Middle East and Africa Recovered Carbon Black Market Forecast to 2028 - COVID-19 Impact and Regional Analysis By Application (Tire, Non-Tire Rubber, Plastics, and Others)

Market Introduction

The MEA region includes countries such as South Africa, Saudi Arabia, UAE, and the rest of the MEA. The growth in synthetic rubber production is fueling the demand for recovered carbon black in the region. Moreover, the preference for environmentally friendly materials is on the rise in the MEA. Carbon black recovery processes are associated with significantly reduced greenhouse gas and CO2 emissions than the traditional virgin carbon black production. As per the UNFCCC Secretariat, Tunisia, an African country, has formally submitted its Intended Nationally Determined Contribution (INDC) highlighting goal to attain 41% emission reduction by 2030 on the back of international funding, capacity building and expansion, and technology exchange. Such initiatives will provide opportunities for the growth of the recovered carbon black market players in the MEA in the coming years. Emphasis on waste tire management is the major factor driving the growth of the MEA recovered carbon black market.

In the MEA region, the worst affected countries are Turkey, South Africa, Iraq, and Israel with a high number of COVID-19 confirmed cases and deaths. According to International Finance Corporation, the COVID-19 pandemic has a severe impact upon the economy of the Middle East and Africa, which has led to a decline in oil production, tourism, and remittances. The confinement measures implemented for sanitary purposes in the region have led to a standstill of several activity across diverse economic sectors. The MEA region comprises of many growing economies, which are prospective markets for recovered carbon black vendors. The pandemic has significantly slowed down the growth of recovered carbon black market in the region.

Get more information on this report :

