The North America aircraft video surveillance market is displaying an upward trend for the past couple of years and it is anticipated to reflect a similar trend during the forecast period. The growth of the aircraft video surveillance market is majorly attributed to significant investments in the aerospace industry. Over the past few decades, the aviation industry has grown immensely. The growth rate of technological transformation has been outstanding, which stimulated the demand for various products and services. There is an increased adoption of aircraft video surveillance solutions in commercial aircraft owing to rise in demand for in-flight safety and security systems. Increasing number of complaints against airlines and improving regulatory standards of safety have highlighted the importance of aircraft video surveillance solutions. To improve the security level, airline companies are installing cockpit door surveillance systems to restrict unauthorized access to the cockpit area. Cabin surveillance systems are also gaining considerable growth in the market, as aircraft operators are demanding video surveillance solutions to monitor suspicious activities outside the cockpit area. Further, advancements in aircraft environmental camera systems, to offer detailed information about traffic, weather, and terrain, are supporting the market growth.

The presence of a large number of well-established players and emerging companies in the North America aircraft video surveillance market is supporting the uprising demand from airline companies. Constant development and continuous upgrade of aircraft video surveillance systems and demand for retrofit video surveillance solutions for the existing fleet are playing a vital role in driving the aircraft video surveillance market.

The North America aircraft video surveillance market is analyzed based on countries in North America. The aerospace industry in North America is matured and is growing at a significant rate due to the presence of a large number of aircraft manufacturers, advanced video surveillance solution providers, and a skilled workforce. There is a tremendous demand for video surveillance systems in the region as aircraft manufacturing companies are well aware of newer technologies. For instance, Airbus is offering advanced security and surveillance system in its A320, A330, A350, and A380 series aircraft models. The video surveillance solutions facilitate the aircraft crew to secure the flight deck and also to maintain high safety standards on-board.

On the other hand, the North America is anticipated to be the fastest-growing region during the forecast period. Increasing number of aircraft fleet in commercial sectors are expected to drive the market in the region. Countries

The COVID-19 pandemic has severely affected the growth of the North America aircraft video surveillance market, specifically in the wide body aircraft segment. The commercial sector experienced a major setback as domestic as well as international flights were put on hold for a certain period. The airline companies postponed or cancelled the new fleet expansion plans owing to a major economic impact. Hence, the demand for new aircraft is reduced, which directly affected the procurement of aircraft video surveillance solutions.

Strategic insights for the North America Aircraft Video Surveillance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

