,897.82 Million by 2027.

As per our report North America Anti-Money Laundering Solution Market, the market size is valued at US$ 550.25 Million in 2019, projecting it to reach US$ 1,897.82 Million by 2027. This translates to a CAGR of approximately 14.6 % during the forecast period.

The North America Anti-Money Laundering Solution Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Anti-Money Laundering Solution Market report:

The North America Anti-Money Laundering Solution Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Anti-Money Laundering Solution Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Anti-Money Laundering Solution Market value chain can benefit from the information contained in a comprehensive market report.