Market Overview and Dynamics

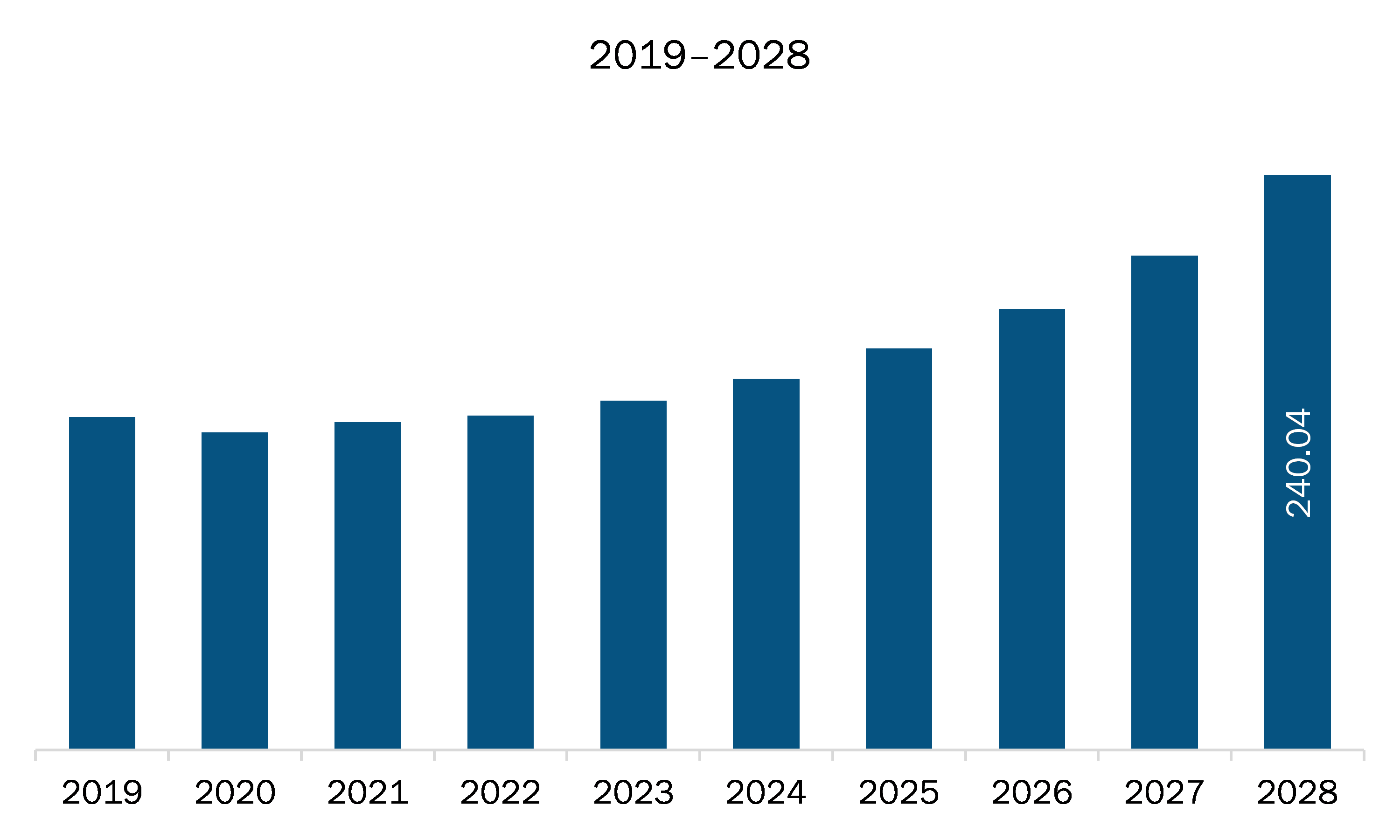

The recovered carbon black market in MEA is expected to grow from US$ 136.88 million in 2021 to US$ 240.04 million by 2028; it is estimated to grow at a CAGR of 8.4% from 2021 to 2028. Recovered carbon black is widely preferred in applications such as tire, non-tire rubber, plastics, coatings, and inks due to its excellent natural or bio-based properties. It is used as a reinforcing agent in the production of hoses, conveyor belts, seals, gaskets, geomembranes, rubber sheets, and rubber roofing, among other non-tire rubber applications. It is also used in footwear rubber to impart abrasion resistance and elasticity. The recovered carbon black increases the strength of mechanical rubber products as it has low ash content. In the plastics industry, it is used in the production of conductive packaging, fibers, films, moldings, pipes, and semi conductive cable compounds that are used in products such as industrial bags, reuse sacks, photography containers, stretch wrap, agriculture mulch film, and thermoplastic molding applications. The thermoplastic molding products find major applications in the automotive, electrical/electronics, and household appliances industries, among others. Recovered carbon black can be used as a substitute for virgin carbon black in coatings to enhance their aesthetics and protective qualities. Demand for high-performance coatings is expected to rise across the world due to their enhanced protection abilities and aesthetics. These coatings provide greater durability and, therefore, are highly demanded by the automotive and aerospace industry. Thus, the expanding application range of recovered carbon black is propelling the market growth.

Key Market Segments

Based on application, MEA recovered carbon black market is segmented into tire, non-tire rubber, plastics, and others. The tire segment dominated the market in 2020 and non-tire rubber segment is expected to be the fastest growing during the forecast period.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on recovered carbon black market in MEA are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Bolder Industries; Delta Energy LLC; ENRESTEC; Klean Carbon; Pyrolyx AG; and SR2O Holdings, LLC are among others.

Reasons to buy report

- To understand the MEA recovered carbon black market landscape and identify market segments that are most likely to guarantee a strong return

- Stay ahead of the race by comprehending the ever-changing competitive landscape for MEA recovered carbon black market

- Efficiently plan M&A and partnership deals in MEA recovered carbon black market by identifying market segments with the most promising probable sales

- Helps to take knowledgeable business decisions from perceptive and comprehensive analysis of market performance of various segment form MEA recovered carbon black market

- Obtain market revenue forecast for market by various segments from 2021-2028 in MEA region.