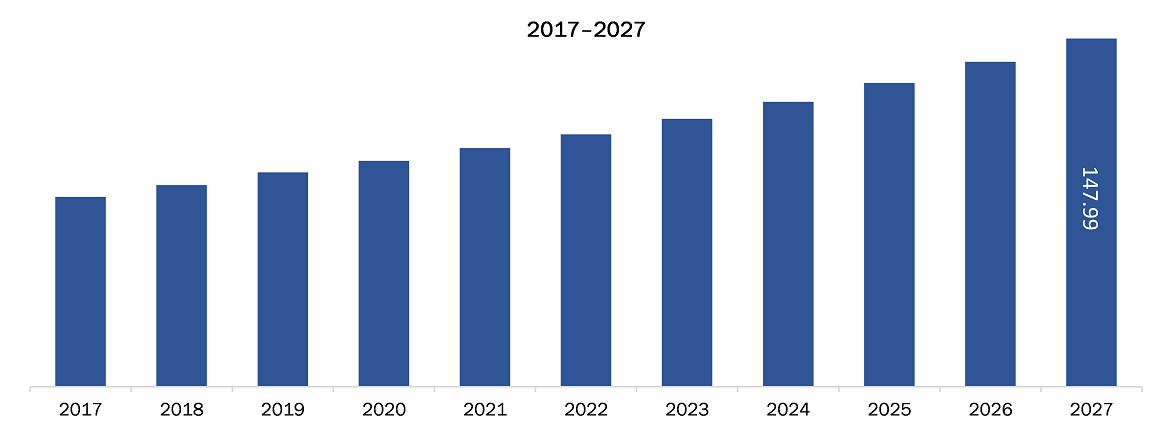

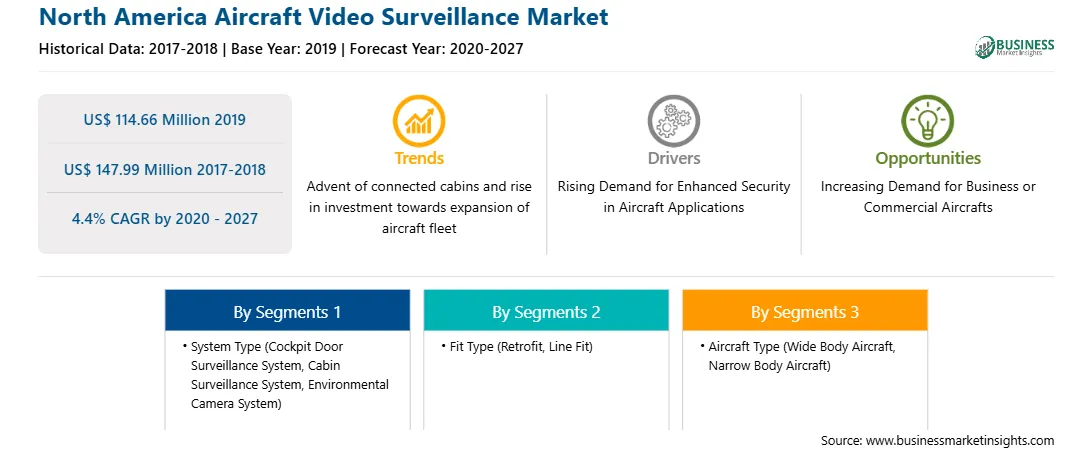

| Market size in 2019 | US$ 114.66 Million |

| Market Size by 2027 | US$ 147.99 Million |

| Global CAGR (2020 - 2027) | 4.4% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By System Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

The geographic scope of the North America Aircraft Video Surveillance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Aircraft Video Surveillance market in North America is expected to grow from US$ 114.66 Mn in 2019 to US$ 147.99 Mn by 2027; it is estimated to grow at a CAGR of 4.4% from 2020 to 2027. The Increasing Demand for Enhanced Security in Aircraft in developed countries has led to increase in the adoption Aircraft Video Surveillance. Countries with high GDP—the US among others—are vigorously carrying out large-scale industrialization and infrastructure developments

Moreover, Accentuating Volumes of Aircraft Order and Delivery are further expected to bolster the market growth.

The market for Aircraft Video Surveillance market is segmented into system type, fit type, aircraft type and country. Based on system type, the market is segmented into Cockpit Door Surveillance Systems, Cabin surveillance systems, environmental cameras system. In 2019, the Cockpit Door Surveillance Systems held the largest share North America Aircraft Video Surveillance market. Based on fit type the Aircraft Video Surveillance market is divided into Retrofit, Line-fit. Similarly, based on aircraft type, the market is bifurcated into wide body aircraft, narrow-body aircraft. The narrow-body aircraft segment contributed a substantial share in 2019

A few major primary and secondary sources referred to for preparing this report on the North America Aircraft Video Surveillance Market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AD Aerospace Ltd.

N

The North America Aircraft Video Surveillance Market is valued at US$ 114.66 Million in 2019, it is projected to reach US$ 147.99 Million by 2027.

As per our report North America Aircraft Video Surveillance Market, the market size is valued at US$ 114.66 Million in 2019, projecting it to reach US$ 147.99 Million by 2027. This translates to a CAGR of approximately 4.4% during the forecast period.

The North America Aircraft Video Surveillance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Video Surveillance Market report:

The North America Aircraft Video Surveillance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Video Surveillance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Video Surveillance Market value chain can benefit from the information contained in a comprehensive market report.