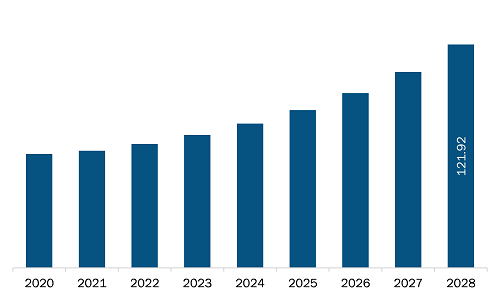

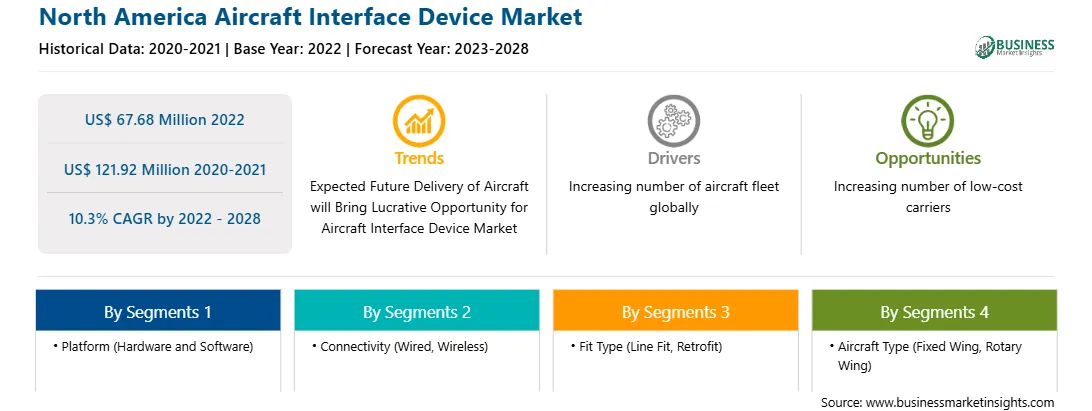

The North America aircraft interface device market is expected to grow from US$ 67.68 million in 2022 to US$ 121.92 million by 2028. It is estimated to grow at a CAGR of 10.3% from 2022 to 2028.

Increasing Number of Aircraft Fleet Regionally Fuel North America Aircraft Interface Device Market

There has been significant growth in the commercial aviation industry in the past decade. The airlines in the developed and developing nations are ordering a high number of aircraft to meet the constantly rising air travel demand. Owing to the continuously growing disposable income among the global population, the need for air travel is also increasing rapidly. Commercial air traffic is anticipated to maintain a constant growth rate, despite various challenges, such as rising aviation fuel costs and technical faults causing accidents. However, these challenges are overcome by the increasing number of passengers, which leads to more aircraft across the region. There has been significant growth in the commercial aviation industry in the past decade. The airlines in the developed and developing nations are ordering a high number of aircraft to meet the constantly rising air travel demand. Owing to the continuously growing disposable income among the global population, the need for air travel is also increasing rapidly. Commercial air traffic is anticipated to maintain a constant growth rate, despite various challenges, such as rising aviation fuel costs and technical faults causing accidents. However, these challenges are overcome by the increasing number of passengers, which leads to more aircraft across the region.

North America Aircraft Interface Device Market Overview

North America comprises the US, Canada, and Mexico. North America has a developed aviation market and industry. The aircraft manufacturers across the region are focusing on the development and the adoption of smart and advanced technologies for the efficient performance of the aircraft. The integration of aircraft interface devices has gained significant popularity in North America. The aircraft manufacturers witnessed substantial demand for line fitting of aircraft interface devices (AIDs) due to the rising concerns among the airlines and the US government. This factor has led the country to experience remarkable growth in the adoption of AIDs over the years. The continuously rising number of new commercial aircraft in the US has increased demand and the number of aircraft interface devices. For instance, according to the Boeing commercial market outlook, 10,835 aircraft fleet will be delivered in North America by 2040. Thus, the rise in investment in aircraft development and its procurement influenced the growth of the maintenance, repair and operations (MRO) services market across the region. The rise in MRO services providers is expected to increase the demand for retrofitting aircraft interface devices, which is expected to contribute to the North American aircraft interface device market over the years.

North America Aircraft Interface Device Market Revenue and Forecast to 2028 (US$ Million)

Strategic insights for the North America Aircraft Interface Device provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Aircraft Interface Device refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Aircraft Interface Device Strategic Insights

North America Aircraft Interface Device Report Scope

Report Attribute

Details

Market size in 2022

US$ 67.68 Million

Market Size by 2028

US$ 121.92 Million

CAGR (2022 - 2028) 10.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Platform

By Connectivity

By Fit Type

By Aircraft Type

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Aircraft Interface Device Regional Insights

North America Aircraft Interface Device Market Segmentation

The North America aircraft interface device market is segmented into platform, connectivity, fit type, aircraft type and country.

Based on platform, the North America aircraft interface device market is segmented into hardware and software. The hardware segment held a larger share of the North America aircraft interface device market in 2022.

Based on connectivity, the North America aircraft interface device market is segmented into wired and wireless. The wired segment held a larger share of the North America aircraft interface device market in 2022.

Based on fit type, the North America aircraft interface device market is segmented into line fit and retrofit. The line fit segment held a larger share of the North America aircraft interface device market in 2022.

Based on aircraft type, the North America aircraft interface device market is segmented into fixed wing and rotary wing. The fixed wing segment held a larger share of the North America aircraft interface device market in 2022.

Based on country, the North America aircraft interface device market is segmented into the US, Canada, and Mexico. The US dominated the share of the North America aircraft interface device market in 2022.

Anuvu; Astronics Corporation; Boeing; Carlisle Companies Incorporated; Collins Aerospace; Honeywell International Inc.; Teledyne Controls LLC; Thales Group; Viasat, Inc.; and SCI Technology, Inc. are the leading companies operating in the North America aircraft interface device market.

The North America Aircraft Interface Device Market is valued at US$ 67.68 Million in 2022, it is projected to reach US$ 121.92 Million by 2028.

As per our report North America Aircraft Interface Device Market, the market size is valued at US$ 67.68 Million in 2022, projecting it to reach US$ 121.92 Million by 2028. This translates to a CAGR of approximately 10.3% during the forecast period.

The North America Aircraft Interface Device Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Aircraft Interface Device Market report:

The North America Aircraft Interface Device Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Aircraft Interface Device Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Aircraft Interface Device Market value chain can benefit from the information contained in a comprehensive market report.