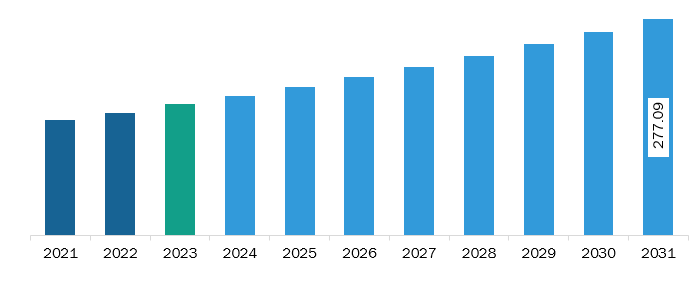

The Middle East & Africa mobile cleanroom market was valued at US$ 168.33 million in 2023 and is expected to reach US$ 277.09 million by 2031; it is estimated to register a CAGR of 6.4% from 2023 to 2031.

Players operating in the mobile cleanroom market are focusing on the adoption of growth strategies such as launching new products; expanding their geographical footprint; and engaging in mergers and acquisitions, partnerships, and In October 2023, Performance Contracting, Inc. (PCI) expanded its existing product portfolio by launching PODular, modular, and hybrid cleanroom solutions for drug development, manufacturing, and packaging solutions. In February 2023, Guardtech Group launched a new website for its CleanCube Mobile Cleanrooms brand. This launch is expected to help the company expand its market reach as well as offer useful technical information about its broad range of portable cleanroom models, including comprehensive breakdowns of the structural, mechanical, and electrical fittings as well as the furniture and equipment options available for buyers. In January 2022, Germfree Labs, a US-based laboratory and cleanroom manufacturing company, launched a new bioGO cGMP mobile cleanroom platform for cell and gene therapy. The new product will help solve complex logistical challenges that are common in the field of cell and gene therapy, along with assisting the stakeholders in this space to overcome the critical constraints they face during the development, manufacturing, and delivery of new and emerging curative therapies. Thus, such strategic initiatives by the market players are likely to bring significant growth trends in the mobile cleanroom market in the coming years.

The Middle East & Africa mobile cleanroom market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of MEA. The market growth in the region is ascribed to rising investments being made toward the progress of the healthcare sector and growing healthcare budgets. The mobile cleanroom market growth in Saudi Arabia is attributed to the increasing need for high-quality and contamination-free environments in sectors such as pharmaceuticals, electronics, and biotechnology. Saudi Arabia has been making significant investments to expand its pharmaceutical and biotech industries as part of its Vision 2030 initiative. The country aims to establish itself as a regional hub for drug production, medical research, and clinical trials. Mobile cleanrooms are employed in pharmaceutical companies for temporary production, clinical trials, and quality control, ensuring compliance with international GMP standards. The Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), one of the largest pharmaceutical manufacturers in the country, has been employing mobile cleanrooms to support drug production and testing, especially during periods of high demand such as the flu season or COVID-19 vaccine production. Further, King Faisal Specialist Hospital and Research Centre in Riyadh utilizes mobile cleanrooms in research focused on advanced medical treatments and clinical trial studies conducted for new therapies.

The Middle East & Africa mobile cleanroom market is categorized into type, end user, and country.

By type, the Middle East & Africa mobile cleanroom market is bifurcated into softwall and hardwall. The softwall segment held a larger share of the Middle East & Africa mobile cleanroom market share in 2023.

In terms of end user, the Middle East & Africa mobile cleanroom market is segmented into microelectronics, pharmaceuticals and biotechnology, medical device manufacturers, and others. The microelectronics segment held the largest share of the Middle East & Africa mobile cleanroom market share in 2023.

Based on country, the Middle East & Africa mobile cleanroom market is segmented into Saudi Arabia, South Africa, the UAE, and the Rest of Middle East & Africa. Saudi Arabia segment held the largest share of Middle East & Africa mobile cleanroom market in 2023.

Ardmac Group Ltd; Aseptic Enclosures; Extract Technology Ltd; G-CON Manufacturing Inc; Germfree Laboratories LLC; Instant Cleanroom Solutions Corp; Modular Devices Inc.; Pacific Environmental Technologies Inc.; Spetec GmbH; and Terra Universal Inc are some of the leading companies operating in the mobile cleanroom market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 168.33 Million |

| Market Size by 2031 | US$ 277.09 Million |

| CAGR (2023 - 2031) | 6.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Mobile Cleanroom Market is valued at US$ 168.33 Million in 2023, it is projected to reach US$ 277.09 Million by 2031.

As per our report Middle East & Africa Mobile Cleanroom Market, the market size is valued at US$ 168.33 Million in 2023, projecting it to reach US$ 277.09 Million by 2031. This translates to a CAGR of approximately 6.4% during the forecast period.

The Middle East & Africa Mobile Cleanroom Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Mobile Cleanroom Market report:

The Middle East & Africa Mobile Cleanroom Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Mobile Cleanroom Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Mobile Cleanroom Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)