MEA Recovered Carbon Black Market Segmentation

MEA Recovered Carbon Black Market –By Application

- Tire

- Non-Tire Rubber

- Plastics

- Others

MEA Recovered Carbon Black Market -By Country

- Saudi Arabia

- South Africa

- UAE

- Rest of MEA

MEA Recovered Carbon Black Market -Company Profiles

- Bolder Industries

- ENRESTEC

- Pyrolyx AG

- SR2O Holdings, LLC

1. Introduction

1.1 Study Scope

1.2 The Insight Partners Research Report Guidance

1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

3.1 Scope of the Study

3.2 Research Methodology

3.2.1 Data Collection:

3.2.2 Primary Interviews:

3.2.3 Hypothesis formulation:

3.2.4 Macro-economic factor analysis:

3.2.5 Developing base number:

3.2.6 Data Triangulation:

4. MEA Recovered Carbon Black Market Landscape

4.1 Market Overview

4.2 Porter’s Five Forces Analysis

4.2.1 Bargaining Power of Suppliers

4.2.2 Bargaining Power of Buyers

4.2.3 Threat of Substitutes

4.2.4 Threat of New Entrants

4.2.5 Intensity of Competitive Rivalry

4.3 Ecosystem Analysis

4.4 Expert Opinion

5. MEA Recovered Carbon Black Market – Key Market Dynamics

5.1 Market Drivers

5.1.1 Ecological Utility of Recovered Carbon Black

5.1.2 Augmenting Application Range of Recovered Carbon Black

5.2 Market Restraints

5.2.1 Limited Availability of Recovery Infrastructure and Increasing Production of Crude Oil

5.3 Market Opportunities

5.3.1 Rise in Need for Green Alternatives with Shift Towards Sustainability

5.4 Future Trends

5.4.1 Emphasis on Waste Tire Management

5.5 Impact Analysis

6. Recovered Carbon Black – MEA Market Analysis

6.1 MEA Recovered Carbon Black Market Overview

6.2 MEA Recovered Carbon Black Market –Revenue and Forecast to 2028 (US$ Million)

7. MEA Recovered Carbon Black Market Analysis – By Application

7.1 Overview

7.2 MEA Recovered Carbon Black Market Breakdown, by Application, 2020 & 2028

7.3 Tire

7.3.1 Overview

7.3.2 Tire: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

7.4 Non-Tire Rubber

7.4.1 Overview

7.4.2 Non-Tire Rubber: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

7.5 Plastics

7.5.1 Overview

7.5.2 Plastics: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

7.6 Others

7.6.1 Overview

7.6.2 Others: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

8. MEA Recovered Carbon Black Market – Country Analysis

8.1 Overview

8.1.1.1 MEA: Recovered Carbon Black Market, by Key Country

8.1.1.2 South Africa: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.2.1 South Africa: Recovered Carbon Black Market, by Application

8.1.1.3 Saudi Arabia: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.3.1 Saudi Arabia: Recovered Carbon Black Market, by Application

8.1.1.4 UAE: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.4.1 UAE: Recovered Carbon Black Market, by Application

8.1.1.5 Rest of MEA: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

8.1.1.5.1 Rest of MEA: Recovered Carbon Black Market, by Application

9. Impact of COVID-19 on MEA Recovered Carbon Black Market

9.1 Overview

10. Company Profiles

10.1 Bolder Industries

10.1.1 Key Facts

10.1.2 Business Description

10.1.3 Products and Services

10.1.4 Financial Overview

10.1.5 SWOT Analysis

10.1.6 Key Developments

10.2 ENRESTEC

10.2.1 Key Facts

10.2.2 Business Description

10.2.3 Products and Services

10.2.4 Financial Overview

10.2.5 SWOT Analysis

10.2.6 Key Developments

10.3 SR2O Holdings, LLC

10.3.1 Key Facts

10.3.2 Business Description

10.3.3 Products and Services

10.3.4 Financial Overview

10.3.5 SWOT Analysis

10.3.6 Key Developments

10.4 Pyrolyx AG

10.4.1 Key Facts

10.4.2 Business Description

10.4.3 Products and Services

10.4.4 Financial Overview

10.4.5 SWOT Analysis

10.4.6 Key Developments

11. Appendix

11.1 About The Insight Partners

11.2 Glossary of Terms

LIST OF TABLES

Table 1. MEA Recovered Carbon Black Market –Revenue and Forecast to 2028 (US$ Million)

Table 2. South Africa Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 3. Saudi Arabia Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 4. UAE Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 5. Rest of MEA Recovered Carbon Black Market, by Application – Revenue and Forecast to 2028 (USD Million)

Table 6. Glossary of Terms, Recovered Carbon Black Market

LIST OF FIGURES

Figure 1. MEA Recovered Carbon Black Market Segmentation

Figure 2. MEA Recovered Carbon Black Market Segmentation – By Country

Figure 3. MEA Recovered Carbon Black Market Overview

Figure 4. Tire Segment Held Largest Share of MEA Recovered Carbon Black Market

Figure 5. Rest of MEA Held Largest Share of MEA Recovered Carbon Black Market

Figure 6. MEA Recovered Carbon Black Market, Industry Landscape

Figure 7. Porter ‘s Five Forces Analysis for Recovered Carbon Black Market

Figure 8. Recovered Carbon Black Market– Ecosystem Analysis

Figure 9. Expert Opinion

Figure 10. MEA Recovered Carbon Black Market Impact Analysis of Drivers and Restraints

Figure 11. MEA: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 12. MEA Recovered Carbon Black Market Breakdown, by Application, 2020 & 2028

Figure 13. MEA Tire: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 14. MEA Non-Tire Rubber: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 15. Plastics: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 16. Others: Recovered Carbon Black Market – Revenue and Forecast to 2028 (US$ Million)

Figure 17. MEA: Recovered Carbon Black Market, by Key Country- Revenue 2020 (US$ Million)

Figure 18. MEA: Recovered Carbon Black Market Revenue Share, by Key Country (2020 & 2028)

Figure 19. South Africa: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 20. Saudi Arabia: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 21. UAE: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 22. Rest of MEA: Recovered Carbon Black Market –Revenue and Forecast to 2028 (USD Million)

Figure 23. Impact of COVID-19 Pandemic in Middle East and Africa

- Bolder Industries

- ENRESTEC

- Pyrolyx AG

- SR2O Holdings, LLC

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the MEA Recovered Carbon Black market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the MEA Recovered Carbon Black market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth MEA market trends and outlook coupled with the factors driving the Recovered Carbon Black market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution