Middle East & Africa Well Completion Equipment and Services Market

No. of Pages: 111 | Report Code: TIPRE00026083 | Category: Manufacturing and Construction

No. of Pages: 111 | Report Code: TIPRE00026083 | Category: Manufacturing and Construction

Saudi Arabia, South Africa, and the UAE are among the key countries in the Middle East & Africa. Saudi Arabia, Iraq, the UAE, Iran, and Kuwait are the top 5 oil producers in the Middle East, and the countries contribute ~27% to the global production of oil. In 2019, Kuwait signed an offshore exploration contract, worth USD 600 million, with Halliburton to drill six high-pressure, high-temperature exploration wells in the next 2–3 years. The Middle East is characterized by the presence of huge oil & gas resources; of these, many need to be explored, which explains extensive opportunities for the drilling service providers. In 2018, Qatar Petroleum (QP) signed a contract for procuring eight jack-ups for drilling and well completion of 80 wells at its offshore North Field expansion project. As estimated by Baker Hughes Company, the offshore rig count in the Middle East is ~44 units, and this may increase during the forecast period due to investments being made in the region. Additionally, the Kingdom of Saudi Arabia (KSA) has maintained high crude oil production levels despite a drop in global crude oil prices. These factors are contributing to the growth of well completion market in the Middle East.

According to the International Energy Agency, the prolonged COVID-19 issue is causing the biggest decrease in the Middle East & Africa energy investment in the history. The lockdown caused supply chain interruptions, personnel shortages, and project finance challenges, all of which have impacted energy projects. Countries in the Middle East and others rely heavily on China, which generates more than half of the world's oil and gas technologies. The bulk of important manufacturers of well completion technology are based in China. As a result of the crisis, the global supply chain network, including oil and gas, has been badly affected. As a result, the COVID-19 pandemic limits the demand development of well completion equipment and services in the Middle East & Africa.

Strategic insights for the Middle East & Africa Well Completion Equipment and Services provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2,153.16 Million |

| Market Size by 2028 | US$ 2,914.18 Million |

| CAGR (2021 - 2028) | 4.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Offerings

|

| Regions and Countries Covered | Middle East and Africa

|

| Market leaders and key company profiles |

|

The geographic scope of the Middle East & Africa Well Completion Equipment and Services refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

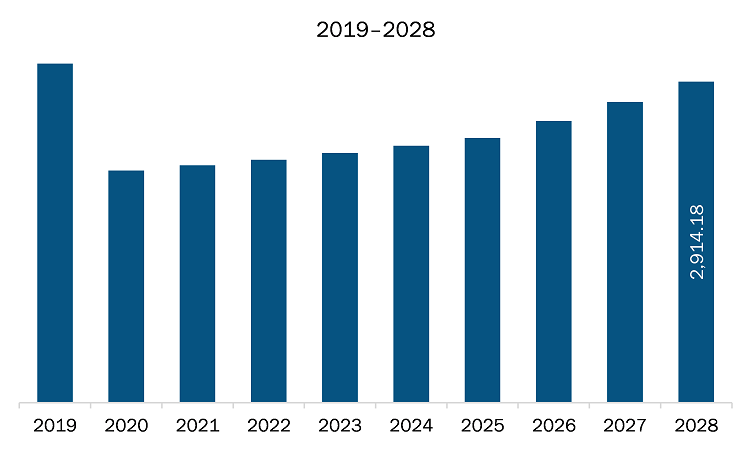

The well completion equipment and services market in Middle East & Africa is expected to grow from US$ 2,153.16 million in 2021 to US$ 2,914.18 million by 2028; it is estimated to grow at a CAGR of 4.4% from 2021 to 2028. Adoption of smart well technologies; the automation in well technologies is one of the major factors aiding the growth of the market across the region. The adoption of smart well technologies has become a popular trend among well rig vendors. It provides different advantages such as an increase in production rates, time and cost savings, a decrease in water injections, and monitoring of the whole production operations, along with real-time updates to the connected monitor or devices. Initially, the smart well concept was tried in onshore wells but now it has been applied to the offshore rigs as well. Moreover, industrial revolution 4.0 in the oil & gas industry has propelled the adoption of smart well technologies and well completion equipment across different oil rigs, which is driving the market. The intelligent well completion system also helps to boost the oil production and overall operational efficiency to 50% and more (if retained successfully). Thereby, adoption of smart well technologies is expected to fuel the Middle East & Africa well completion equipment and services market growth.

Based on the offerings, the well completion equipment and services market are segmented into equipment and services. In 2020, the services segment held the largest share Middle East & Africa well completion equipment and services market. Based on equipment the market is divided into packers, sand control tools, multistage fracturing tools, liner hangers, smart wells, valves, control devices, and others. In 2020, the packers segment held the largest share Middle East & Africa well completion equipment and services market. Based on location, the well completion equipment and services market, is segmented into onshore and offshore. The offshore segment accounts for largest market share in the 2020.

A few major primary and secondary sources referred to for preparing this report on the well completion equipment and services market in Middle East & Africa are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Baker Hughes Company; Halliburton Company; Nov Inc.; Royal Dutch Shell PLC; Schlumberger Limited; and Welltec among others.

The Middle East & Africa Well Completion Equipment and Services Market is valued at US$ 2,153.16 Million in 2021, it is projected to reach US$ 2,914.18 Million by 2028.

As per our report Middle East & Africa Well Completion Equipment and Services Market, the market size is valued at US$ 2,153.16 Million in 2021, projecting it to reach US$ 2,914.18 Million by 2028. This translates to a CAGR of approximately 4.4% during the forecast period.

The Middle East & Africa Well Completion Equipment and Services Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Well Completion Equipment and Services Market report:

The Middle East & Africa Well Completion Equipment and Services Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Well Completion Equipment and Services Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Well Completion Equipment and Services Market value chain can benefit from the information contained in a comprehensive market report.